2025 Car Dealerships Industry Analysis

If you’re short on time, here’s the headline. This 2025 Car Dealerships Industry Analysis shows a market that’s grown online by +8% YoY on average, but with sharp divergence between the biggest marketplaces, the networks, and the franchised dealer groups.

Below, I unpack the numbers from our sector report and translate them into plain‑English signals about consumer behaviour and search trends. If you want all the data, you can get the free 69‑page report for deeper insight for free.

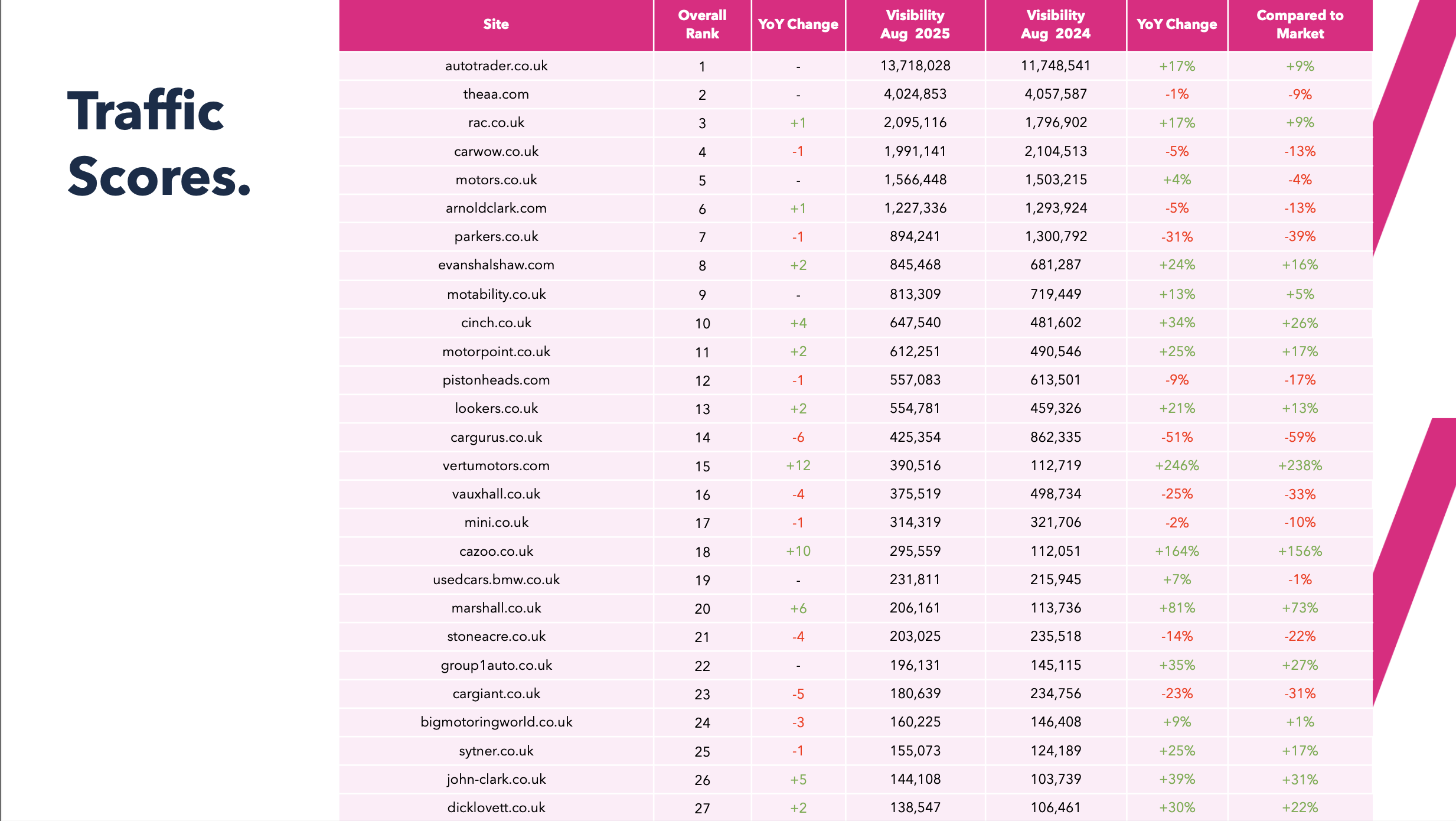

Which car dealership brands dominate organic visibility in 2025?

The table shows the leading brands by organic Traffic Score (YoY), with ranking shifts and how each compares to the wider market.

| Rank (2025) | Brand | Aug 2025 Traffic Score | Aug 2024 Traffic Score | YoY | Vs Market |

|---|---|---|---|---|---|

| 1 | autotrader.co.uk | 13,718,028 | 11,748,541 | +17% | +9% |

| 2 | theaa.com | 4,024,853 | 4,057,587 | −1% | −9% |

| 3 | rac.co.uk | 2,095,116 | 1,796,902 | +17% | +9% |

| 4 | carwow.co.uk | 1,991,141 | 2,104,513 | −5% | −13% |

| 5 | motors.co.uk | 1,566,448 | 1,503,215 | +4% | −4% |

Autotrader stretches its lead, combining scale with dependable YoY growth, while RAC keeps pace and CINCH and Motorpoint post strong double‑digit gains. By contrast, Parkers and Cargurus show steep declines, suggesting a reset in how buyers discover advice‑led content versus marketplace inventory. Dealer networks like Lookers and Evans Halshaw have edged up.

