2025 Kitchenware Industry Analysis

The category is expanding. Industry variance clocks in at +23% year-on-year (September 2024 → September 2025), signalling a meaningful rise in organic opportunity. In a space where a £200 pan set involves weeks of research and social influence, search is the channel that carries intent across that journey. This piece blends hard numbers from the 69-page sector report with directional strategy thoughts for marketers who need to win in 2025.

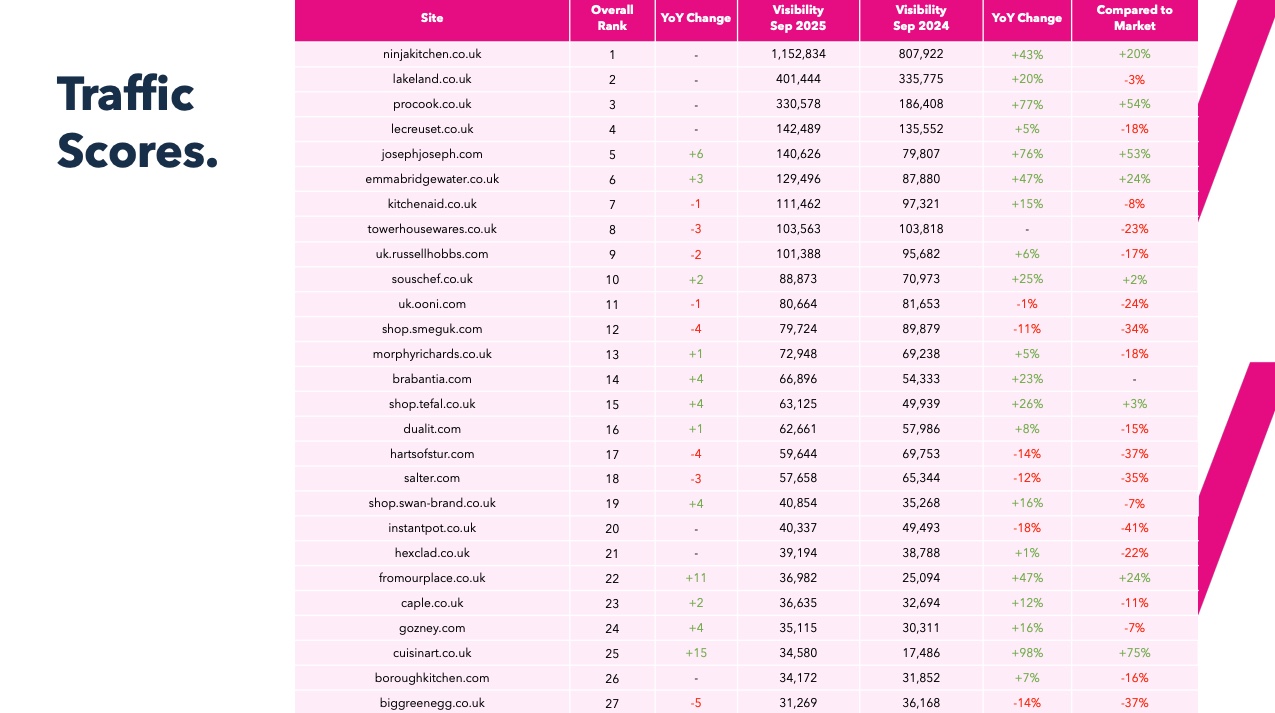

Which kitchenware brands lead in organic visibility in 2025?

Below is a snapshot of organic Traffic Score (Ahrefs) visibility for September 2025 with year-on-year (YoY) change. I’ve included a mix of market leaders and the spotlight brand.

| Brand | Sep 2025 Visibility | Sep 2024 Visibility | YoY Change |

|---|---|---|---|

| Ninja Kitchen | 1,152,834 | 807,922 | +43% |

| Lakeland | 401,444 | 335,775 | +20% |

| ProCook | 330,578 | 186,408 | +77% |

| Le Creuset | 142,489 | 135,552 | +5% |

| Joseph Joseph | 140,626 | 79,807 | +76% |

| Emma Bridgewater | 129,496 | 87,880 | +47% |

| KitchenAid | 111,462 | 97,321 | +15% |

| Tower Housewares | 103,563 | 103,818 | 0% |

| Russell Hobbs | 101,388 | 95,682 | +6% |

| Sous Chef | 88,873 | 70,973 | +25% |

| Borough Kitchen (spotlight) | 34,172 | 31,852 | +7% |

What the table shows. The market is both consolidating and fragmenting. Ninja Kitchen towers over everyone through category-defining products, while ProCook and Joseph Joseph post outsized YoY growth through strong execution. Mid-tier heritage players such as Le Creuset and KitchenAid hold steady with incremental gains, reflecting durable brand equity.

