ROAS Is Losing Relevance in the UK E-commerce Market

Return on Ad Spend (ROAS) has long been the go-to metric for measuring advertising success. It tells you how much revenue you earn for each pound spent on ads.

However, in today’s UK market, ROAS is becoming a dangerously misleading figure. Why?

Soaring operational costs are devouring profit margins, even when ROAS looks healthy. UK inflation hit a 41-year high of 11.1% in late 2022, driving up the cost of everything from fuel to packaging. E-commerce brands face a barrage of expenses, including shipping fees, payment processing charges, costly packaging, high return rates, and constant discounting—all eating into the bottom line.

ROAS, however, doesn’t account for any of these. As one analysis bluntly put it, revenue “doesn’t necessarily translate to what’s in the bank” – you can have high sales figures yet find yourself “up the creek without a paddle” if overheads silently swallow your profits.

Let’s break down the hidden costs eroding UK e-commerce margins even as ROAS stays rosy:

- Shipping & Logistics: UK carriers and fuel costs are high, and Brexit-related frictions haven’t helped. Free delivery isn’t free to you – it cuts directly into your margin.

- Payment Fees: Every PayPal, credit card, or even Klarna transaction skims a percentage off the sale. ROAS ignores these fees entirely.

- Product Costs & Packaging: The cost of goods sold (COGS) and packaging materials (boxes, labels, etc.) have all increased. These are real expenses that ROAS doesn’t reflect..

- Returns & Refunds: UK shoppers are notorious for high return rates, especially in fashion. Processing returns, refurbishing items, or writing them off is a huge profit drain that a simple ROAS metric won’t reveal.

- Discounts & Promotions: Amid a cost-of-living crisis, UK retailers often run sales or voucher codes to entice buyers. You might give up 10-20% of revenue per order. ROAS counts the top-line sales before discounts, masking the lower actual take-home revenue.

In short, a 5:1 ROAS might impress on a PowerPoint chart, but if shipping, payment and return costs eat 80% of each sale, that 5x return is an illusion. Revenue-focused metrics hide these truths. One marketing report stated clearly: “Revenue provides little insight into fixed costs, payment fees, margins or shipping costs”.

This is precisely the scenario many UK businesses find themselves in – chasing a high ROAS while net profit dwindles. It’s a recipe for disaster. Brands are waking up to the fact that what matters is profit, not just revenue. That’s where POAS comes in.

Why ROAS No Longer Cuts It

Return on Ad Spend (ROAS) once made sense. When operational costs were low and competition was softer, you could live with measuring gross revenue returns.

A “400% ROAS” sounds good.

But after discounts, free shipping, payment fees and returns?

The actual profit margin can be close to zero.

We, as an agency, are guilty of having fallen into this false mirage, too. If you have the joy of reading this article, then you’re at the fortunate end of seeing us make a significant shift in moving our agency’s model to profitability only.

Profitability that drives business growth. Congrats.

What Is POAS (Profit on Ad Spend) and How Do You Calculate It?

Profit on Ad Spend (POAS) is the antidote to ROAS’s blind spots. Put simply, POAS measures the actual profit you generate for each £1 of ad spend, after all costs are deducted. Instead of focusing on revenue, POAS asks: “After we pay for the product, the shipping, the payment fees, the returns – how much money do we keep from this campaign, relative to what we spent on ads?”

It’s an accurate gauge of campaign success because it reflects money in your pocket, not just money through the till.

Calculating POAS: Divide the profit attributed to an ad campaign by the ad spend. Profit means revenue minus all associated costs (product, shipping, fees, etc.).

