2025 Trade Plumbing Industry Analysis: brand visibility, awareness & AI share of voice

If you sell into the UK trade-plumbing market, this is your 2025 Trade Plumbing Industry Analysis. I’ve blended the latest Salience Index data with brand-demand signals and AI visibility findings to show who’s winning attention, where search demand is drifting, and how AI-powered results are reshaping discovery. Want every chart and the sector’s full table set? You can get the free 69-page report.

Which trade plumbing brands lead brand awareness in the UK?

Brand demand + owned social reach (UK)

| Rank | Brand | Monthly brand searches | Owned Social Score |

|---|---|---|---|

| 1 | Screwfix | 5,000,000 | 915 |

| 2 | Wickes | 1,500,000 | 648 |

| 3 | Toolstation | 1,830,000 | 382 |

| 4 | Victorian Plumbing | 246,000 | 271 |

| 5 | Plumbworld | 49,500 | 181 |

| 6 | City Plumbing | 110,000 | 69 |

| 7 | Bradfords | 165,000 | 43 |

| 8 | Easy Bathrooms | 33,100 | 188 |

| 9 | TradePoint | 14,800 | 324 |

| 10 | Huws Gray | 49,500 | 46 |

What the table shows: Brand recall is still concentrated at the top. Screwfix remains the name most buyers type, dwarfing the rest. Toolstation and Wickes sit in a strong second tier, but there’s a steep drop to specialist or regional players such as Plumbworld, City Plumbing and Bradfords. Note the outlier: Easy Bathrooms has modest brand searches yet a comparatively healthy owned-social score, suggesting campaigns that drive conversation even if they don’t always translate to navigational queries.

Why it matters: High branded search doesn’t just inflate traffic; it changes how every channel performs. Buyers who already know you convert faster and tolerate fewer clicks. In the era of AI answers, brand recall also increases the chance your name appears in the text of responses, not just as a buried source link. For the mid-pack, this means building recognisable, expert content around high-intent projects, and amplifying that content with Digital PR so you’re present when buyers search by problem, not by brand.