Search Behaviour in the Car Dealership Industry

Searchers are keeping one tab open for the big marketplaces (Autotrader, CINCH), but they’re also returning to dealer‑owned journeys when stock, finance calculators and part‑exchange tools line up. I.e. the user journey matches the intent of their query.

Fewer shoppers are browsing generic research pages. More are jumping straight into transactional filters based on preferences such as (“used SUV”, “cars under 3000”) and then comparing finance options. That tilt towards action bias rewards pages that answer intent fast, load quickly, and showcase stock variety without burying the details.

This, in fact, is something we’ve seen recently across various sectors and queries. Users are increasingly searching using NLP, e.g. ‘Which electric cars are best for high mileage?’ rather than keyword-based queries like ‘High range EVs’. Search engines now prioritise understanding user intent over exact keyword matching, which means sites that craft content for humans first are consistently outperforming those still optimising for search algorithms.

Who grew fastest — and who lost ground

A quick view of the biggest movers by % change in Traffic Score.

| Brand | YoY |

|---|---|

| vertumotors.com | +246% |

| brayleys.co.uk | +165% |

| cazoo.co.uk | +164% |

| harwoods.co.uk | +115% |

| monmotors.com | +111% |

| Brand | YoY |

|---|---|

| buyacar.co.uk | −56% |

| cargurus.co.uk | −51% |

| classiccarsforsale.co.uk | −34% |

| parkers.co.uk | −31% |

| brindley.co.uk | −27% |

Car Dealerships Industry Keyword Trends

| Query | UK monthly searches | Competitiveness |

|---|---|---|

| sell my car | 67,000 | 46 |

| electric cars | 47,000 | 58 |

| second-hand cars | 31,000 | 54 |

| car dealerships near me | 24,000 | 50 |

| used car | 9,700 | 65 |

Classic head terms remain crowded, but notice how location‑plus‑intent (“near me”) sits alongside broader category nouns. That blend tells us shoppers now expect listings, pricing, and service coverage on the first click and increasingly in the SERPs themselves.

| Query | UK monthly searches | Competitiveness |

|---|---|---|

| cars for sale | 95,000 | 11 |

| used cars for sale | 36,000 | 8 |

| cars for sale near me | 35,000 | 10 |

| used cars near me | 14,000 | 14 |

| electric cars for sale | 7,500 | 6 |

Many of these keywords are transactional, meaning brands may need to consider a “centre‑out” content model. Start with the experiences people actually want, then add helpful guides that support conversion (valuation, PCP vs HP explainers, delivery policies).

Emerging vs receding demand: how search behaviour is shifting

| Query | UK monthly searches | Trend |

|---|---|---|

| used car dealer near me | 4,400 | +114% |

| used car dealerships near me | 9,900 | +102% |

| electric suv | 8,100 | +14% |

| second hand electric cars | 6,600 | +14% |

| cars under 3000 | 4,400 | +14% |

| Query | UK monthly searches | Trend |

|---|---|---|

| electric vehicles | 110,000 | −68% |

| used cars for sale | 110,000 | −53% |

| used automatic cars | 6,600 | −49% |

| car dealer | 74,000 | −43% |

| cheap used cars | 5,400 | −42% |

What’s going on under the bonnet: Searchers are moving from broad “what are my options?” queries towards sharper, map‑backed intent that expects live stock and local availability. Electric remains a split story: generic “EV” interest is ebbing, yet specific segments (SUVs, hybrids, second‑hand EVs) continue to climb as prices normalise and charging improves.

Brand awareness and social: who is front‑of‑mind?

We blend brand search demand with owned social activity to understand Digital Brand Reach.

| Brand | Monthly brand searches | Owned social score (index) |

|---|---|---|

| autotrader.co.uk | 6,120,000 | 955 |

| arnoldclark.com | 550,000 | 334 |

| parks.uk.com | 368,000 | 112 |

| cazoo.co.uk | 301,000 | 163 |

| vauxhall.co.uk | 246,000 | 510 |

Autotrader towers over everyone else when it comes to brand awareness. Manufacturer brands (MINI, FIAT) punch high on social communities, while dealer groups with strong local footprints (Arnold Clark, Parks) see sizeable branded demand but lower social following.

“Awareness” is multi‑channel. Search demand is a proxy for memorability, while social tells you who your ‘more loyal’ following is. Digital PR that creates talkable content and credible links remains the cleanest way to grow both measures.

Trust & reviews: which domains carry the most social proof?

| Brand | Reviews | Avg. score |

|---|---|---|

| evanshalshaw.com | 170,643 | 4.7 |

| rac.co.uk | 166,854 | 4.5 |

| sytner.co.uk | 109,909 | 4.5 |

| autotrader.co.uk | 101,944 | 4.6 |

| theaa.com | 100,966 | 4.4 |

High volumes of fresh, replied‑to reviews correlate with higher click‑through on branded SERPs and better local pack presence. They also reduce friction on inventory pages by answering the “can I trust this?” question before a shopper even finds a model they like.

Think less about gathering stars and more about closing the loop. Clear response patterns, transparent policies and on‑page trust cues (returns, warranties, finance compliance) all feed the trust equation the algorithms — and people — now expect.

Autotrader’s search marketing machine — how a 47‑year‑old brand keeps winning online

SPOTLIGHT

A few headline stats from the dataset:

- Traffic Score: 13.72m (Aug 2025), up +17% YoY

- Brand demand: 6.12m searches/month

- Owned social: index 955

- Reviews: 101,944 at 4.6★ average

We’ve done a full teardown of Autotrader’s search strategy to find out how they continue to dominate the car dealer category.