The formula is straightforward:

POAS = (Profit from ad campaign) / (Ad spend on campaign)

However, if you’re partnered with an incumbent agency right now, this looks a little different. That looks like this for us:

Ad spend + agency fee / ad spend * break even ROAS (1/profit margin e.g 1/.5 for 50% margin)

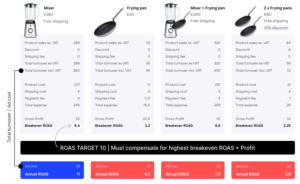

This article by profitmetrics.io (a tool; we’ve deployed to some client campaigns) does a stellar job of visualising the distinct differences between ROAS & POAS across different product lines:

The Real-World Impact of Tracking POAS

To drive the point home, here’s a side-by-side comparison of ROAS and POAS:

| Metric | ROAS (Return on Ad Spend) | POAS (Profit on Ad Spend) |

| What it Measures | Revenue generated per £1 of ad spend (ignores production and fulfilment costs). It’s essentially gross return on ad spend. | Profit generated per £1 of ad spend (after all costs are accounted for). Offering an accurate net return on your advertising spend. |

| Visibility into Costs | None. ROAS doesn’t factor in cost of goods, shipping, fees, or discounts – so it can look high even when margins are low. . It’s a top-line metric. | Complete. POAS bakes in product costs, shipping, payment fees, returns, and other overheads. It’s a bottom-line metric showing actual profitability. |

| Behavior & Incentives | Tends to reward revenue at any cost. Teams chasing ROAS might push expensive products or heavy discounts to boost sales ££, even if the profit per sale is thin. High ROAS can also come from targeting existing customers who would’ve bought anyway – a vanity win that inflates the metric without growing profit. | Rewards efficient profit. POAS highlights campaigns and products that deliver higher margins. It naturally steers budget toward high-profit items and efficient channels, and flags low-margin sales that lose money. A POAS-driven strategy focuses on the quality of revenue, not just quantity. |

| Ease of Tracking | Plug-and-play. All major ad platforms (Google, Facebook, etc.) report ROAS by default using revenue data. No extra setup needed, which is why many stick with it. | It requires setup. You need to input your cost and margin data into the tracking mix. This can mean configuring your analytics or ad platform to use profit instead of revenue (via custom columns, data feeds, or back-end integration). It’s a bit of upfront work, but it yields far more meaningful insight. |

| Insight for Leadership | Potentially misleading. A high ROAS might satisfy at a glance, but CFOs and CEOs can be misled if they assume it equals high profit. Doesn’t directly inform financial decisions because it’s not tied to actual profit. | Boardroom-ready. POAS shows precisely how much money the business makes from its ad spend. It speaks the language of CEOs, CFOs and finance teams who ultimately care about profit, cash flow, and ROIadcore.com. A POAS figure directly and confidently informs strategic decisions (scaling spend, cutting losses). |

In summary, ROAS is a vanity metric in the current environment – it can make an unprofitable campaign look profitable.

POAS is the reality check, telling you whether your ad spend truly contributes to the business or generates hollow revenue. As one marketing expert quipped, “ROAS is a misnomer. It should be called ‘credit for ad spend’. If your team or agency is still bragging about ROAS alone, it’s time to dig deeper.

Why UK Business Leaders Need POAS for Decision-Making

If you’re a CEO, CFO, or CMO in the UK, you’re under immense pressure to deliver actual financial results, not just pleasing graphs. When advertising reports come in, the first question in the boardroom isn’t “How much did we sell?” It’s “How much did we profit?”.

In a climate of tight margins and cautious spending, UK executives need metrics that align marketing with the bottom line. This is precisely why POAS is fast becoming the north star metric for savvy businesses.

We get this through and through. We’ve been in those exact boardrooms, and we recognise that paid media agencies have to make a fundamental shift.

ROAS is useless for real decision-making. A campaign can smash its ROAS target and lose money once costs are counted. British businesses have found that out the hard way. You hit the ROAS goal last quarter, but the P&L still bled red. Sound familiar? It happens all the time: marketing cheers revenue, finance counts losses. POAS cuts through the noise by focusing on what matters—profit.

