The search-led winners, growth signals and strategy advice…

Where is demand rising? which brands are over- or under-performing? How does the search journey work in flooring?

What’s the flooring growth rate in 2025?

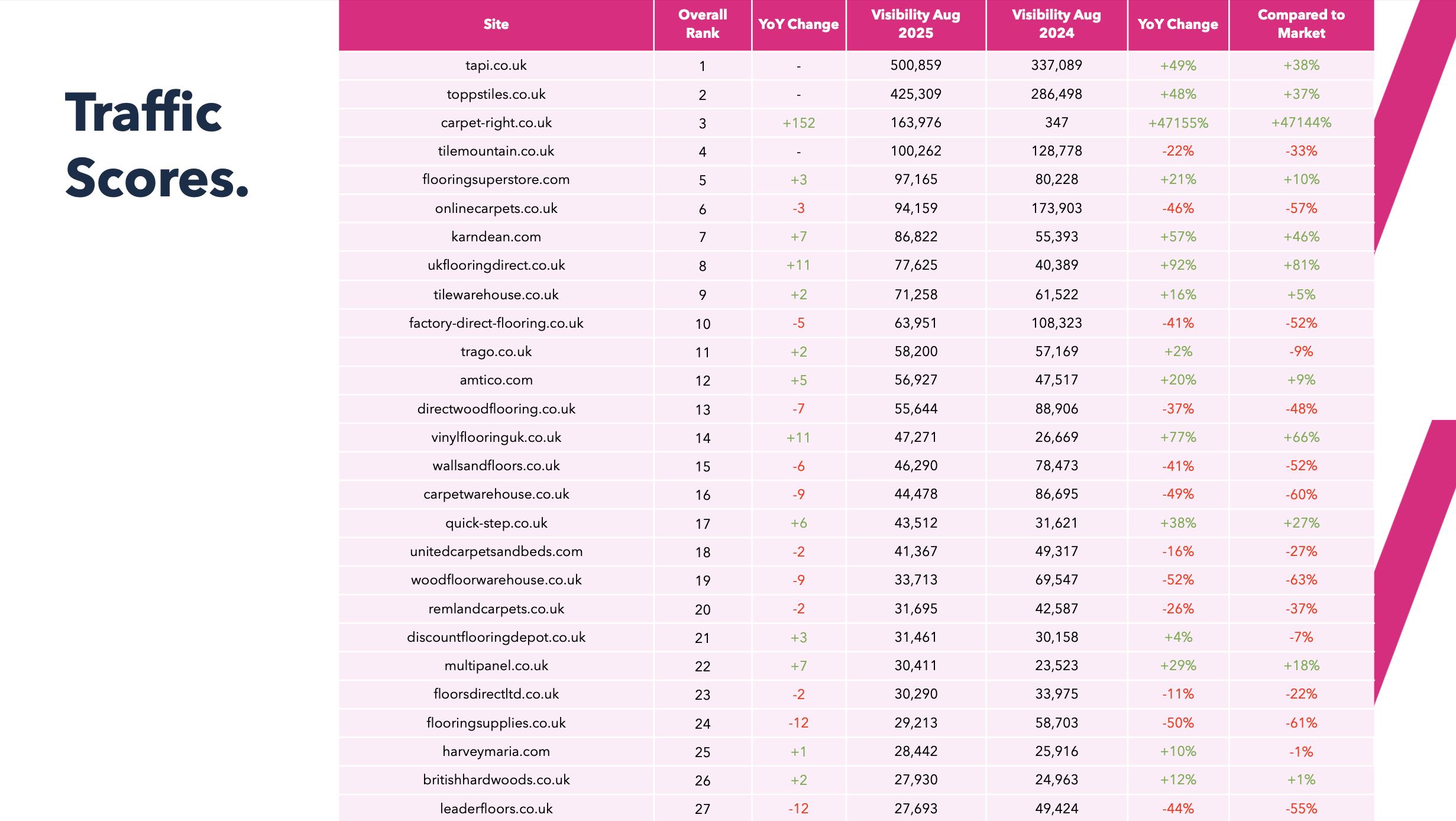

Our market momentum metric shows +11% industry variance year-on-year (traffic-score growth across the tracked brands). That’s a healthy growth for anyone building a share of voice. It doesn’t mean everyone’s up. It implies the headroom exists if you earn it.

