Oh Polly grew +72% in organic traffic score while the UK clothing market slipped. Here’s the part most brands miss…

UK clothing search is noisy on a good day. In the last 6 months, the category has dropped -1% in overall organic visibility. That’s the average movement across the market. Not a collapse, but enough to show how hard it is to grow without doing something properly different.

Now look at ohpolly.com:

- Overall rank: 23

- Rank movement: +11 places

- Traffic score Jan 2026: 802,042

- Traffic score Jul 2025: 465,227

- YoY change: +72% (and +74% vs market)

That’s not “we wrote a few blogs” growth. That’s “we built a demand-capture machine” growth. And here’s the twist that makes this case worth your time: The report flags “oh polly” as a receding brand query at 450,000 monthly searches with -23% interest trend. So they’re growing hard in organic at the same time brand interest is cooling. That usually only happens when a brand stops relying on people typing the brand name… and starts winning the messy middle: occasion searches, style searches, colour searches, last-minute outfit problem searches.

That’s what we’re spotlighting.

First, what the “Traffic Score” is (so nobody argues about the number)

This report’s “traffic score” is a third-party estimate (Ahrefs-based), used to compare brands consistently, not to claim exact GA sessions. It’s based on the keywords a site ranks for (top 100), plus ranking position, search volume and estimated click-through rate. So no, we’re not pretending it’s your analytics. But as a relative measure, it’s very good at showing who is gaining share of voice and who is losing it.

Why clothing SEO now starts on TikTok, not on Google

Clothing demand doesn’t behave like “I need a toaster”.

It behaves like:

- I saw a fit on TikTok.

- I saved it.

- Two days later I search a version of it.

- I land on three sites.

- I bounce off two because I can’t answer: Will it fit? Will it arrive in time? Will it look like the video?

That’s why your SEO plan can’t just be “rank for dresses”.

The report’s emerging product keywords tell the story: people are searching very specific stuff, often driven by social trend cycles:

- “striped long sleeve top” (2,900 searches, +138% interest trend)

- “brown shorts” (2,400 searches, +175%)

- “brown leather shorts” (1,000 searches, +178%)

If you’re not structurally set up to create and surface pages for this kind of demand, you get stuck fighting for the same head terms forever.

Why we picked Oh Polly

Because their data pattern screams: they’re winning non-brand demand. Yes, the giants are still huge (Next is rank #1 at 15,212,019 traffic score; M&S rank #2 at 13,894,383).

But the growth is where the story is:

- Next: -3% YoY

- M&S: -2% YoY

- ASOS: -12% YoY

- Oh Polly: +72% YoY

Oh Polly is not “biggest”. It’s one of the clearest examples of a brand building the site around how people shop right now.

The core idea (the thing they do that most clothing sites still don’t)

Oh Polly turns social-led demand into indexable demand by building pages around “moments” (occasion, fit, colour, length) and then removing purchase doubt on the product page.

That sounds simple. Most teams still don’t do it because it needs coordination across:

- merchandising

- SEO / content

- UX

- product data

- creative / social

Oh Polly’s site shows what happens when that coordination actually exists.

What we saw on the site (and why it matters for search)