Why it matters. With the industry up +23%, brands that grew <23% effectively lost share of voice. Share is captured not by short bursts of content, but by owning the queries that sit along the full consideration path — from inspiration (“cast iron pan dinner ideas”) to post-purchase care (“how to season carbon steel”).

Who’s outperforming their authority?

The report plots Traffic Scores vs Authority (Domain Rating) to surface “overachievers” and “sleeping giants”. Borough Kitchen appears among the overachievers (18th), delivering healthy visibility despite a modest backlink profile. Key peers across quadrants include:

| Quadrant | Illustrative Brands |

|---|---|

| Overachievers (high traffic vs lower authority) | Lakeland, Joseph Joseph, Ninja Kitchen, Zwilling, Hart of Stur, Borough Kitchen, Tefal |

| Sleeping Giants (high authority, lower traffic) | Fisher & Paykel, Prestige, Magimix, Mason Cash, Geepas |

| Leaders (high traffic & high referring domains) | Ninja Kitchen, Brabantia, Smeg |

| Early-stage (low traffic & low authority) | HexClad, Wüsthof, Scoville, Karaca |

What the table shows. Being “big” isn’t enough. Link volume alone doesn’t predict organic traffic; the weak correlation between referring domains and visibility highlights the primacy of quality over quantity. Brands that build topical depth, fix technical debt and publish user-helpful content can outpace sites with larger press footprints.

Directional strategy. If you’re an overachiever like Borough Kitchen, double down on what’s working: expand successful content clusters and shore up authority with targeted digital PR. If you’re a sleeping giant (e.g., Prestige, Magimix), sequence a technical and structural audit before chasing links; resolve crawl waste and internal linking first, then pursue authoritative, brand-relevant coverage instead of spray-and-pray link building.

Are reviews and trust signals deciding who converts?

In high-consideration retail, social proof shortens the journey from “researching” to “ready to buy”.

| Brand | No. of Reviews | Average Score |

|---|---|---|

| Borough Kitchen | 8,155 | 4.9 ★ |

| Lakeland | 161,589 | 4.8 ★ |

| Ooni | 7,862 | 4.8 ★ |

| Fisher & Paykel | 6,224 | 4.9 ★ |

| Harts of Stur | 26,192 | 4.9 ★ |

| Ninja Kitchen | 42,257 | 4.5 ★ |

| Gozney | 10,082 | 4.4 ★ |

| Salter | 10,017 | 4.4 ★ |

What the table shows. Borough Kitchen ranks among the very best for review quality (4.9 ★) with a meaningful volume of responses. Meanwhile, mass-market players like Lakeland demonstrate the compounding effect of long-term trust collection.

Directional strategy. Treat reviews as a product. Build a timely post-purchase request loop, feature ratings at decision points (PLPs, PDPs, cart), and respond visibly. For premium items, include “care & maintenance” reassurance near the CTA to de-risk the buy.

Which brands have the strongest digital brand awareness?

Brand awareness is a blend of branded search and owned social. Here’s a cut of the leaders and the spotlight brand:

| Brand | Monthly Brand Searches | Owned Social Score |

|---|---|---|

| Lakeland | 246,000 | 804 |

| Le Creuset | 135,000 | 472 |

| Emma Bridgewater | 110,000 | 971 |

| Tefal | 27,100 | 8,114 |

| Smeg (Shop) | 2,900 | 1,448 |

| Borough Kitchen | 9,900 | 80 |

What the table shows. A few giants dominate branded demand, yet owned social isn’t always proportional. Smeg’s social channel strength outstrips its branded search volume, while Tefal shows the power of a strong social engine in driving ongoing attention.

Directional strategy. For challenger brands with mid-table awareness (like Borough Kitchen), the goal isn’t vanity followers, it’s memorable, repeatable moments that push shoppers back into search with your brand in the query. Think practical series (e.g., “steel pan masterclass”), creator collaborations that link back to deep guides, and UGC that closes the loop on post-purchase pride.

