You’ve hit that magical 10× ROAS. The board loves it. Your marketing team is celebrating. The agency sent a hamper. And yet, your business is slowly dying. Welcome to the biggest con in digital marketing. The metric you worship drives you straight into the red.

What’s wrong with ROAS?

ROAS looks beautiful on paper. Revenue divided by ad spend. Clean. Simple. It tells you how many pounds you made per pound spent on ads. A 5× ROAS means £5 revenue for every £1 in ads. Marketing teams love it. Agencies worship it. Boards nod approvingly at it. But ROAS lies.

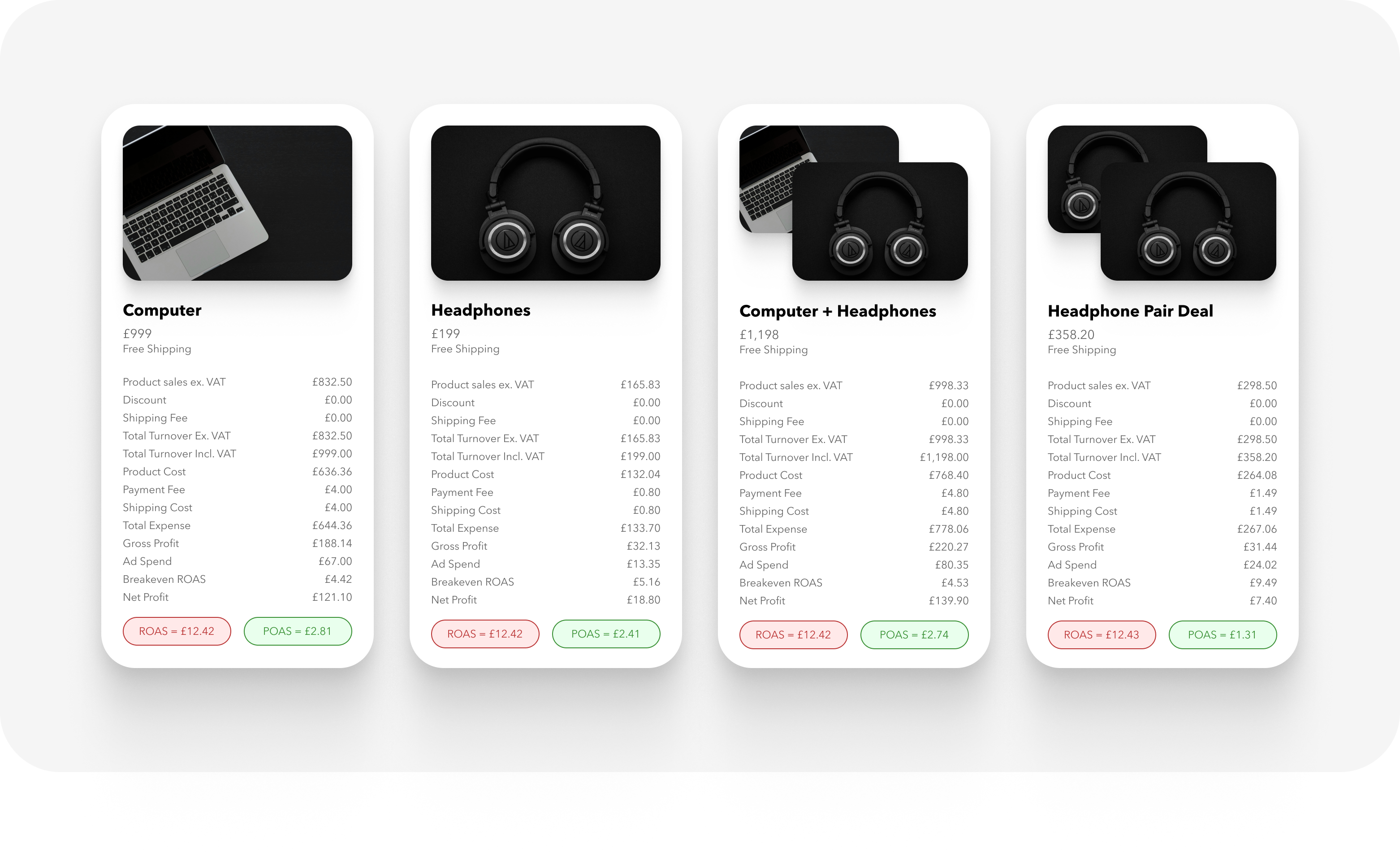

ROAS calculates the revenue generated for every dollar spent on ads, but critically, it doesn’t account for the varying profit margins of different products.

That 5× ROAS campaign? It might be selling products with razor-thin margins. You’re efficiently converting ad spend into sales that barely break even.

Imagine this: Campaign A sells cheap phone cases at £10 each. Your ROAS is 5× (£10 revenue from £2 ad spend). But each case costs you £9. You’ve made a £1 loss.