Consider what UK leadership teams face: higher wage bills, pricier imports, and consumers expecting free returns and next-day delivery. Every pound of marketing spend must be justified in terms of profit, or it’s simply not sustainable. Nearly half of marketers say ROI (not ROAS) is the most important metric for their CEO, CFO, and board.

Why do we, as an industry, not prioritise this? Why do we run these massive QBR reviews and not mention final business profit even once? POAS should be tracked across every product line and in every report.

ROI is what POAS delivers in the advertising context – it shows the real return on your ad investment. By adopting POAS, CMOs can finally speak the same language as CFOs. Instead of debating if a 4x ROAS is “good,” you’ll discuss how a campaign yielded £X net profit. There’s no ambiguity there.

POAS empowers better decisions: When you know which campaigns make money, you can confidently scale them up. If a certain product line shows a POAS of 5 (i.e. £5 profit per £1 ad spend), you have a green light to invest more in it – it’s driving real growth. Conversely, if another campaign pulls a POAS of 0.8 (losing 20p per £1 spent), you can cut it before it burns a hole in your budget. This might sound obvious, but too many UK companies have been flying blind on this because they only saw the revenue, not the profit.

Tracking POAS gives far more profound insight into the health of your business. It “paints a clearer picture of how well you are doing” by focusing on clear profit instead of just revenue. It factors in all those fluctuating costs in your supply chain and marketing, showing you how much money you’re truly bringing in from a given campaign.

In practice, UK leaders using POAS can answer critical questions with confidence:

- Which products should we push this quarter? The ones with high POAS – i.e. our most profitable sellers, not just the top-line sellers.

- Can we afford to increase ad spend? POAS will tell us. If we maintain a POAS above 1, we know we’re scaling profit, not just revenue.

- Where do we need to improve efficiency? If our overall POAS is slipping due to rising costs (say, shipping or returns spiked), we see it immediately and can react (renegotiate rates, adjust pricing, etc.).

- What’s our true marketing ROI? POAS answers this in a way ROAS never could, by showing net returns. This helps in budget planning and in justifying marketing spend to the board with evidence of profit impact.

Simply put, POAS turns marketing analytics into a CFO-friendly report. It gives UK executives the truth about advertising performance, enabling data-driven decisions that bolster the company’s financial strength. In an economy where every percentage point of margin counts, this clarity is not just nice to have – it’s essential for survival and growth.

How To Start Moving From ROAS to POAS

Making the switch from ROAS to POAS might sound technical, but it’s entirely achievable with today’s tools. The key is to integrate your cost-of-goods and other expense data into your marketing analytics. Here’s a practical roadmap for UK e-commerce brands to migrate their reporting and mindset:

1. Centralise Your True Cost Data: Gather all the cost inputs impacting your orders. This includes product unit costs (The amount it costs you to produce or buy each item), average shipping cost per order, packaging cost, payment processing fees, and even an average return cost if applicable. Get these numbers from your finance or operations team – a cross-department effort. In the UK, be sure to factor in things like VAT on fees or any Brexit-related surcharges in shipping. A clear list of costs per product (or per order) is the foundation.

2. Link Cost Data to Sales Data: Connect these costs to your marketing measurement system. By default, platforms like Google Ads, Facebook, or Google Analytics record revenue, not profit. You need to override that by feeding in the profit for each transaction. There are a couple of ways to do this:

-

- E-commerce Platform & DataLayer: If you use Shopify, Magento, etc., you can include product costs in the data layer on purchase events. When an order is completed, pass the profit for each item (price minus cost) instead of or in addition to the revenue. This might require a developer to push those values. One guide notes you can simply send your earnings (profit) for each product as the value, “instead of the purchase amount”, to your analytics tool.

- Custom Variables or Lookups: Another method is using Google Tag Manager with a lookup table or custom JavaScript. For example, you maintain a table of product IDs to product margins, and GTM replaces the revenue with the appropriate profit figure on the fly. This ensures every reported conversion value is profit.

