2025 Eyewear Industry Analysis: search trends, key players & where growth will come from

If you sell glasses, contacts or sunglasses, this 2025 Eyewear Industry Analysis distils what’s really moving the market. I’ve blended our latest Salience Index data with on-site research to show where demand is rising, which brands are gaining ground, and the keywords that will drive next-year revenue. Along the way I’ll talk about how consumer behaviour and search behaviour are changing — and what that means for your roadmap.

Before we dive in, if you want the raw data behind this piece, you can get the free 69-page report covering every brand and metric in full (including visibility, brand reach and technical benchmarks). Get the free 69-page report.

Which eyewear products are trending up in 2025?

These are the fastest-rising product searches in the UK eyewear market. They’re not just fads — taken together, they map a clear shift towards eye-health, performance and niche fit.

| Keyword | UK monthly searches | Interest trend |

|---|---|---|

| blue light glasses | 49,500 | +7% |

| bifocal glasses | 5,400 | +7% |

| blue light blocking glasses | 5,400 | +7% |

| tortoise shell glasses | 4,400 | +24% |

| cateye glasses | 4,400 | +17% |

| theatrical contact lenses | 3,600 | +15% |

| varifocal contact lenses | 3,600 | +6% |

| circle glasses | 2,900 | +22% |

| running sunglasses women | 2,400 | +16% |

| rimless glasses for men | 2,400 | +24% |

| circle sunglasses | 1,900 | +24% |

| photochromic glasses | 1,600 | +74% |

| running sunglasses for men | 1,300 | +12% |

| blue light blockers | 1,300 | +19% |

| browline glasses | 1,000 | +115% |

| oval glasses | 1,000 | +50% |

| pinhole glasses | 1,000 | +63% |

| frameless glasses | 1,000 | +15% |

| fishing glasses | 880 | +108% |

| polarised fishing glasses | 720 | +46% |

| luxury sunglasses for men | 590 | +28% |

| mens high end sunglasses | 590 | +28% |

| Keyword | UK monthly searches | Interest trend |

|---|---|---|

| oval sunglasses womens | 480 | +23% |

| oval prescription glasses | 390 | +111% |

| prescription sunglasses for women | 320 | +91% |

| polar optics hd sunglasses | 260 | +87% |

| lazy reader glasses | 260 | +92% |

| browline sunglasses | 260 | +44% |

| prescription sunglasses for men | 210 | +71% |

| gold sunglasses women’s | 140 | +95% |

What the data says about demand. Health-first and performance use-cases are shaping growth: blue-light filtering, photochromic switching and fit-for-sport variants are all climbing. Gendered and purpose-built lenses (run-specific, fishing-specific) suggest shoppers expect eyewear to solve a concrete problem. That’s a shift from fashion-only browsing towards functional search intent.

How search behaviour is evolving. You can see long-tail modifiers doing the heavy lifting: “for women”, “for men”, “for fishing”. That maps to a broader change in how people describe needs to search engines (and AI assistants). Category pages and filters that mirror these intents will earn more qualified clicks. Brands may need to consider building mini-hubs around use-cases (screen work, endurance sport, driving) rather than a one-size-fits-all catalogue.

What’s losing steam right now?

| Keyword | UK monthly searches | Interest trend |

|---|---|---|

| sunglasses | 135,000 | −28% |

| glasses | 135,000 | −19% |

| contact lenses | 90,500 | −7% |

| optical near me | 60,500 | −12% |

| male shades | 49,500 | −30% |

| prescribed shades | 40,500 | −19% |

| glasses online | 27,100 | −12% |

| spectacles online | 27,100 | −12% |

| sunglasses for him | 22,200 | −14% |

| reading glasses | 22,200 | −18% |

| prescription glasses | 22,200 | −12% |

| ladies shades sunglasses | 18,100 | −33% |

| designer sunglasses | 18,100 | −29% |

| sunglasses for women | 18,100 | −18% |

| optician near me | 18,100 | −12% |

| designer shades for men | 14,800 | −24% |

| male designer sunglasses | 14,800 | −24% |

| polarised sunglasses | 12,100 | −13% |

| kids sunglasses | 9,900 | −35% |

| infant sunglasses | 9,900 | −32% |

| clip on sunglasses | 9,900 | −13% |

| running sunglasses | 8,100 | −26% |

| cat eye sunglasses | 6,600 | −29% |

| off white sunglasses | 5,400 | −46% |

| heart sunglasses | 3,600 | −56% |

| mens shades sale | 3,600 | −38% |

| sunglasses sale | 3,600 | −41% |

| pink sunglasses | 3,600 | −43% |

| sunglasses store | 2,400 | −65% |

| fun sunglasses | 1,900 | −46% |

Why it matters. Generic browsing terms are softening. Partly this is seasonality normalising after pandemic spikes; partly it’s the return to in-store for everyday frames; and partly it’s users getting more specific with their needs. “Near me” terms dipping suggests in-store discovery is happening via maps and social/local features as much as via traditional search.

