UK Online Betting: Search Winners, Trends & Opportunities in 2025

If you’re working in online gambling, this 2025 Online Betting Industry Analysis pulls together the headline movements from the Salience Index so you can benchmark where you stand, see what’s changing in search, and spot the following places to win. I’ll keep this practical and human-first, with the key stats up front and thought-through commentary on what the numbers suggest about how people now discover, choose, and return to betting brands.

Spotlight brand: flashscore.co.uk — a utility-led publisher converting live-interest into repeat demand and brand reach.

Which online betting brands dominate organic visibility in 2025?

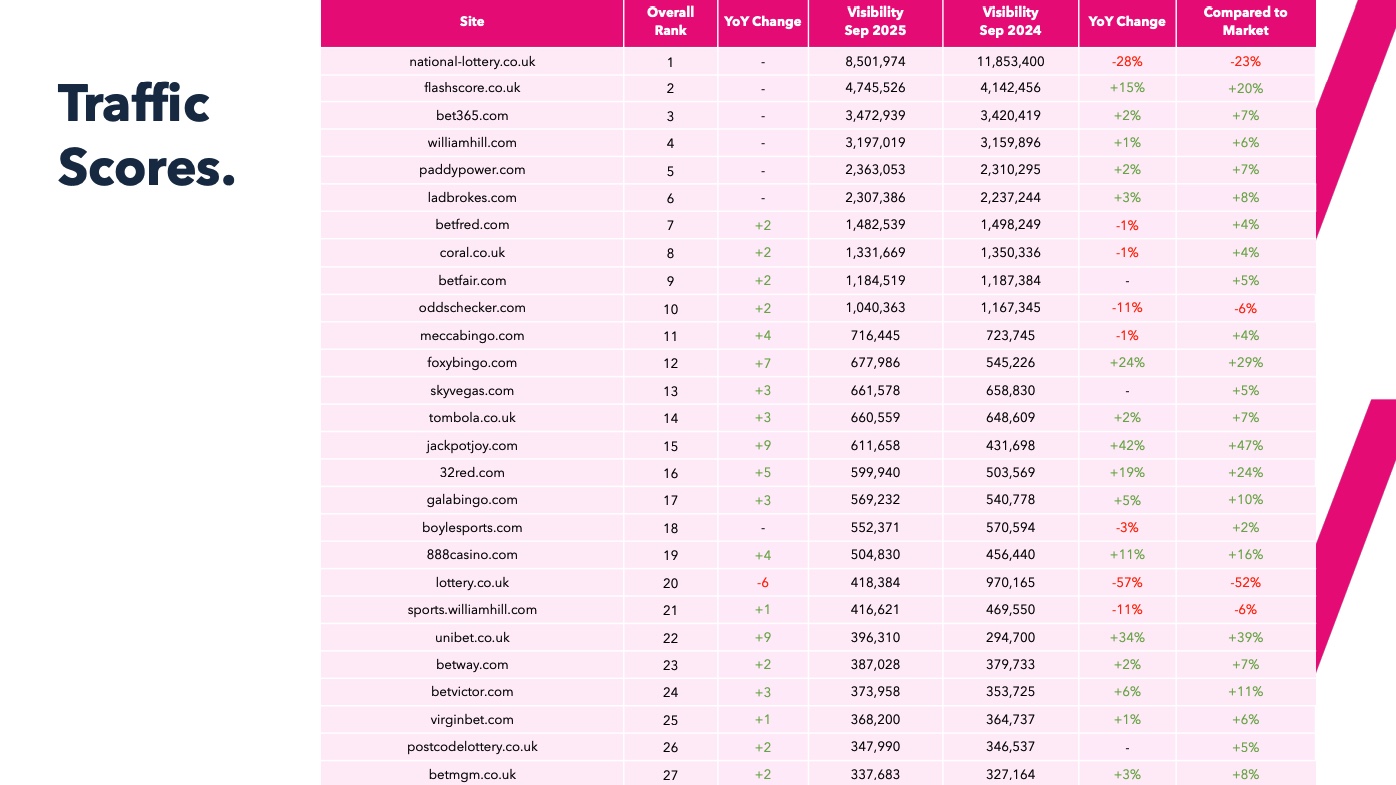

Below are the market-level traffic score movements year-over-year (September 2025 vs September 2024) for the leaders. Traffic score is an estimate of monthly organic visits based on rankings and CTR modelling. It’s directional and superb for comparing brands at the market scale.

