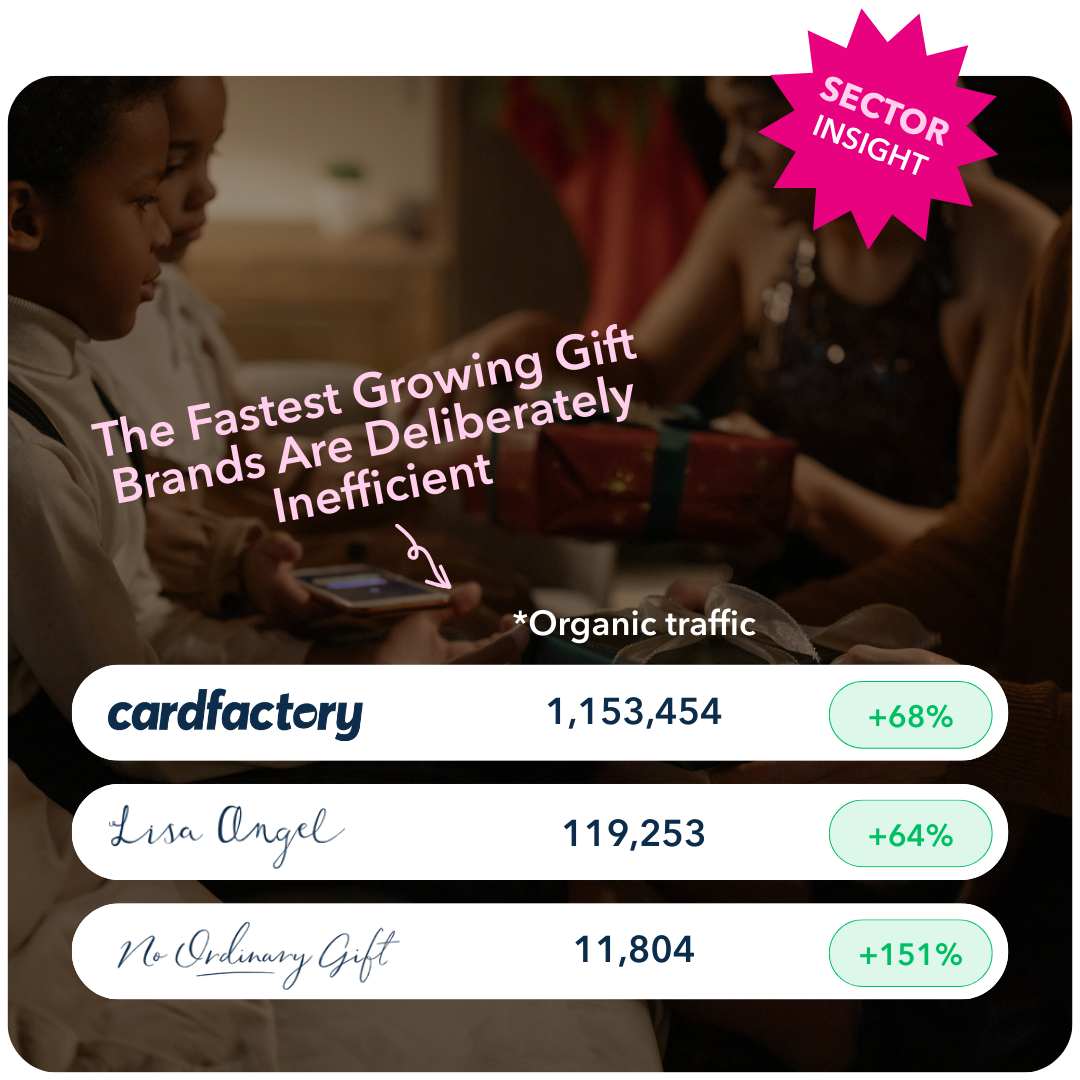

A tiny Oxfordshire workshop sells personalised leather bookmarks. Each one is hand-engraved to order, takes 1-2 days to dispatch, and carries this promise: “If you’re not 100% happy, return it free of charge.” Free returns on personalised items violate e-commerce orthodoxy. You can’t resell a bookmark engraved with “James & Sophie.” The conventional wisdom says personalised products must be final sale. Last year, No Ordinary Gift’s organic visibility grew 151%.