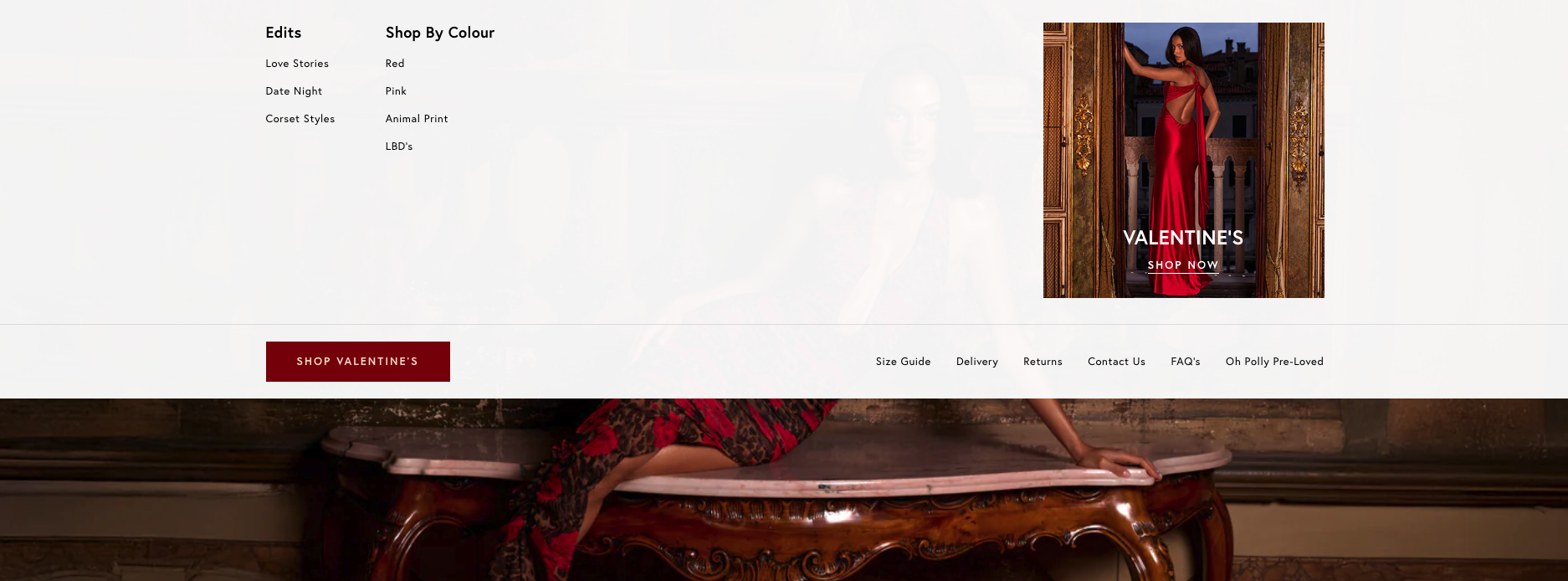

1) Their navigation is built around how people think.

On the homepage navigation, you immediately see New In, Bestsellers, Trending, plus routeways like Shop By Style and Shop By Colour. You also see “Pre-loved” called out as a first-class area, not hidden away. That matters because:

- Google can only rank pages you actually have.

- Users coming from social rarely land on your homepage. They land on a product or a collection page.

- Strong site taxonomy becomes your safety net when trend traffic hits.

If your nav is “New / Women / Men / Sale” you’re basically saying: we’ve decided you can do the hard work. Oh Polly doesn’t.