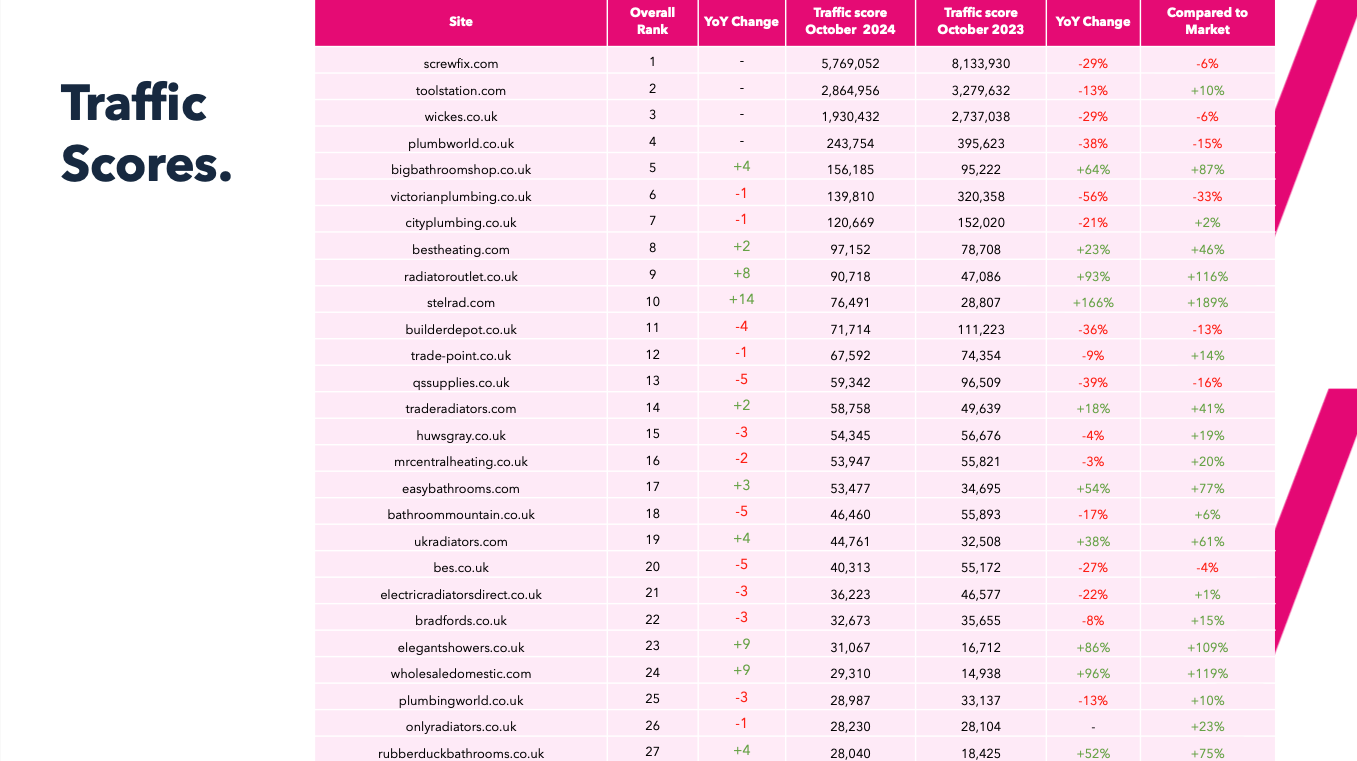

Who dominates organic search visibility right now?

Organic visibility snapshot (Traffic Score, Sep 2025 vs Sep 2024)

| Rank | Brand | Traffic Score (Sep 2025) | Traffic Score (Sep 2024) | YoY |

|---|---|---|---|---|

| 1 | Screwfix | 8,168,507 | 6,724,684 | +21% |

| 2 | Wickes | 4,116,375 | 1,975,926 | +108% |

| 3 | Toolstation | 2,777,645 | 2,675,658 | +4% |

| 4 | Victorian Plumbing | 294,527 | 156,346 | +88% |

| 5 | Plumbworld | 281,269 | 241,122 | +17% |

| 6 | City Plumbing | 122,230 | 126,196 | −3% |

| 7 | Big Bathroom Shop | 118,937 | 160,423 | −26% |

| 8 | TradePoint | 108,123 | 91,282 | +18% |

| 9 | Bathroom Mountain | 105,778 | 68,403 | +55% |

| 10 | Stelrad | 105,099 | 93,724 | +12% |

What the table shows: Screwfix still owns the biggest share of organic demand, but the standout story is Wickes doubling its Traffic Score year-on-year. Toolstation holds steady, Victorian Plumbing surges within its niche, and Plumbworld edges forward. The long tail is volatile: Big Bathroom Shop shrinks; Bathroom Mountain accelerates from a smaller base, hinting at gains in specific category clusters.

Why it matters: Traditional SEO remains the engine room for revenue. The winners aren’t just ranking for head terms; they’re broad across thousands of query variants that map to jobs, parts, sizing, and compatibility questions. If your YoY curve is flat while the market is rising, you’re losing share. The data suggests two levers: (1) expand structured category content that reflects how tradespeople actually filter and compare options; (2) publish definitive reference resources (compatibility, calculators, spec explainers) that pick up links and lock in long-tail rankings—groundwork that also feeds AI systems with trustworthy context.

Want to turn category depth and reference content into measurable growth? Learn more about our eCommerce SEO service.

Visibility vs authority: who’s punching above their weight?

The quadrant view tells you where technical foundations, content depth and link equity are out of balance:

- High traffic, high authority (A-quadrant) — market leaders combining strong link profiles with broad visibility. Think Screwfix and, increasingly, Wickes. If you’re competing, assume you’ll need non-linear moves: owned data tools, distinctive formats, or community assets.

- High traffic, low authority (B-quadrant) — overachievers whose technical setup and content quality carry a lighter link graph. There’s headroom here: targeted Digital PR could harden rankings that currently ride on content alone.