Keyword battlegrounds: where to fight and where to flank

Not all queries are equal. High-competition terms protect incumbents; “opportunity” keywords offer outsized returns for everyone.

High-competition keywords (defend or disrupt thoughtfully)

| Keyword | UK Monthly Searches | Competitiveness |

|---|---|---|

| cooker | 19,000 | 43 |

| spoons | 10,000 | 28 |

| ice cream machine | 7,300 | 25 |

| pots and pans set | 5,500 | 21 |

| japanese kitchen knives | 2,000 | 39 |

| non toxic cookware | 1,900 | 17 |

| japanese knives | 3,700 | 36 |

| cast iron frying pan | 3,100 | 26 |

| kitchenware | 2,800 | 31 |

| cast iron pans | 2,700 | 24 |

Strategic read. Treat these as brand-building positions, not pure acquisition plays. If you’re defending, maintain relevance through evergreen guides, comparison content and strong internal linking from your best knowledge assets. If you’re disrupting, arrive with product authority and proof — reviews, test results, chef endorsements — not just another product grid.

Opportunity keywords (lower competition, real intent)

| Keyword | UK Monthly Searches | Competitiveness |

|---|---|---|

| pan set | 3,600 | 3 |

| pots and pans | 4,200 | 5 |

| coffee bean grinder | 4,200 | 5 |

| plate set | 5,100 | 7 |

| kitchen knives | 7,400 | 12 |

| kitchen knife set | 8,100 | 12 |

| coffee machine with milk frother | 6,200 | 4 |

| skillet pan | 7,400 | 3 |

| crockery | 6,400 | 5 |

| kitchen utensils | 7,100 | 4 |

Strategic read. These are conversion-adjacent terms with practical intent and lighter SERP competition. Build helpful pages that answer the question behind the query: buying checklists, care instructions, size guides, compatible hob types, “good, better, best” ranges. Tie each to your review corpus and price-promise messaging to reduce comparison churn.

Emerging vs receding demand: what’s rising, what’s fading?

Emerging product themes

- milk frothers (49,500; ▲)

- stainless steel frying pan (8,100; ▲)

- stainless steel pan set (4,400; ▲)

- cast iron pan / pots (multiple queries; ▲)

- grinder for salt and pepper (9,900; ▲)

- coffee brewer with grinder (12,100; ▲)

- ceramic frying pan / cookware (2,400; ▲)

- turkey kitchenware (8,100; ▲)

Receding product themes

- dinner set (60,500; ▼)

- kettle and toaster set (49,500; ▼)

- saucepan sets (14,800; ▼)

- kitchen knives (18,100; ▼) — generic head term

- professional chef knives (3,600; ▼)

What this means. Demand is polarising between premium single-item searches (steel, cast iron, ceramic) and bundled commodity sets losing steam. The stainless and cast-iron surge is part performance, part culture. Social cooking videos celebrate the hiss, patina and technique. Generic “kitchenware” basket terms are softening.

Directional strategy. Brand your expertise around the rising materials. For example, assemble an “Everything Stainless” hub with care, compatibility and comparative guides, then link into product pages with transparent pros/cons. For receding sets, reframe bundles around use-cases (“first flat”, “family refresh”) and lead with value-for-money storytelling rather than deep discounting alone.

Why spotlight Borough Kitchen?

Borough Kitchen is an independent retailer that excels at turning consideration into conversion through education. Despite ranking 26th by visibility (34,172; +7% YoY), the brand outperforms on the intangibles that move revenue in a high-consideration category.

By the numbers

| Metric | Value | Context |

|---|---|---|

| Visibility (Sep 2025) | 34,172 | Organic visibility baseline |

| YoY change | +7% | Steady growth against a rising market |

| Traffic vs Authority | Overachiever (18th) | Strong visibility despite modest authority |

| Reviews | 8,155 | High volume of social proof |

| Avg review | 4.9 ★ | Top-tier rating in the sector |

| Brand searches | 9,900 / month | Mid-table brand recall |

| Owned social | 80 | Room to grow audience quality |

How it wins. The site behaves like an editorial brand. The top-level Guides & Recipes hub is a first-class citizen in the navigation, not a forgotten blog. Articles such as pressure-cooker recipes or knife-care walkthroughs are thorough, reference credible sources, and link naturally to relevant products. “Meet the Makers” profiles put craftsmanship at the heart of the proposition, building trust that generic retailers can’t replicate. Utility links for Cook School and Gift Registry add offline and social proof touchpoints that feed branded search.

