2025 Cruise Holidays Industry Analysis: who’s winning, who’s drifting, and where demand is moving

You’re reading the 2025 Cruise Holidays Industry Analysis based on the latest Salience Index (69 pages). The sector’s organic market has edged down −2% year-on-year on average, but the picture is uneven.

Some brands are flying. Others are taking on water. Below, I’ve pulled the headline stats and paired them with clear, directional commentary. If you want the data behind every chart, you can get the free 69-page report here.

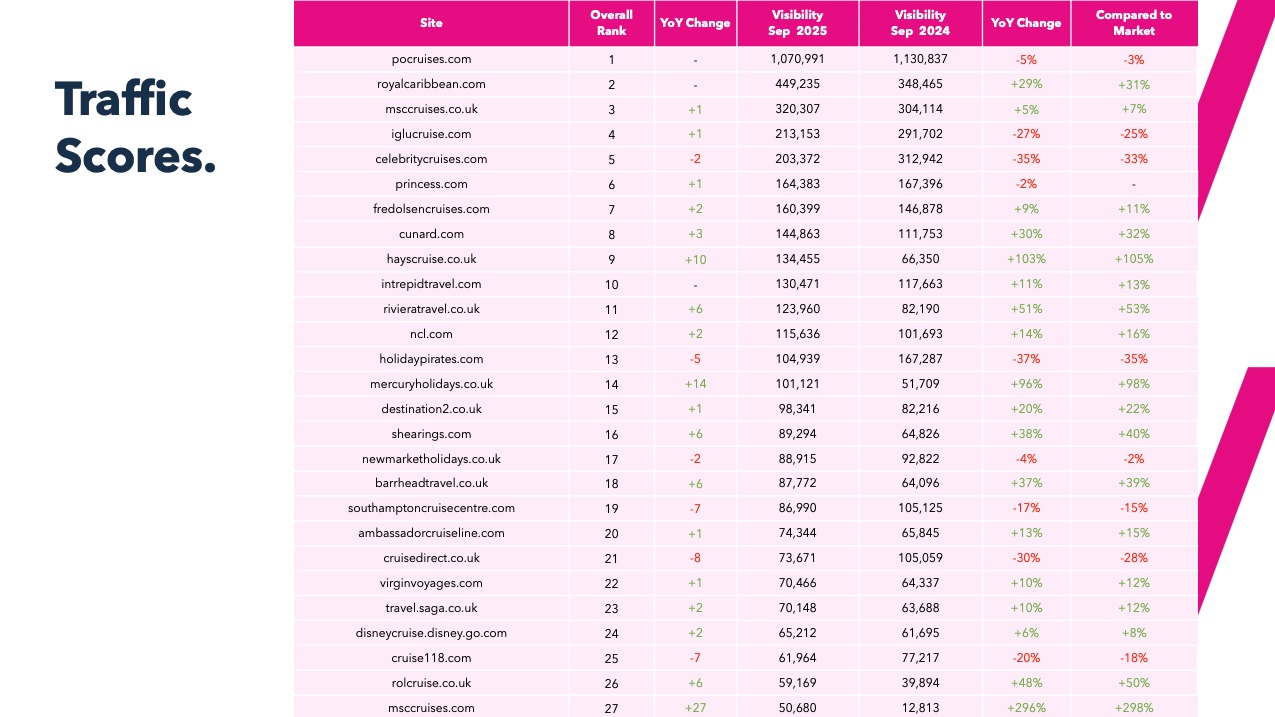

Which cruise holiday brands dominate organic visibility?

The leaderboard shows estimated organic traffic (“Traffic Score”) for September 2025 vs September 2024, plus YoY change. I’ve listed the top 15 to keep it usable.

| Rank | Brand (domain) | Sep ’25 Traffic Score | Sep ’24 | YoY |

|---|---|---|---|---|

| 1 | P&O Cruises (pocruises.com) | 1,070,991 | 1,130,837 | −5% |

| 2 | Royal Caribbean (royalcaribbean.com) | 449,235 | 348,465 | +29% |

| 3 | MSC Cruises (msccruises.co.uk) | 320,307 | 304,114 | +5% |

| 4 | Iglu Cruise (iglucruise.com) | 213,153 | 291,702 | −27% |

| 5 | Celebrity Cruises (celebritycruises.com) | 203,372 | 312,942 | −35% |

| 6 | Princess (princess.com) | 164,383 | 167,396 | −2% |

| 7 | Fred. Olsen Cruises (fredolsencruises.com) | 160,399 | 146,878 | +9% |

| 8 | Cunard (cunard.com) | 144,863 | 111,753 | +30% |

| 9 | Hays Cruise (hayscruise.co.uk) | 134,455 | 66,350 | +103% |

| 10 | Intrepid Travel (intrepidtravel.com) | 130,471 | 117,663 | +11% |

| 11 | Riviera Travel (rivieratravel.co.uk) | 123,960 | 82,190 | +51% |

| 12 | NCL (ncl.com) | 115,636 | 101,693 | +14% |

| 13 | Holiday Pirates (holidaypirates.com) | 104,939 | 167,287 | −37% |

| 14 | Mercury Holidays (mercuryholidays.co.uk) | 101,121 | 51,709 | +96% |

| 15 | Destination2 (destination2.co.uk) | 98,341 | 82,216 | +20% |

Direct cruise lines and specialist tour operators are gaining share. Royal Caribbean, Cunard, Hays Cruise, Riviera Travel and Mercury Holidays all post strong YoY growth.