- Low traffic, high authority (C-quadrant) — the “sleeping giants.” Good link equity, weaker visibility. This often signals crawl/indexation inefficiencies, thin category frameworks, or legacy IA. Fix the foundations and you unlock disproportionate gains.

- Low traffic, low authority (D-quadrant) — early-stage or under-invested brands. Here, momentum comes from focus: pick a few projects/products and build the best resources on the web around them.

A sister chart plotting Brand Searches vs Traffic Score reinforces the story. If your brand searches are high but traffic is low, you’re leaving generic demand on the table; if traffic is high but brand searches are light, Digital PR and brand activity should raise navigational demand and improve your AI name-check rate.

How are brands showing up inside AI-generated answers?

AI visibility at a glance (multi-platform)

| Brand | AI Share of Voice (all platforms) | Google AI Overviews (SGE) SoV | ChatGPT mention rate | Bing AI mode SoV | AI citations (approx.) | Topics where brand is named (count) |

|---|---|---|---|---|---|---|

| Screwfix | ~50% | ~62% | ~32% | ~50% | ~9,000 (incl. Screwfix forum >6,000) | 285 |

| Wickes | ~26% | ~17.5% | ~25% | ~34% | ~1,200 | ~159 |

| Toolstation | ~21% | ~6% | ~28% | ~30% | ~652 | ~83 |

| Victorian Plumbing | ~12% | ~9% | ~20% | ~8% | ~1,234 | ~73 |

| Plumbworld | ~7% | ~7% | low | low | ~1,300 | 0 (cited, rarely named) |

| City Plumbing | low | very low | very low | very low | ~135 | few |

| Bradfords | minimal | minimal | minimal | minimal | ~56 | few |

| Easy Bathrooms | minimal | minimal | minimal | minimal | 28 | few |

What the table shows: AI answers magnify brand separation. Screwfix isn’t just cited; it’s named. The Screwfix Community forum is a heavyweight information source, creating a flywheel where forum Q&A fuels citations which reinforce future mentions. Wickes outperforms its classic SEO rank inside AI formats, likely off the back of guide-style content. Toolstation under-indexes in generative answers compared with its organic footprint—strong for product queries, lighter on community or evergreen how-to content that LLMs love to quote.

Why it matters: Being the link behind an AI answer is useful; being the brand named in the wording is better. Name-checks drive memory and future navigational searches. To shift from “cited” to “credited,” brands may need assets LLMs can confidently summarise: project walkthroughs, troubleshooting trees, calculators and glossaries. UGC hubs (forums, pro-tips archives) are particularly powerful in trades where edge-case detail matters. Expect AI platforms to reward breadth of topic coverage and consistency of helpful tone as they tune for safety and user trust.

Which product and brand trends are moving up (and down)?

Emerging products (search demand)

| Query | UK monthly searches | Trend |

|---|---|---|

| column radiator | 18,100 | +6% |

| thermostatic rad valves | 14,800 | +8% |

| tall radiators | 12,100 | +7% |

| electric radiators wall mounted | 6,600 | +15% |

| pan connector for toilet | 2,900 | +24% |

| toilet flushing mechanism | 1,900 | +44% |

| brushed brass radiator | 1,000 | +36% |

| 22mm copper pipe 3m | 880 | +30% |

Receding products (search demand)

| Query | UK monthly searches | Trend |

|---|---|---|

| plumbing | 74,000 | −18% |

| vertical radiators | 27,100 | −18% |

| plumbing supply | 14,800 | −28% |

| electric towel rail | 12,100 | −18% |

| radiator grey | 6,600 | −24% |

Emerging brands (brand queries)

| Brand | UK monthly searches | Trend |

|---|---|---|

| City Plumbing | 110,000 | +15% |

| Plumbworld | 49,500 | +22% |

| Easy Bathrooms | 33,100 | +39% |

| Bathroom Mountain | 33,100 | +31% |

| Builder Depot | 27,100 | +15% |

Receding brands (brand queries)