Directional strategy. This is the model for specialist retailers in 2025: content as a service that reduces risk, heightens enjoyment and earns loyalty. If your brand doesn’t yet have deep knowledge assets, start with the top five questions your customer service team answers each week and build authoritative, interlinked guides that can stand beside any product page.

Page speed and the craft of fast experiences

Speed matters twice: once for search systems, and again for human patience. Every second shaved improves perceived quality, especially on mobile. The fastest kitchenware winners keep layouts clean, reduce unused scripts and image weight, and prioritise interaction readiness.

Directional strategy. Treat speed as a content problem as much as a dev problem. Strip template noise from guides, use lightweight media for how-to content, and prefetch critical journeys (e.g., Guides → Product → Cart). Your best content shouldn’t wobble under the weight of your own design flourishes.

Traffic vs referring domains: quality beats quantity

The report’s Traffic Score vs Referring Domains view highlights a loose correlation between link counts and visibility. In other words, spammy or legacy link profiles don’t buy growth in 2025.

Directional strategy. Build links that a human would miss if they disappeared tomorrow. That means:

- Expert commentary with journalists in food/home titles.

- Maker-led storytelling that earns lifestyle features.

- Data-led PR on cooking trends that journalists want to cite.

Aim for brand-relevant coverage over raw volume. Good links lift both authority and branded demand.

Putting it together: the 2025 kitchenware playbook

Here’s a directional sequence I recommend for brands across the four quadrants:

- Fix foundations (everyone). Resolve indexation bloat, consolidate thin variants, and re-architect internal links around buyer tasks (choose → compare → care). A tidy site multiplies the value of every new guide you publish.

- Codify your knowledge. Design 10–15 evergreen guides that map to the biggest intent clusters: steel vs cast iron, pan sizing, knife maintenance, appliance compatibility, cleaning & longevity. Make them the best on the web; keep them updated.

- Build a live content engine. Publish recipes and maker stories weekly. Each piece should link back to one or more evergreen guides and forward to relevant products. Think “constellations”, not posts.

- Turn trust into a feature. Pipe review snippets into PLPs, PDPs and guides. Add care guarantees, warranty clarity, and returns. Confidence in the layout — not tucked away.

- Earn authority with relevance. Choose 2–3 PR themes: sustainability in cookware, expert classes, and the science of heat. Pitch hard to consumer lifestyle, interiors and food media. One great FT-style feature beats ten obscure blogs.

A closer look at the consideration journey (and where content earns its keep)

- Inspiration. Social and visual discovery seed desire — think tasteful kitchen photography, short-form prep videos, chef-endorsed techniques. Your job is to make sure those moments lead somewhere useful on your site.

- Discovery. Long-tail queries such as “how to season carbon steel” or “best moka pot grind size” are where shoppers reveal intent without yet naming a brand. Your guides should own these answers with clarity and care.

- Education. Deep, credible content (with product link-ups only when relevant) reassures buyers and gets bookmarked, shared and revisited.

- Consideration. Human stories — maker profiles, craft processes, material sourcing — give premium items a soul. Classes, events and registries move you from retailer to partner.

- Purchase. Make the path from guide to product obvious, not pushy. Keep checkouts fast. Follow up with care tips to reduce returns and create delight.

How to use this report in your planning

- Use the visibility table to benchmark momentum. If you’re growing slower than +23%, decide whether you defend head terms or expand long-tail.

- Use the quadrant view to prioritise your efforts. Overachievers should scale content clusters and brand PR. Sleeping giants should fix the site first.

- Use reviews as a lever for premium categories: they de-risk, differentiate and convert.

- Use emerging themes (steel, cast iron, ceramic) to guide category, content and creativity in 2025.

- If you want the deeper cuts, you can get the free 69-page report via our landing page here: download the full Kitchenware Market Report.

- If you’re exploring support, you can also learn more about our eCommerce SEO service — it’s built for retailers who need compounding, human-first visibility.

- And if you’d like to see the calibre of work we’d apply to Borough Kitchen, have a look at this award-winning retail case study: our approach we’d adapt for Borough Kitchen.