Fifty miles away, a Norwich jewellery boutique called Lisa Angel warned customers that items are hand-made and take longer to ship. They deliberately limited their product catalogue while competitors expanded. They put the founder’s photo on the home page, admitting they’re small and independent. Their visibility grew 64%, outperforming the market by 51 percentage points.

In Greater Manchester, Card Factory, a budget high-street chain selling greeting cards, added countdown timers to £2.99 products. “Order in the next 4 hours 13 minutes for dispatch today.” Urgency mechanics are supposed to be for luxury limited releases, not cards that cost less than a coffee. Card Factory’s online visibility exploded 68%. They jumped to #2 in the entire UK gift sector. These brands are doing everything wrong according to standard e-commerce playbooks. Yet all three are winning. The question is, why?

The Data Behind the Paradox

The Salience Gifts Index 2026 tracked organic search performance across 100+ UK gift e-commerce brands, comparing November 2024 to November 2025 visibility. The methodology uses Ahrefs’ organic traffic score, an estimate of monthly visits based on keyword rankings and click-through models. Most brands in the index moved with the market. Single-digit growth or decline, positions shifting by one or two ranks. But seven brands exhibited unusual patterns. They grew dramatically while breaking core e-commerce rules. They sacrificed efficiency, limited choice, admitted weakness, and increased friction, all moves that should have reduced conversions. We’ve produced a piece of analysis diving into the search marketing lessons and strategies that you can draw from the data in our report. Read that here.

Instead, they captured market share from technically superior competitors. The insight hiding in this data isn’t about SEO tactics. It’s about human psychology. Gift-giving is fundamentally anxious. You fear choosing the wrong item, spending the wrong amount, or having it arrive late. You worry about what your gift signals about you, to the recipient and to yourself. E-commerce brands that grow fastest aren’t the ones with the most products or fastest sites. They’re the ones that understand and alleviate these anxieties through what behavioural economists call “costly signals.”

The Costly Signal Advantage

Lisa Angel’s growth reveals the mechanism clearly. Their website greets visitors with “independent, female-founded since 2004” and a photo of founder Lisa in the original store. This messaging is deliberately costly: it admits limited scale when conventional wisdom says project corporate strength. They offer a long 45-day return period and a one-year guarantee on £26 necklaces, absorbing risks that cut into margins.

Product pages emphasise hand-crafted details and warn about 1-2 day dispatch times. The “Selling Fast” section shows six items, not hundreds. Each limitation signals authenticity. Why does this work?

In behavioural economics, a costly signal is an expensive or difficult-to-fake action that demonstrates quality. A peacock’s tail signals genetic fitness precisely because growing one is metabolically expensive. Lisa Angel’s inefficiencies signal genuine craft for the same reason. Mass manufacturers physically cannot replicate hand-made production at scale, and drop-shippers cannot claim a 20-year independent heritage.

No Ordinary Gift applies the same principle through risk reversal. By accepting free returns on personalised items, they eliminate the prospect theory loss aversion that keeps hesitant buyers (who feel losses much more intensely than equivalent gains) from being stuck with an unusable custom gift. This guarantee is expensive to honour (they absorb the loss on returns), which makes it credible. Cheap brands couldn’t afford to make this promise. By making it anyway, No Ordinary Gift signals confidence and quality.

Anxious gift-givers who would never risk a personalised purchase now convert. The 151% surge in visibility, from 4,700 to 11,804 monthly visits, proves the strategy works despite sacrificing margins.

The Procrastinator’s Dilemma

Card Factory operates at the opposite end of the spectrum. Mass-market, budget-focused, hundreds of physical stores. Yet their online growth mirrors the boutique success stories, suggesting a different psychological mechanism. Their website is plasterred with “3 cards for £5” promotions. Product grids resemble discount catalogues. Page speed is mediocre. Everything about the experience signals low-cost volume retail.

Except for one thing. Countdown timers.

“Order in the next 4 hours 13 minutes” appears on £2.99 greeting cards. This urgency framing is typically reserved for luxury product releases or limited-edition clothes. Applying it to cheap cards seems absurd. But Card Factory’s customers aren’t buying cards. They’re buying relief from procrastination. Behavioural economics research shows that people delay unpleasant tasks, like buying a card for an upcoming birthday, because the process (finding a design, writing a message, posting it) generates more friction than the cost. Card Factory removes each barrier. Choose quickly, personalise easily, we’ll send it directly to the recipient today, and it costs £2.99.