Campaign B sells premium laptops at £1,000 each. Your ROAS is 10× (£1,000 revenue from £100 ad spend). Each laptop costs you £600. You’ve made a £300 profit. ROAS would rate both campaigns equally successful. Your cash balance tells a different story.

You can drive a spectacular ROAS by running flash sales, pushing low-margin products, chasing last-click conversions, and targeting bottom-funnel customers only. Meanwhile, your profit margins shrink. Your dashboard cheers. Your finance team sweats. It’s the emperor’s new clothes of marketing metrics.

How can ROAS damage your business?

ROAS actively damages your business from within. Your marketing team celebrates “record” ROAS. Your operations team drowns in low-margin orders. Your warehouse fills with returns. Your customer service team gets swamped. None of this shows up in your marketing reports.

A surge in “successful” campaigns forces your supply chain into overdrive. Staff work overtime. Suppliers rush extra stock. All chasing revenue that barely covers costs. Finance looks at the P&L and wonders why revenue grew but gross profit flatlined. The board asks tough questions: “We hit our ROAS goals, but why are we cutting budgets elsewhere?”

Meanwhile, cost pressures intensify. Higher employer NI contributions and bigger living wage hikes challenge how retailers manage future growth and protect against margin losses. Every penny of profit is under siege from tax and wage inflation. ROAS notices none of this.

According to the Advertising Association/WARC report, UK ad investment grew 10.4 % in 2024 to £42.6 billion. Digital channels now claim £4 of every £5 spent. Yet forecasters expect growth to slip to about 6.3 % in 2025, and media analysts warn that “confidence has softened… with economic headwinds, political uncertainty and looming US trade tariffs.” Budgets aren’t rising. Every pound must work harder. Advertising costs will climb, consumers will tighten their belts, and profitability, not vanity metrics, will decide who survives. Companies clinging to outdated numbers risk watching their profits vanish.

Why do agencies use ROAS?

Agencies hide the problem. They tout ROAS because it looks impressive in presentations. A campaign hitting “10× ROAS” makes for heroic PowerPoint slides, even if it just retargeted existing customers at a loss. It’s celebrating speed on the way to a brick wall.

An agency can create a Facebook sale, load stock on discount, and pump traffic. ROAS spikes. Revenue climbs. The agency claims victory, while your net profit stalls. Some agencies selectively report metrics, focusing on conversion rates or ROAS without showing gross margin impact. Others exclude shipping and discount costs from their data feed, so Google optimises for revenue alone.

What is POAS targeting?

POAS focuses on the actual profit generated from ad spend. Instead of telling Google the sale value (£100), you report the profit after considering COGS (£30). In practice, if an item sells at £100 but costs £70, the POAS value is £30. A POAS of 1 means break-even on ad spend; above 1 means profit. Bids rise only when profit does.

The main advantage? Transparency. With POAS, every campaign above 1 generates actual profit. You immediately see which ads and products make money and which lose money. Shipping, payment fees, promotions, and all costs are included in the profit calculation, so no nasty surprises are hidden in the margins.

Even Google recognises the problem. It’s new Gross‑Profit Optimisation (profit tROAS) beta lets advertisers feed cost‑of‑goods data into Google Ads and switch bids from revenue‑ROAS to profit‑based ROAS. Early tests show about a 15 % uplift in campaign profit. The beta makes Google’s algorithm value real profit, not just sales (set‑up means adding COGS or cart data so Google can calculate profit per conversion). In short, even the platform that popularised ROAS is pivoting to profit. Follow its lead, or get left behind.

What tools track POAS?

Implementation needs data or tools. Analytics software like ProfitMetrics pulls real order data (revenue, COGS, shipping, fees) and feeds profit values into Google or Facebook. These services compute profit-per-sale 24/7.

Alternatively, Google Ads simplifies things. Their Gross-Profit Optimisation beta asks you to upload the cost of goods for each product in your Merchant Feed. Then switch your Smart Bidding goal from ROAS to profit tROAS.

Google’s documentation notes you “need to include your cart data and product COGS in the product feed.” Once configured, the algorithm automatically bids toward profit, instead of revenue. Any tool pushing profit data to the platform works for POAS. Some advertisers tag offline profit per customer in each conversion. Others use Facebook’s cost+profit fields for Purchase events.

Make your bid strategy margin-aware. Let it redirect spend into segments, adding real value. As a bonus, POAS rebalances budgets.

How do I use POAS?

1. Audit Your Campaigns

Start by comparing reported ROAS with actual gross profit. Pull last quarter’s campaigns. Calculate profit margins of top-selling products. Identify any campaign that “crushed ROAS targets” but made little money.

For example, a fashion retailer might find very high ROAS on deeply discounted items, yet its gross profit fell.

Book a call to calculate your POAS and pivot reporting towards profit.

POAS is the metric that changes everything.