TL;DR: Buyers are still researching flooring online, even if decision cycles are long.

Search is skewing towards information-rich, sample-led journeys rather than quick basket checkouts.

Brands with coherent category depth and helpful content are riding the waves of algorithm updates and changes in search behaviour. Shallow catalogues are sliding.

Which keywords shape demand? (High-competition vs. low-friction wins)

The flooring SERP splits into heavyweight, brand-building terms and a set of quieter, conversion-friendly queries. Here’s a cut of both.

| Keyword | Local monthly searches (UK) | Competitiveness |

|---|---|---|

| carpets | 26,000 | 65 |

| vinyl flooring | 74,000 | 37 |

| laminate flooring | 80,000 | 36 |

| LVT flooring | 55,000 | 24 |

| engineered wood flooring | 16,000 | 32 |

| carpet shops near me | 13,000 | 33 |

| luxury vinyl flooring | 8,100 | 34 |

| laminate flooring near me | 3,300 | 39 |

| Tapi carpets near me | 3,000 | 32 |

These are brand-building battlegrounds. They’re crowded, price-anchored and unforgiving on UX. Winning here usually reflects strength across the board: depth of ranges, fast pages, applicable advice content, and a low-friction conversion journey.

If you already rank, keep the moat topped up with better category authority (content clusters that mirror how people shop and create semantic relevance) and helpful copy around delivery, returns, and sample timelines. If you don’t rank, avoid brute-force tactics. Build topic coverage around intent (room-type, material, installation) and let the authority compound over time. Note how “near me” queries align to hybrid journeys. Stores using live stock messaging and book-a-measure tools can connect research to real-world action.

| Keyword | Local monthly searches (UK) | Competitiveness |

|---|---|---|

| carpet underlay | 11,000 | 6 |

| LVT | 12,000 | 11 |

| vinyl floor tiles | 9,800 | 5 |

| LVT click flooring | 7,100 | 6 |

| vinyl flooring near me | 2,800 | 9 |

| vinyl click flooring | 7,800 | 10 |

| bathroom vinyl flooring | 4,800 | 3 |

| vinyl tiles | 4,800 | 6 |

| cheap carpet | 4,600 | 5 |

So what? These are pragmatic footholds for visibility and revenue. They skew to mid-funnel and are perfect for landing pages that do three things fast: explain options, set expectations (samples, delivery, fitting), and show price brackets. Because competition is lighter, tidy technicals and strong copy often beat bigger brands. Get your schema in order, keep images lean, and map FAQs to real user anxieties (installation, care, returns, sample limits).

Expect more retailers to create content clusters that mirror these intents (e.g., “bathroom vinyl floors” with splash-proof value props).

Where is demand rising or fading? (Emerging vs. receding trends)

Emerging product searches

| Keyword | Volume | Trend |

|---|---|---|

| LVT flooring | 49,500 | +14% |

| herringbone floorboards | 40,500 | +14% |

| LVT | 9,900 | +7% |

| LVT click flooring | 8,100 | +22% |

| flooring places near me | 8,100 | +15% |

| herringbone carpet | 5,400 | +50% |

| beige carpet | 4,400 | +14% |

| wool carpet | 4,400 | +7% |

| LVT herringbone flooring | 3,600 | +40% |

| LVP flooring | 3,600 | +22% |

| herringbone LVT | 2,900 | +32% |

| LVT floor tiles | 2,400 | +23% |

| light oak laminate flooring | 1,900 | +12% |

| lino flooring near me | 1,300 | +85% |

| LVT bathroom flooring | 1,300 | +40% |

| LVT adhesive | 1,300 | +19% |

| engineered hardwood flooring | 1,000 | +90% |

| engineered flooring near me | 1,000 | +50% |

| carpet and vinyl flooring | 1,000 | +20% |

| herringbone carpet stairs | 880 | +42% |

| engineered parquet flooring | 880 | +49% |

| solid wood floors | 880 | +32% |

| herringbone linoleum flooring | 720 | +39% |

Pattern-led terms and engineered products are getting traction. Brands that marry inspirational content with precise sample experiences will capture this demand. This is less about trend-chasing and more about translating intent into architecture. If “herringbone” trends, you need a topic cluster covering pattern types, preparing for herringbone flooring, room suitability, and price bands.