- Use an External Database or Tool: For more complex setups, you might use an external database that your analytics pings to fetch the correct profit values (some cloud tools like Stape Store or Funnel’s data hub can facilitate this. The idea is the same – the ad platforms must receive profit data. Tools exist to help merge the cost of goods into your ad tracking without exposing sensitive data publicly.

3. Configure Ad Platforms for POAS: Many platforms allow custom metrics or value import. For instance, in Google Ads, you can use offline conversion import or value rules to adjust for profit margin; in Facebook (Meta) Ads, you can pass a custom conversion value.

Some marketers create a custom column in Google Ads called “Profit”, which is Revenue minus a cost factor, to optimise campaigns towards actual profit. Marketing data platforms, e.g., Funnel.io or others, also support this, which lets you join cost data with ad data to compute POAS in dashboards. The goal is to have your dashboards and reports show POAS instead of ROAS.

It might mean a new column in your report titled “Profit on Ad Spend,” which your team will monitor daily.

3. Educate and Align Your Team: Make sure everyone understands the new metric. Train your marketing team to optimise for POAS, not ROAS.

This is a mindset shift. Campaigns that used to be lauded for 500% ROAS might now only show a POAS of 150% if margins were thin. That can be an initial shock, so expect some figures to look “lower” because they’re more honest. Tie campaign goals to profit (e.g., “target POAS 3+”) so your team knows how to make decisions.

For example, they may need to allocate more budget to Campaigns or products that, while driving slightly lower volume, yield higher profit per sale.

4. Update Reporting Structures: Present your following marketing report to leadership with POAS front and centre. Show a before/after comparison if needed: “Here’s what our Q1 looked like in ROAS, and here it is in POAS.” This transparency builds trust.

Smart UK business leaders will appreciate the candour and rigour. Over time, you might entirely phase out ROAS from the conversation.

The new standard becomes: “This campaign delivered a POAS of 4, meaning £4 profit per £1 spent – shall we scale it?” or “That other campaign fell below 1.0 POAS, meaning it’s destroying value – we’ll drop it.” Your finance team will likely applaud this move.

5. Leverage Analytics & Attribution on Profit Basis: As you implement POAS, make sure your attribution model (how you credit sales to clicks) is reasonable. Just as with ROAS, multi-touch attribution or media mix modelling can be used, but now with profit as the output.

For example, Google Analytics 4 or a third-party attribution tool can be configured to optimise for profit events. This ensures all your fancy attribution algorithms are focused on what truly matters. Real-time profit dashboards can also be set up, so you aren’t waiting for the end of the month to see how you did. Many UK firms are integrating their Shopify/Magento data with BI tools (like Looker or Power BI) to monitor POAS by channel daily.

The technology is there; it’s mostly about taking the plunge.

The transition requires some initial work under the hood, but it’s not overwhelming. Some solutions make it plug-and-play – for instance, some services automatically calculate profit per SKU and feed it into ad platforms.

However you do it, the key is to start now. Every day running on ROAS alone, you might unknowingly be bleeding profit on seemingly “good” campaigns.

Why Most Agencies Won’t Talk About POAS

- It’s harder to report.

- It reveals fundamental inefficiencies.

- They’re incentivised to look good, not necessarily be good.

If you’re reading this and thinking, “Why hasn’t my agency already done this?”, you’re not alone. Many UK agencies stubbornly cling to ROAS because it’s the path of least resistance – frankly, it makes them look good with minimal effort.

This is an industry-wide issue, and it boils down to a mix of habit, incentive, and sometimes outright laziness.

Here’s the uncomfortable truth: ROAS is a convenient vanity metric for agencies.

It’s easy to generate a flashy ROAS figure by doubling down on branded keywords, retargeting loyal customers, or targeting only your most high-intent audiences. These tactics often inflate the ROAS number without actually driving incremental profit.