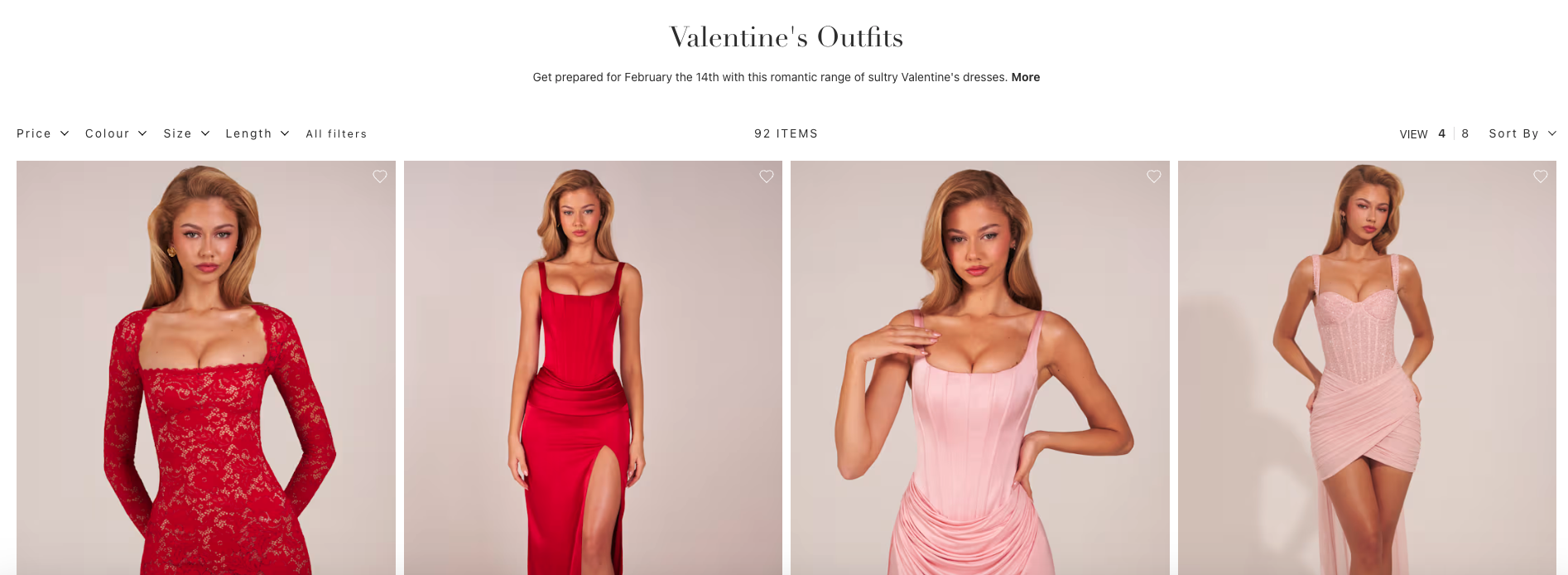

2) Their category experience is set up for “I need an outfit for X” searches

On the dresses collection, the page talks directly about fit confidence and pushes shoppers towards reviews and their sizing tool. It calls out “real-time reviews” and the ‘Whats My Size’ tool to figure out sizing based on height and other factors.

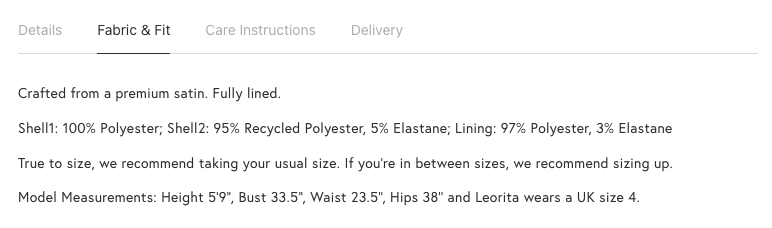

3) Product pages are built to answer the three purchase blockers: fit, trust, and urgency

We looked at one product page. Here’s what it includes, in plain sight:

- model info: “Sophia is 5’4″ and wears a UK size 4”

- a clear Size Guide link

- “Details / Fabric & Fit / Care Instructions / Delivery” sections

- buy-now-pay-later options (Clearpay, Klarna)

- an out of stock “Notify Me” state (so the page still has a job even when stock is gone)

- reviews with “Popular Topics” like Fit / Appearance / Versatility and “Verified Buyer” review structure

This is the bit a lot of brands still treat as a “nice UX add-on”. It isn’t. If social is generating demand spikes, and Google is sending you long-tail traffic, the product page is your closing argument.

4) They treat resale and rental as demand loops, not CSR pages

The site links out to Oh Polly Pre-Loved as a dedicated resale area. Even if you don’t copy the model, the structural lesson is this:

Secondary value propositions deserve their own crawlable, navigable footprint, not a one-off blog post.

The numbers behind the story (from the report)

Here are the only numbers you need to brief this internally.

| Metric | What the report shows | Why it matters |

| Market organic visibility change (last 6 months) | -1% | Growth isn’t “the tide rising”. Someone is taking share. |

| Oh Polly organic traffic score (Jan 2026) | 802,042 | They’re now a serious organic player, not a niche brand. |

| Oh Polly organic traffic score (Jul 2025) | 465,227 | Baseline for their growth. |

| Oh Polly YoY change | +72% (and +74% vs market) | Their strategy is scaling, not just spiking. |

| Oh Polly brand query trend | 450,000 searches, -23% interest trend | They’re not reliant on brand demand to grow organic, at a time where everyone is telling you, that you need to build a brand. |

What UK clothing marketers can steal from this.

1) Build “occasion architecture” first, then hang SEO off it

If your category tree is only product-led, you miss the searches that matter:

- birthday

- prom

- wedding guest

- date night

- “going out” variants

These are how people actually shop.

Oh Polly’s navigation and collections lean heavily into that pattern.

2) Treat “colour / length / fit” as demand, not filters

Social doesn’t sell “dresses”. It sells a red maxi with a low back. If your only entry point is “Dresses”, you force the shopper to do all the work after the click. Oh Polly explicitly supports “Shop By Colour” and “Shop By Length” in their structure.

3) Product pages should read like an answer page

The product page we reviewed shows:

- model height and size

- structured details tabs

- review topics like Fit and Appearance

- delivery information surfaced as part of the page content

4) Keep pages useful when stock is gone

“Oh great, we ranked. Shame it’s out of stock” is a self-inflicted wound. Oh Polly’s “Notify Me” gives the page a job even when the item can’t be bought right now.

5) Stop separating “social” and “SEO” like they’re different planets

In clothing, social often creates the demand, and Google catches the follow-up search. So if your social team is pushing “brown leather shorts” and your SEO team has no page to land it… you just paid to teach people to shop elsewhere. The report’s emerging product set is basically a ready-made briefing list for that alignment.

What’s next?

If you want the full benchmark set (who’s up, who’s down, and what trend keywords are bubbling up), grab the report here.

If you want us to sanity-check your current structure against this market (and show you the pages you’re missing), book a free search consultation here.