| Rank | Brand | Traffic Score Sep 2025 | Traffic Score Sep 2024 | YoY | vs Market |

|---|---|---|---|---|---|

| 1 | national-lottery.co.uk | 8,501,974 | 11,853,400 | −28% | −23% |

| 2 | flashscore.co.uk | 4,745,526 | 4,142,456 | +15% | +20% |

| 3 | bet365.com | 3,472,939 | 3,420,419 | +2% | +7% |

| 4 | williamhill.com | 3,197,019 | 3,159,896 | +1% | +6% |

| 5 | paddypower.com | 2,363,053 | 2,310,295 | +2% | +7% |

| 6 | ladbrokes.com | 2,307,386 | 2,237,244 | +3% | +8% |

Industry variance across the market is 5%, so growth above that line is genuine out-peAverrformance rather than a rising tide. Only a handful of brands are growing faster than the market contraction.

What the leaderboard reveals

Two things jump out. First, flashscore.co.uk is the only non-operator in the top two, growing 15% YoY in a market that shrank overall. That points to changing discovery patterns: in a SERP full of AI overviews, odds tools, and answer boxes, utility content that solves immediate tasks (scores, fixtures, form) is capturing intent before betting brands do. Second, bet365.com, williamhill.com, paddypower.com, and ladbrokes.com are all eking out low single-digit gains. That’s resilience at scale, but it also hints at a ceiling on pure brand power when informational intent is siphoned by facilitators like flashscore.co.uk.

Looking outwards, we’re seeing a behavioural split by journey stage. Younger cohorts begin by engaging with utilities and creators, gravitating towards live data, community tips, and rapid context. Older bettors cut through with branded navigational queries. That divide explains why utilities and specialised content hubs are making ground while traditional operators hold ground. For operators, the job is to meet users earlier with valuable experiences, not just offers.

Do more links still mean more traffic? (Traffic score vs referring domains)

Link volume alone is no longer a reliable predictor of visibility. In the market scatter, you see four quadrants:

- High traffic / high referring domains — the dominant cluster; keep doing you.

- High traffic / low referring domains — technically strong sites with content-market fit; brand reach can be amplified via targeted digital PR.

- Low traffic / high referring domains — potential “sleeping giants”; check for stale or off-topic links and on-site friction.

- Low traffic / low referring domains — brands needing a fundamental search push.

Examples appearing across the scatter: grosvenorcasinos.com, foxybingo.com, playojo.com, tombola.co.uk, buzzbingo.com, galabingo.com, jackpotjoy.com, skyvegas.com, postcodelottery.co.uk, pokerstars.uk, betmgm.co.uk, virginbet.com, slotstemple.com, livescorebet.com, admiralcasino.co.uk, heartbingo.co.uk, monopolycasino.com, 10bet.co.uk, rainbowrichescasino.com, lottomart.com, skybingo.com, ballycasino.co.uk, lottogo.com, doublebubblebingo.com, thephonecasino.com, fabulousbingo.co.uk.

What the link analysis tells us

When link footprints are heavy but traffic is light, it often signals a mismatch: links earned to commercial landing pages or outdated content that no longer reflects how people search. Sites winning with fewer domains typically have crisp architectures, clean Core Web Vitals, and content aligned to volatile demand (think fixtures, in-play, and squad news). For flashscore.co.uk, the opportunity isn’t raw link volume; it’s to continue earning high-signal mentions tied to features, data quality, and integrations.

Which betting keywords are hardest to win in 2025?