Aggregators and content-heavy publishers have a rougher ride: Iglu Cruise, Celebrity Cruises, Holiday Pirates all fall back. That aligns with the search preference for intent-matched, brand-trust pages over generic “deal” hubs.

You win attention now by pairing clear intent (what the user wants, page by page) with brand trust. Sites that narrow the gap between research and booking with strong FAQs, transparent pricing and clear USPs convert that attention into visibility.

The losers here look like they’ve either thinned their informational depth, split signals across similar pages, or kept legacy content that no longer aligns with 2025 search patterns.

The biggest risers and fallers (YoY)

A quick cut of standout moves from the wider table.

Risers

- Hays Cruise +103%

- Mercury Holidays +96%

- Cunard +30%

- Royal Caribbean +29%

- Riviera Travel +51%

- MSC Cruises (.com) +296% (ranked lower down but huge relative gain)

Fallers

- Cruise Critic −81%

- Cruise Nation −52%

- Planet Cruise −43%

- Iglu Cruise −27%

- Cruisedirect −30%

- Southampton Cruise Centre −17%

Keyword trends shaping cruise demand in 2025

Emerging product searches (interest rising)

| Keyword | UK monthly searches | Interest trend |

|---|---|---|

| river cruises | 22,200 | +1% |

| celebrity cruises from uk | 18,100 | +31% |

| mini cruise from southampton | 8,100 | +41% |

| around the world cruise | 4,400 | +4% |

| cruise ship around the world | 4,400 | +4% |

| scenic river cruises | 2,900 | +43% |

| norway cruise from uk | 2,900 | +32% |

| luxury cruisers | 2,900 | +16% |

| cheap cruises from uk | 2,400 | +40% |

| celebrity cruises from southampton uk | 2,400 | +15% |

| iceland cruise from uk | 1,900 | +29% |

| christmas market cruise | 1,900 | +14% |

| cruises from dover uk | 1,600 | +47% |

| short cruises from uk | 1,600 | +49% |

| cruise to australia from uk | 1,600 | +15% |

| cruising from dundee | 1,300 | +43% |

| cruises from hull uk | 1,300 | +13% |

| cruise holidays from uk | 880 | +94% |

| world cruise 2026 | 720 | +107% |

| northern lights cruises from uk | 590 | +60% |

| 3 night christmas market cruise | 480 | +26% |

| solo cruises from uk | 390 | +251% |

Intent is polarising into “convenient short breaks” and “once-in-a-lifetime” ambitions. UK-departure phrases and city-specific terms are lively, as are experiential themes (Northern Lights, Christmas markets).

You should build clusters for UK-departure ports and short-break formats alongside deeper, guide-led content for bucket-list itineraries. Don’t stuff generic “cruise deals” pages. Match copy and CTAs per intent and you’ll bank both visibility and conversions.

Receding product searches (interest falling)

| Keyword | UK monthly searches | Interest trend |

|---|---|---|

| cruises from liverpool uk | 9,900 | −18% |

| cruise 2025 | 8,100 | −61% |

| all inclusive cruises | 8,100 | −24% |

| cruises from britain | 8,100 | −6% |

| thompsons cruises | 8,100 | −6% |

| british cruises | 6,600 | −6% |

| united kingdom cruises | 6,600 | −6% |

| mini cruise to europe from uk | 5,400 | −41% |

| christmas cruises | 5,400 | −4% |

| singles cruises | 4,400 | −12% |

| uk cruises around uk | 4,400 | −12% |

| cruise mediterranean | 3,600 | −18% |

| cruise to london | 2,900 | −18% |

| cruises from tilbury uk | 2,900 | −19% |

| cruise october | 1,900 | −24% |

| no fly cruises from uk | 1,900 | −13% |

| all inclusive cruises 2025 | 1,600 | −62% |

| last minute cruises from uk | 1,600 | −34% |

| cruise weekend | 1,600 | −21% |

| world cruises 2025 | 1,000 | −82% |

| no fly cruises from southampton | 1,000 | −16% |

| last minute cruise deals uk | 880 | −24% |

Users are no longer making as many vague searches. They’re looking for specifics. Port, duration, season, etc…

Brand search: who’s getting talked about more?