Receding product interest

| Keyword | Volume | Trend |

|---|---|---|

| floorboards laminate | 135,000 | −13% |

| carpets | 110,000 | −12% |

| vinyl flooring | 110,000 | −12% |

| Karndean floor | 49,500 | −18% |

| large carpet | 27,100 | −13% |

| engineered timber floorboards | 27,100 | −7% |

| carpet and flooring near me | 22,200 | −13% |

| washable carpet | 22,200 | −7% |

| carpet underlay | 18,100 | −13% |

| linoleum tile flooring | 14,800 | −29% |

| vinyl floor tiles | 14,800 | −29% |

| grey carpet | 14,800 | −24% |

| grey laminate flooring | 12,100 | −33% |

| cheap carpet | 12,100 | −24% |

| herringbone laminate flooring | 12,100 | −24% |

| luxury vinyl flooring | 12,100 | −18% |

| vinyl click flooring | 9,900 | −33% |

| affordable laminate flooring | 9,900 | −18% |

| vinyl tiles | 8,100 | −29% |

| carpet for stairs | 8,100 | −18% |

| vinyl plank flooring | 5,400 | −42% |

| cheap vinyl flooring | 5,400 | −24% |

| cushion flooring | 4,400 | −24% |

| carpet flooring | 4,400 | −24% |

| striped stair carpet | 4,400 | −25% |

Receding brands

| Brand | Volume | Trend |

|---|---|---|

| Topps Tiles | 201,000 | −7% |

| Carpetright | 60,500 | −55% |

| Tile Mountain | 33,100 | −7% |

| UK Flooring Direct | 27,100 | −13% |

| United Carpets and Beds | 18,100 | −6% |

| Al-Murad | 12,100 | −23% |

| Karndean | 12,100 | −6% |

| Amtico | 9,900 | −13% |

| Quick-Step | 6,600 | −12% |

| Bert & May | 5,400 | −18% |

| Multipanel | 5,400 | −13% |

| Flooring Supplies | 5,400 | −13% |

| Vinyl Flooring UK | 5,400 | −13% |

| Leader Floors | 4,400 | −20% |

| Gillies | 4,400 | −7% |

| Discount Flooring Depot | 1,600 | −19% |

| Harvey Maria | 1,600 | −23% |

| Remland Carpets | 1,300 | −29% |

| Flooring Hut | 1,300 | −21% |

| Best4Flooring | 880 | −6% |

Falling interest doesn’t automatically mean falling sales. It usually means the generic search is fragmenting. Big umbrella terms (e.g., “vinyl flooring”) break into more specific modifiers (“bathroom vinyl”, “click LVT”). If your taxonomy still leans on legacy categories, you’ll miss that shift and see a gradual visibility bleed.

Search behaviour is changing. More people query in natural language. Queries are longer and more complex — so your content has to answer those specifics quickly and clearly.

Reviews and trust still decide conversions.

Review depth is a strong tie-breaker in flooring. One leader here is Gillies, with a high review score and sizeable volume. It’s not the only brand doing well, but it shows the pattern. Quick replies, visible proof across PDPs and PLPs, and third-party badges like Trustpilot build confidence. In such a high-ticket, high-commitment category, reviews do more than nudge — they de-risk remote buying, especially when shoppers can’t touch the product.

UK Flooring Direct and the sample-to-order journey

We singled out UK Flooring Direct in this year’s analysis for how it turns research into orders. The brand appears in the overachiever set, which implies strong visibility on the back of technical hygiene and a product experience tuned to how people choose floors.

Flooring is a long, tactile decision. Shoppers want to see tones at home, in their lighting, and compare across price points. Brands that reduce friction from sample to checkout will keep winning share, especially on mobile.

Final word

Buyer journeys are longer, and trust travels with them. Brands that respect that journey, especially the sample step, are growing fastest. The numbers above should help you prioritise.

Want every table, method and brand breakdown? Get the free 69-page report. Need hands-on help? Learn more about our eCommerce SEO service. How does this play out in real campaigns? See how brands like UK Flooring Direct scale organic growth.