These “heavyweight” terms attract the biggest brands and demand a near-perfect page experience and trust signals.

| Keyword | UK Monthly Searches | Competitiveness |

|---|---|---|

| football tips | 16,000 | 86 |

| free bets | 8,800 | 88 |

| betting tips | 8,800 | 88 |

| sports betting | 6,200 | 96 |

| online bingo | 6,200 | 89 |

| online poker | 5,000 | 90 |

| online lottery | 8,500 | 85 |

| online betting | 5,200 | 96 |

| football betting | 6,900 | 87 |

| black jack | 6,700 | 87 |

Why this matters

Competition scores in the high-80s/90s sit alongside saturated SERPs dominated by brands, comparison engines, and (increasingly) AI answer units. Qualifying intent on these terms is everything. Users want clarity in milliseconds, not a maze of tabs. For operators, ranking here without a recognisable brand is becoming unrealistic; instead, the strategy is often to earn presence in the spaces around them (modules, guides, tools) and build branded demand elsewhere.

From a behaviour standpoint, users are getting more selective with generic queries. If they don’t see a brand they recognise, they scroll, and only 0.63% of searchers click into page two. The upshot: trust and recognisability have compounded value at head terms. Utilities like flashscore.co.uk claim upstream sessions; operators must make a branded recall the tiebreaker.

Where are the realistic wins? (Opportunity keywords)

These terms show strong demand with comparatively lower competitive intensity.

| Keyword | UK Monthly Searches | Competitiveness |

|---|---|---|

| horse racing tips | 38,000 | 81 |

| political betting | 11,000 | 78 |

| racing tips today | 9,200 | 82 |

| grand national odds | 5,100 | 78 |

| grand national betting | 4,600 | 78 |

| golf betting | 4,200 | 80 |

| horse tips | 3,900 | 79 |

| spread betting | 3,100 | 77 |

| live roulette | 2,700 | 80 |

| live blackjack | 2,700 | 77 |

Why are these attractive?

These queries reflect specific moments, such as marquee events, today-only decisions, or niche interest pockets. They skew toward in-play behaviour and habit loops (daily tips, race-day routines), which create repeatable acquisition opportunities. Visibility here builds brand memory so that, when a user graduates to a high-competition term, they’re predisposed to click you.

For flashscore.co.uk, the alignment is obvious: daily formats (“today”, “odds”, “non-runners”) map to its live-update DNA. Owning these spaces reinforces the brand’s role as the always-on companion and opens collaborative paths with operators without eroding user trust.

What’s rising and what’s fading? (Keyword trend lines)

Emerging products & topics

| Query | UK Monthly Searches | Interest Trend |

|---|---|---|

| virtual horse race result | 90,500 | +6% |

| black jack | 27,100 | +15% |

| football tips today | 22,200 | +6% |

| horse track betting | 14,800 | +31% |

| online bingo | 14,800 | +7% |

| online lottery | 12,100 | +2,677% |

| transfer betting odds | 12,100 | +308% |

| horse racing non runners for today | 9,900 | +22% |

| play lotto online | 5,400 | +54% |

| championship promotion odds | 5,400 | +20% |

| free poker | 5,400 | +14% |

| championship odds | 4,400 | +38% |

| horse racing odds | 4,400 | +23% |

| free racing tips | 3,600 | +40% |

| cricket betting | 2,900 | +28% |

| free bingo games | 2,900 | +35% |

| buy lottery tickets online | 2,400 | +68% |

| snooker betting | 2,400 | +80% |

| bingo and slot games | 2,400 | +25% |

| tennis betting | 1,900 | +32% |

| cricket match odds | 1,300 | +58% |

| buy lottery online | 1,000 | +90% |

| casino betting | 1,000 | +70% |

| online lottery games | 880 | +262% |

| player transfer odds | 880 | +195% |

| derby betting | 880 | +167% |

| football transfer betting | 720 | +105% |

| derby odds | 590 | +155% |

| lotto official website | 590 | +180% |

| england india odds | 170 | +2,111% |

Receding products & topics

| Query | UK Monthly Searches | Interest Trend |

|---|---|---|

| live casino | 8,100 | −24% |

| football odds | 6,600 | −37% |

| betting tips today | 6,600 | −27% |

| free poker machine games | 5,400 | −34% |

| betting sign up offers | 5,400 | −25% |

| new customer betting offers | 4,400 | −38% |

| football odds today | 4,400 | −48% |

| betting odds | 3,600 | −36% |

| online bingo sites | 3,600 | − |