The countdown timer doesn’t create artificial scarcity. It creates a deadline that tells the procrastinator: “You still have time. You haven’t completely failed as a friend.” That psychological reassurance is worth more than the card itself.

Card Factory also enables direct-to-recipient shipping with the sender’s details pre-printed on the envelope. This solves a friction point most brands ignore, physically posting the card. By removing that final step, they capture the last-minute shopper who would otherwise give up. The 68% visibility growth, and jump to #2 in the sector, validates the strategy. Competitors with slicker designs and faster sites can’t match this psychological positioning without adopting similar discount messaging, which would undermine their premium brands.

The Satisficing Economy

Across all seven high-growth brands in the analysis, one pattern dominates: they make “good enough” arrive faster. Barry Schwartz’s paradox of choice research shows that too many options reduce satisfaction. Yet most e-commerce sites maximise SKU counts, chasing long-tail keyword rankings. The assumption is that more products = more ways to match customer intent. But gift-giving involves uncertainty and anxiety, not just preference matching. Shoppers don’t know exactly what they want. They need reassurance that what they choose will be “good enough.”

This explains why technically inferior sites can outperform superior ones. Card Factory’s slower page speed doesn’t matter if psychological friction (procrastination anxiety, price uncertainty, posting hassle) matters more than technical friction. Lisa Angel’s limited catalogue doesn’t cost sales if reducing choice paralysis increases conversion rates. The brands growing fastest recognise that in gift retail, the competition isn’t other websites. It’s abandonment. The shopper who closes the tab because they’re overwhelmed, uncertain, or anxious.

What This Means Strategically

Yes, you need decent page speed, mobile optimisation, and clear navigation. But once competitors match those basics, differentiation comes from psychology, not technology.

The brands winning in gift e-commerce make deliberate trade-offs:

- Lisa Angel sacrifices scale for authenticity. Their hand-made approach limits production volume, but creates defensible positioning that mass manufacturers cannot replicate without restructuring operations.

- Card Factory sacrifices design elegance for anxiety reduction. Their cluttered interface and discount aesthetic alienate premium shoppers, but capture the procrastinator market.

- No Ordinary Gift sacrifices margins for trust. Free returns on personalised items cost money, but eliminate the barrier stopping hesitant buyers.

These most likely aren’t accidental inefficiencies, but choices. What looks like bad e-commerce might be excellent behavioural economics.

The Defensibility Question

Why can’t competitors copy these strategies? Some tactics seem simple: add countdown timers, curate product ranges, offer founder stories. But implementing them requires giving up something valuable. To adopt Card Factory’s anxiety-reduction approach, premium brands would need to embrace discount messaging and sacrifice their aspirational positioning. To match Lisa Angel’s authenticity, large retailers would need to slow production and limit choice, reducing efficiency and revenue.

To offer No Ordinary Gift’s guarantee, brands would need to restructure operations to absorb personalised returns at scale. To replicate Zavvi’s pre-order model, you’d need exclusive licensing deals and fandom credibility built over years. The trade-offs make these strategies defensible. It’s not that competitors don’t understand the psychology. It’s that adopting it would undermine their existing business model. This is the strategic value of psychological positioning: it creates moats that aren’t based on proprietary technology or exclusive supplier relationships. The moats are built from deliberate inefficiency that signals quality in ways efficiency cannot.

The Path Forward

For in-house marketers at gift e-commerce brands, the lesson isn’t to copy Lisa Angel’s tactics or Card Factory’s countdowns. It’s to audit where your brand is sacrificing psychological resonance for conventional optimisation.

Are you adding products to chase keyword rankings when curation would reduce decision paralysis? Are you hiding fulfilment times when transparency would signal craft? Are you avoiding risk (like returns on custom items) when absorbing that risk would eliminate buyer anxiety?

The brands growing fastest in the Salience Index data violated best practices strategically. They understood that gift-giving is fundamentally about social signalling and anxiety reduction. They designed their experiences around those truths rather than around technical benchmarks.

In a sector where seasonal search spikes create last-minute desperation and choice overload breeds abandonment, the winners aren’t necessarily the fastest or the biggest.