| Brand | UK monthly searches | Trend |

|---|---|---|

| Bradfords | 165,000 | −6% |

| BestHeating | 18,100 | −13% |

| TradePoint | 14,800 | −13% |

| Mr Central Heating | 14,800 | −18% |

| QS Supplies | 8,100 | −13% |

What the tables show: Demand is clustering around practical efficiency and finish choices (thermostatic control, brushed brass, specific pipe sizes), while some generic or fashion-led terms fade. On brands, City Plumbing pushes up in navigational interest, and mid-tier specialists like Plumbworld and Easy Bathrooms trend positively. Meanwhile, several heritage names show softening interest.

Why it matters: Category pages that reflect how trades buy—by size, connection type, finish, heat output—win. Brands seeing uplift tend to have clear, filterable ranges and guides that resolve compatibility doubts. Where demand is receding, assume higher competition for fewer clicks; your content must do more work per visit. Map this to generational patterns: younger DIYers and first-time buyers search with “what is / how to / size for” queries, while trade pros pivot quickly to product codes and parts. Content and on-page UX should serve both modes.

Which sites earn the most trust through reviews?

Review profile (selected high-volume sites)

| Site | Reviews (count) | Review score |

|---|---|---|

| Bathroom Mountain | 542,927 | 4.5 |

| Victorian Plumbing | 411,582 | 4.7 |

| Plumbworld | 69,997 | 4.5 |

| BestHeating | 65,531 | 4.6 |

| Wickes | 61,066 | 4.7 |

| ShowerSpares | 57,239 | 4.6 |

| HeatandPlumb | 25,658 | 4.6 |

| JT Atkinson | 13,606 | 4.9 |

Why it matters (reviews): Reviews uplift click-through and time-on-page, two behaviours that correlate with conversion and with the kind of engagement AI systems interpret as helpful. Embed review signals in the right places—PLPs, PDPs, and help content—to let buyers validate choices without pogo-sticking. Responding to negatives quickly also protects your brand’s AI footprint; LLMs increasingly surface tone and resolution in their synthesis of review content.

Page speed: why seconds still matter in trades

Core Web Vitals put numbers to what trade buyers feel: slow, janky pages burn daylight. In this sector, many sessions begin on mobile, often on-site or on the way to a branch. Lightweight templates, compressed imagery for product detail, and stable PLP grids reduce frustration and lower abandonment. Faster sites tend to rank better, but the bigger effect shows up in conversion and in AI—models favour sources that load reliably and structure information clearly.

Where to focus:

- Keep the biggest content element on each template lean and visible (LCP).

- Make filters instant and predictable; avoid layout shift that pushes results down (CLS).

- Ensure interactive controls appear responsive even when data calls run (INP).

The brands that treat speed as part of product fit—not just a tech chore—unlock compounding gains across SEO, CRO and AI citation likelihood.

Interpreting the wider pattern: how behaviour is evolving

- Jobs-to-be-done beats brand loyalty at the point of need. Even loyal Screwfix or Toolstation customers search tasks and parts first. Brands that pre-empt these queries with precise, visual explainers capture intent early.

- AI is normalising “list answers”. When ChatGPT or SGE lists Screwfix, Wickes and Toolstation together, it compresses perceived differentiation. That places more weight on what your brand is known for (community help, calculators, next-day availability) rather than what you stock.

- Generational split is widening. Younger DIYers and first-time buyers want step-by-step content and rapid validation via reviews; seasoned trades lean on product codes, spec sheets and peer tips. A single page often has to serve both.

- Local fulfilment still matters. Click-and-collect and branch stock visibility influence rankings indirectly through behaviour signals. When buyers don’t bounce, you win.

Strategic takeaways (directional, not prescriptive)

- Move from parts lists to proof. If you’re Toolstation or City Plumbing, pair catalogue depth with unmissable proof assets—compatibility tables, BTU calculators, wiring diagrams, “will-it-fit?” decision trees. These are magnets for links and AI citations.