As one ex-Adidas marketing director famously said, “ROAS … should be called ‘credit for ad spend’”– it often just credits the ad platform for sales that would have happened anyway.

An agency focused on ROAS can claim credit for your baseline sales and show a great ROAS, while in reality, their campaigns might not have moved the needle for your business. It’s smoke and mirrors.

Why do some agencies resist switching to POAS? A few reasons:

Lack of Capability or Data Access:

POAS needs integration with cost data. Many agencies don’t have direct access to their clients’ COGS or profit numbers and won’t go out of their way to get them. It’s easier for them to stay siloed in the ad platforms and avoid talking to your finance team.

This data gap works in their favour: if they don’t see profit figures, they can’t be held accountable for profit.

Fear of Accountability:

The moment an agency agrees to report on POAS, it loses cover. If a campaign loses money, POAS shows it clearly. Some agencies fear they’ll get blamed, or even, fired.

So they steer the conversation to safer ground: “Look at all the revenue we drove!”

It takes a confident, growth-focused agency to say “we made £X profit” and face it when expectations aren’t met. Not every agency has that honesty.

Vanity and Client Perception:

Agencies know many clients still get dazzled by high ROAS numbers. A 10:1 ROAS sounds impressive to anyone who doesn’t dig deeper. POAS usually gives a more petite figure (because profit is only a slice of revenue).

An insecure agency fears that a 1.5 POAS (150% ROI) sounds worse than a 5 ROAS (500% return), even if the POAS is better for your business. They think you “won’t understand” or that you’ll get disappointed. So they stick to the glossy numbers and hope you won’t ask awkward questions.

Inertia and Skill Gaps:

Tracking POAS properly takes skill and effort. Many agencies are stuck. Their teams are trained to chase ROAS. Their reports are built around it. Their bonuses might depend on it.

Switching means retraining media buyers to optimise for profit, changing how they bid, and teaching account managers how to explain profit metrics. It’s easier to keep doing the same thing and hope you don’t push for better.

If your agency still feeds you ROAS figures in 2025, that’s a red flag. It means they either can’t evolve or won’t. Either way, it’s bad for business. You can’t build long-term growth on short-term metrics.

ROAS rewards the wrong behaviour – quick wins that make the agency look good but do little for the bottom line. This leads to underinvestment in broader marketing and a narrow view of success.

A good agency won’t fear POAS – they’ll push for it. Because they’re confident their work makes you money, not just sales.

If your agency resists POAS, ask why. Are they unable or unwilling to prove their value?

The best UK agencies are already using POAS. They optimise for profit, earn trust through transparency, and build strategies that deliver real returns.

Don’t let vanity metrics hold your business back. Press the issue.

Profitability Is the Only KPI That Counts

It’s time to call out the old ROAS game for what it is: dated at best, deceptive at worst. In a market as competitive and cost-intensive as the UK, POAS is the only metric that matters. It’s the metric that separates vanity from value.

By adopting POAS, you ensure every advertising pound is evaluated on real merit – did it generate profit or not?

This clarity will drive more intelligent decisions, whether reallocating the budget to a higher margin product, pushing back on wasteful spending, or holding your marketing partners to higher standards.

UK business leaders are increasingly demanding this clarity. They are tired of marketing reports that brag about revenue while profit leaks out the back door. As one 2024 report said, focusing on profit metrics provides “a solid understanding of how much money you are actually bringing in” – and that understanding is power. It enables you to invest in winners and cut losers without hesitation. It turns your marketing from a cost centre into a valid driver of the business’s financial success.

So, challenge your team, your agency, and the status quo. Shift the spotlight from ROAS to POAS. Your financial statements will thank you. And if your current agency can’t get on board, maybe it’s time to find a partner who isn’t afraid to be held accountable for real results. After all, in business, especially in these times, profit isn’t just a metric. It’s the mission.