Emerging brands (brand interest rising)

| Brand term | UK monthly searches | Interest trend |

|---|---|---|

| Iglu Cruise | 135,000 | +7% |

| Celebrity Cruises | 90,500 | +14% |

| P&O Cruises | 60,500 | +6% |

| Disney Cruise | 49,500 | +19% |

| Fred Olsen Cruises | 49,500 | +22% |

| Cunard | 49,500 | +14% |

| Viking Cruises | 33,100 | +7% |

| Newmarket Holidays | 27,100 | +22% |

| Shearings | 27,100 | +15% |

| Intrepid Travel | 14,800 | +22% |

| Titan Travel | 14,800 | +15% |

| Bolsover Cruise Club | 14,800 | +7% |

| Emerald Cruises | 9,900 | +74% |

| Holland America | 9,900 | +36% |

| Cruise118 | 9,900 | +22% |

| Silversea | 8,100 | +22% |

| Cruise Kings | 8,100 | +15% |

| Costa Cruises | 6,600 | +32% |

| Love It Book It | 5,400 | +7% |

| Wendy Wu Tours | 4,400 | +30% |

Receding brands (brand interest falling)

| Brand term | UK monthly searches | Interest trend |

|---|---|---|

| Royal Caribbean | 110,000 | −1% |

| Holiday Pirates | 90,500 | −7% |

| Barrhead Travel | 49,500 | −18% |

| Destination2 | 33,100 | −7% |

| NCL | 33,100 | −7% |

| Virgin Voyages | 27,100 | −33% |

| Mercury Holidays | 27,100 | −18% |

| Ambassador Cruise Line | 22,200 | −42% |

| Cruise1st | 22,200 | −18% |

| Planet Cruise | 22,200 | −18% |

| Cruise Nation | 18,100 | −7% |

| Cruise Critic | 14,800 | −13% |

| Imagine Cruising | 14,800 | −5% |

| ROL Cruise | 9,900 | −10% |

| Viking River Cruises | 8,100 | −6% |

| Red Sea Holidays | 6,600 | −13% |

| Saga Travel | 1,600 | −11% |

High-competition keywords: where giants still jostle

These are the heavyweight queries. Volumes are strong and the SERPs are tightly contested.

| Query | UK monthly searches | Competitiveness |

|---|---|---|

| cruises 2025 | 26,000 | 25 |

| river cruises | 13,000 | 60 |

| uk cruises | 2,300 | 75 |

| all inclusive cruises 2025 | 1,700 | 26 |

| cruise companies uk | 700 | 78 |

| cruise deals uk | 800 | 40 |

| cruise critic uk | 1,100 | 43 |

| around the world cruise | 1,200 | 24 |

| river cruise holidays | 1,000 | 37 |

| cheap cruises from uk | 1,100 | 27 |

High intent still clusters around “river”, “UK departure”, and price modifiers. The competitiveness spread shows openings even at the top table.

Don’t funnel all of these into a single “deals” page. Map pages to sub-intents: short-breaks, UK-departures, river lines, and specific brands. Use clean, literal headings. Add short, structured answers to common questions to win “People also ask” and AI-overviews without bloating copy.

Visibility vs authority: who’s overperforming and who’s under their weight

The report plots sites by Traffic Score vs Authority (domain rating). It’s a handy way to spot “sleeping giants” (high authority, low traffic) and “overperformers” (low authority, high traffic). In cruise, you tend to see brand-heavy operators with strong authority, but some mid-tier specialists are still punching up by getting the technical base and content hierarchy right.

If your authority is high but visibility is weak, stop link-chasing and fix the basics: intent-mapped pages, duplicate consolidation, and internal links that move users between research pages and bookable product pages. If your authority is low but visibility is decent, you’re living on borrowed time; add travel-relevant coverage with data-led digital PR and

If you want more on the method and the KPIs we benchmark, you can learn more about the SEO service we’re discussing.

Riviera Travel: growth via intent-first architecture and PR

Riviera Travel set targets across River Cruises, European, and Worldwide categories. The work focused on restructuring category templates around user intent, then fuelling authority with data-led PR.

Key outcomes:

- 84% visibility for River Cruises, surpassing Viking River Cruises.

- 67% visibility in European Tours and 41% in Worldwide Tours.

- Over £10.5 million in organic revenue within the period.

- 1,361 transactions and 960,253 sessions reported alongside the visibility gains.

- An average of 71 linked coverage pieces per month reaching 122 million audience.

When you separate research pages (destinations) from purchase pages (tours), you reduce friction and stop pages fighting each other. Tie that to PR that earns coverage for timely, data-rich stories, and you get authority that actually feeds money pages. If you want to see the shape of the work, read our Riviera Travel case study.