Talk to us about POAS

No hard pitch. No charge. Just the truth about your ads.

2. Include True Costs

Update your tracking so platforms see profit instead of sales. Send the correct profit value for each conversion. For e-commerce, ensure your feed includes cost-of-goods, shipping and fees.

If using Google, add a cost field to the Merchant Centre feed and switch your goal to Profit tROAS. If unavailable, use a profit calculator tool: ProfitMetrics or similar software can read sales data and automatically feed profit per order back into ad accounts. Every “conversion value” should equal net profit, not gross revenue.

3. Segment By Margin

Reorganise campaigns around profitability. Group high-margin products separately from low-margin ones. Set different ROAS targets accordingly (or use profit bidding).

Consider setting lower ROAS targets on premium goods, they remain profitable even at lower efficiency because each sale adds substantial profit. Smarter Ecommerce suggests this “crazy idea” of lowering ROAS goals for high-margin items, because “even if the ROAS is lower, the significant profit margins… can lead to greater overall profitability.”

Let high-priced, high-margin items get more spend. Be choosier with ads for slim-margin products. This immediately flips the budget into winners.

4. Try Profit-Based Bidding

Take advantage of modern bid strategies. If you can access Google’s profit tROAS beta, test it on a campaign. Ensure each product has the correct profit data, then let Google bid for profit. Early reports show profit lifts of 15 %+.

Tools like ProfitMetrics offer “profit bidding” for Google or Facebook if Google is unavailable. Explicitly switch campaigns from ROAS to POAS. Compare outcomes: Are you seeing higher margin orders or more cost-effective spending? These tests often pay for themselves quickly.

5. Review Budgets And Measure Profit

When switching to POAS, watch your budgets. Google’s algorithm may treat higher-value conversions as “expensive” and throttle spending.

Check daily budgets. As one guide warns, “it’s important to review your daily budget, as the change in value may affect Google’s averages.” Don’t let small budgets strangle newly valuable campaigns.

Build a simple dashboard tracking gross profit from ads versus spend. If profit grows, you’re on track. If not, investigate. Consider complementary metrics like Customer Lifetime Value or total margin pounds. A few quick checks, product margin, basket margin, and average order profit keep you honest.

The Human Cost of ROAS Obsession

ROAS doesn’t just hide financial costs. It hides human costs, too. When your warehouse staff works overtime fulfilling low-margin orders, ROAS doesn’t notice. Your staff labour over little profit and little reward. When your marketing team burns out chasing ever-higher efficiency numbers while profits stagnate, ROAS keeps demanding more.

Real business success means sustainable profits that support your team, not only vanity metrics that look good in reports. Prioritising true profitability means respecting the human side of business, the people who make it all happen.

Beyond POAS: The Full Picture

POAS matters, but it’s just the start. Smart businesses look beyond single metrics. They integrate:

- POAS (short-term profit)

- Customer Lifetime Value (long-term profit)

- New Customer Acquisition Cost (growth investment)

- Inventory Turnover (operational efficiency)

- Gross Margin Return on Investment (GMROI)

These metrics together form a complete view of marketing’s impact on business health. As Smarter Ecommerce notes, neither ROAS nor POAS alone saves you. You need the full picture. The goal isn’t optimising one ratio. It’s building a sustainable, profitable business.

How can I hold my agency accountable?

If your agency reports only ROAS, demand more. Ask them:

- “What’s the POAS on our top campaigns?”

- “Which products drive profit, not purely sales volume?”

- “How are you factoring margin into bidding decisions?”

If they can’t answer, they’re not managing your account correctly. Modern agencies worth their salt should understand margin strategy. They should optimise for profit, not spend or revenue. If yours doesn’t, they’re either behind the curve or deliberately hiding the whole picture. Either way, it’s time for a serious conversation.

Implementation Steps

For Marketing Directors

- Calculate the actual profit for your top 10 products. Compare against their ROAS performance.

- Meet with finance to understand your whole cost structure. What hidden costs does ROAS ignore?

- Create a profit-first dashboard showing POAS alongside ROAS.

- Set test budgets for profit-optimised campaigns.

- Rebalance spend based on profit potential.

For E-commerce Managers

- Add COGS data to your product feed or analytics.

- Track which products generate the most total profit.

The Bottom Line

UK ad spend hit £42.6 billion in 2024. But pumping money into ads chasing ROAS doesn’t guarantee profits. Google knows it. Industry leaders acknowledge it. Your CFO feels it. Will you adapt before your profits disappear?

Switch to POAS. Optimise for profit, not merely revenue. Align your marketing with what truly matters. Your ROAS might drop, but your profits will thank you.

Want to know more about POAS? We’ve written a bunch more about it:

1. Introducing POAS: The Only Metric That Actually Matters

2.The New Blueprint for Agency Accountability: POAS

Want to know more about how we approach this for our clients? Read about our paid media service here.