Every year, Q1 means our Salience Index releases cover some of the most competitive verticals in all of the UK in search maturity.

This series distils the tactics working for growing brands right now; meaning you’re now reading the tactics employed by the brands fighting for every inch of digital real estate.

In this article:

4x actionable tactics

4x niche verticals

1,123 x brands monitored

Loads of 💰💰💰 to be made.

Let’s dive in.

Presenting: SPRINT Winners #5 // Febuary 2025

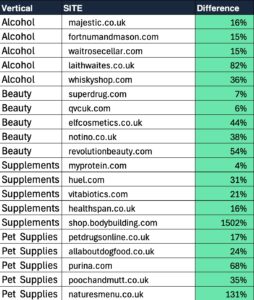

Vertical level growth/ decline.

- Alcohol +10%

- Beauty Retailers +1%

- Sports Nutrition (Incl CBD) +3%

- Pet Supplies -5%

These are the brands growing the fastest:

Here are the best stories in February:

Laithwaits Wine: The Brand Redefining Alcohol Search

The alcohol market? Shrinking, they say. But in search, it’s telling a different story—up 10% YoY.

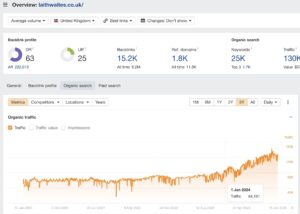

And then there’s Laithwaites.co.uk, smashing through the average and growing 72% faster. This isn’t your typical “overnight success” story. No hype. No viral stunts.

Just relentless consistency and brilliantly doing the basics. They’ve climbed #4 places in our 2025 Alcohol Industry Index, rubbing shoulders with giants like Whisky Exchange and Majestic.

What’s their secret sauce?

Their site structure is so clean, search engines and users glide through it effortlessly. No dead ends, no faff—just streamlined navigation. Thousands of quality referring domains act like rave reviews in Google’s eyes. They’re building trust, one link at a time.

By going after intent-rich long-tail searches like “best red wine subscription,” they capture the customers who want to buy—not just browse. Their blog? Updated. Their landing pages? Always relevant. They’re serving content like they serve wine—timely and tailored to taste.

Their site doesn’t just load; it zips. Because if you’re making customers wait, you’re losing them. This isn’t just SEO—it’s a masterclass in keeping things simple, sharp, and scalable. Laithwaites isn’t chasing viral moments—they’re building a legacy.

Steady growth. Big results. Top 5. Cheers to that. 🥂

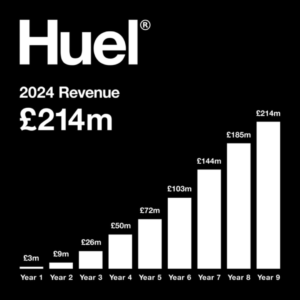

How Huel Grew into a £214 Million Brand:

Since launching in 2015, Huel has grown from a small UK startup to a global nutrition powerhouse, selling over 300 million meals and generating £214 million in annual revenue.

They’re climbing the ranks in the SERPs too, growing 34% quicker than the market average. They’re currently #3 in the sector, pulling in an estimated 205,077 monthly organic traffic.

Here’s how:

Let’s be honest, meal replacements and protein supplements are nothing new. What Huel does differently is reframing the narrative. They venture beyond the fitness and performance niche, positioning themselves as a complete nutritional base for everyday health and wellness.

By shifting the focus to “fuel for life” rather than just enhancements for athletes, they’ve opened the category to a much broader, health-conscious audience. Huel leans heavily into technical, evidence-backed content to build trust.

Their dedicated “Science” section in the navigation, packed with detailed breakdowns of every ingredient and health benefit, speaks directly to a sceptical audience seeking credibility. It’s not flashy, but it’s incredibly effective at converting wary consumers.

They’ve also mastered the art of intent.

Huel sponsors The Diary of a CEO podcast, aligning with an audience driven by personal growth, health, and productivity (among many others). The podcast’s listeners mirror Huel’s ideal customer profile: high-achieving individuals who value efficiency and wellness.

Huel’s product pages are also SEO gold. They address every potential objection head-on, from cost concerns to ingredient transparency, while leveraging principles of E-E-A-T (Expertise, Experience, Authority, Trustworthiness) to dominate in a “Your Money or Your Life” (YMYL) space.

The design is deliberate, with deep topical depth and extensive FAQs designed to reassure every type of buyer. Perhaps one of Huel’s most subtle yet effective strategies is their opt-out subscription model. By pre-selecting subscriptions as the default, they capitalise on the “path of least resistance” in buyer psychology.

Once customers start receiving regular shipments, it becomes part of their routine. A behaviour that’s hard to break and builds long-term loyalty. Huel’s community of ‘Hueligans’ is also an additional marketing channel in disguise.

Their forum ranks in the top 10 for over 300 high-intent search terms, such as “is Huel ultra-processed?” and “Huel for diabetics.” These discussions provide authentic, user-driven content that attracts organic traffic while addressing genuine customer concerns.

This strategy has allowed them to dominate organic search without pouring resources into traditional blog content.

Revolution Beauty; beauty revolution.

Up nine places and on its way to becoming a beauty industry powerhouse.

54% growth YOY, and climbing the ranks.

How?

This strategy revolves around virality, crushing TikTok.

Here’s what they’re doing:

TikTok has become a decision-making hub for young people, functioning as both a search engine and a trendsetter. A 15-second video showcasing a product with a hashtag like #TikTokMadeMeBuyIt is enough to turn a new launch into a must-have.

Revolution Beauty understands this. They’ve mastered the art of moving quickly, spotting trends, and turning them into opportunities.

When Charlotte Tilbury’s Magic Cream went viral, Revolution launched their affordable alternative, Miracle Cream. It sold out twice, created a 13,000-person waitlist, and drove organic search demand up by +2015%.

Their waitlist gathered 10,000 email addresses, setting them up for future campaigns and ensuring faster sellouts for the second launch. Today, their Jelly Blush (another affordable dupe) is front and centre, proudly labelled “TikTok Viral” on their website – another example of this strategy working so well for them.

Revolution Beauty is the perfect case study of what happens when a brand understands its audience, acts fast and leans into the platforms shaping consumer behaviour today.

How PetDrugs Online’s organic traffic hit 305,601,

Growing +22% more than the market average YoY growth (-5% 😬).

Averaging 90,500 monthly brand searches.

It’s no accident they’re leading the pack. In fact, they’re up a place in our rankings, overtaking zooplus.com and into the top 3, hot on the heels of market leaders like Pets at Home and Purina.

Here’s three things they’re getting right;

- The site asks users questions about their pet’s age, size, and diet needs and serves up exactly what the user is looking for.

- Filters allow users to narrow down grain-free, high-protein, low-calorie, and many other options, eliminating endless scrolling.

- Every product has clear reviews, so the user knows other pet parents swear by it.

For brands in any space, the takeaway is clear: know your customer, solve their problems, and give them an experience that sticks.

That’s all. Stay human ✌️.

Interested in a free 2025 search strategy wash-down?

We’ll audit all your core channels and ensure they’re in the best possible position to yield maximum growth in the year ahead.

You can book a 15-minute meeting with our consultant, Josh, here.

(Friendly advice, not a sales pitch)

P.S Want to see this series every other week? Subscribe yourself here 🙂

Want to see this stuff daily? Connect with Michael (Jimmy) or Sean to have posts like this appear in your LinkedIn feed daily.