- Turn “cited” into “credited.” Brands like Plumbworld are heavily cited but rarely named in answers. Bridge that by putting your brand name and expertise into the content itself—named expert quotes, author bios, and community round-ups that AI will carry verbatim.

- Double down on project language. Wickes’ uplift suggests guide-led content travels well across SEO and AI. Structure projects around inputs (room size, heat output, water pressure) and outcomes (noise, finish, install time) so models can safely summarise you.

- Defend head terms, grow the long tail. Screwfix has the head; challengers can out-ship on long-tail clarity. Standardise faceted copy and FAQs so every combination a buyer actually uses returns a helpful page.

- Make review signals work harder. Surface the most informative reviews, not just the newest. Highlight use-cases (“installer-friendly”, “quiet pump”, “fits Victorian soil pipe”) to feed both buyers and AI prompts.

One last thing: see how brands outside plumbing are playing the game

Want to see how we break down brand momentum in adjacent retail? If you’re benchmarking Screwfix’s playbook, see our Screwfix market breakdown and compare tactics that travel well into trade plumbing. And if you need a deeper cut of the numbers—including every keyword table and all 11 KPIs—get the free 69-page report via the form.

What I’ll be watching through 2025

- AI answer stability. Expect more variability in what SGE shows from week to week. Brands with broad, evergreen help hubs will ride the bumps better than those reliant on a handful of high-value URLs.

- Branch-aware UX. More sites will expose local stock and same-day collection at category level. That reduces bounce and strengthens both SEO and AI trust signals.

- Spec literacy. Content that explains equivalence and compatibility between parts (e.g., thread types, copper sizes, valve formats) will gather links and citations because it solves costly mistakes.

- UGC you can trust. Moderated, searchable community content—think the Screwfix forum model—will spread beyond the biggest players as brands look for persistent advantages in AI visibility.

Spotlight: how Screwfix turns community knowledge into AI authority

When people talk about authority, they often mean links. In trades, the richer signal is solved problems. The Screwfix Community forum packages thousands of real-world fixes, workarounds and brand-agnostic tips. That gives AI models a dense, trustworthy corpus to draw from. It also means the brand is helpful at the moment of need, not just visible in a product listing.

What makes that corpus unusually powerful is breadth. Questions span electrical, heating, fixings, bathrooms, compliance, and building control; answers are short, specific and experience-led. That pattern is easy for models to summarise safely. It’s why Screwfix doesn’t just get cited—it gets named in answers across many topics. Name-checks matter: they drive memory and future navigational searches, which in turn lift organic performance.

There’s a structural point here. Forums and help hubs create persistent surface area for long-tail intent. Threads attract links from blogs and social groups; they also generate a cadence of fresh engagement that keeps content current. That combination nudges both classic ranking systems and AI ranking heuristics.

Two enablers tend to separate useful UGC from noise: moderation and structure. Moderation keeps advice civil, legal and safe; structure makes content scannable—clear titles, accepted answers, and linkable snippets. Screwfix benefits from both. The knock-on effect is visible in AI share of voice: when a model must pick sources it can defend, a well-moderated, well-structured archive is a low-risk choice.

Could others replicate this? Yes—but only if the community serves jobs-to-be-done, not just product talk. A focused “Pro Tips” hub, searchable by task, material and fitting type, can deliver similar dividends. Pair that with a help centre that reads like a library—spec explainers, sizing guides, compatibility lookups—and you create overlapping assets that search engines and models can trust.

Finally, consider generational behaviour. Younger buyers want fast validation and visuals; seasoned trades want certainty and part codes. A forum thread with a labelled diagram, a brief bill of materials and a safety caveat satisfies both. Brands that ship those elements consistently will see their content reused in AI answers and recalled by buyers.

Method note

Traffic Score is an Ahrefs-derived estimate for relative visibility across ranking keywords. It’s not a replacement for analytics, but it’s ideal for market comparison. AI visibility metrics reflect captured impressions and citations across SGE, ChatGPT and Bing’s AI mode at the time of collection.