Strategic take. Chasing volume on broad “sunglasses” and “glasses” terms looks less efficient than last year. The growth is in solving a job-to-be-done. That suggests a shift towards intent-grouped architecture (e.g., “computer glasses” as a cluster with explainer content, fit guides and problem-first PDPs), supported by on-site copy that answers narrow questions clearly.

Which eyewear brands are rising vs. sliding?

| Brand keyword | UK monthly searches | Interest trend |

|---|---|---|

| vision express | 246,000 | +6% |

| ray ban | 165,000 | +6% |

| select specs | 49,500 | +15% |

| firmoo | 33,100 | +71% |

| feel good contacts | 33,100 | +22% |

| shade station | 14,800 | +31% |

| jimmy fairly | 14,800 | +22% |

| oliver peoples | 9,900 | +22% |

| scrivens | 8,100 | +7% |

| moscot | 6,600 | +22% |

| lensology | 5,400 | +50% |

| maui jim | 5,400 | +14% |

| goodr | 4,400 | +14% |

| direct sight | 4,400 | +7% |

| bolle | 1,600 | +13% |

| block blue light | 1,300 | +19% |

| edel optics | 1,000 | +22% |

| m and s opticians | 1,000 | +9% |

| glasses 2 you | 720 | +6% |

| specs art | 40 | +21% |

| Brand keyword | UK monthly searches | Interest trend |

|---|---|---|

| spec savers | 1,000,000 | −12% |

| glasses direct | 165,000 | −13% |

| sunglass hut | 90,500 | −13% |

| contact lenses (brand-led searches) | 90,500 | −7% |

| oakley | 74,000 | −7% |

| goggles 4u | 27,100 | −7% |

| sungod | 18,100 | −18% |

| cubitts | 18,100 | −18% |

| day soft | 14,800 | −18% |

| david clulow | 12,100 | −28% |

| mister spex | 8,100 | −38% |

| designer glasses (brand-style query) | 8,100 | −18% |

| izipizi | 8,100 | −7% |

| fashion eyewear | 6,600 | −12% |

| cooper vision | 6,600 | −7% |

| opticians direct | 5,400 | −18% |

| persol | 4,400 | −6% |

| good lookers | 2,400 | −29% |

| smart buy glasses | 1,900 | −15% |

| discounted sunglasses | 1,300 | −7% |

| foster grant | 880 | −7% |

| spex 4 less | 720 | −19% |

Reading brand momentum. The winners combine clear positioning with community or PR — niche retailers, revived heritage labels and category experts. The losers skew towards generic brand terms and discount-chasing. One nuance: you can grow organic visibility while brand-name interest softens. If your generic category rankings are strong, you’ll still win demand — but nurturing brand recall becomes the hedge.

What this means for marketing. Brands may need to consider moving beyond “brand name + product” as the only route to discovery. Invest in use-case clusters and editorial that earns mentions and links, while folding trust assets (reviews, guarantees, policies) into PDPs. That mix builds both visibility and salience.

Which eyewear keywords are the toughest to win?

These are the high-competition battleground terms. They’re prize-winners, but they demand authority, strong UX and a spotless technical base.

| Keyword | UK monthly searches | Competitiveness |

|---|---|---|

| sunglasses | 83,000 | 59 |

| glasses | 66,000 | 62 |

| contact lenses | 52,000 | 70 |

| prescription glasses | 20,000 | 64 |

| aviator glasses | 2,800 | 48 |

| eyewear | 2,600 | 49 |

| glasses frames | 10,000 | 50 |

| cheap glasses | 7,600 | 52 |

| aviator sunglasses | 7,500 | 49 |

| cheap prescription glasses | 3,800 | 68 |

Interpreting difficulty. High intent plus national competition means SERP real estate is crowded with retailers, marketplaces and guides. E-E-A-T signals (who you are, why you’re credible) and fast, mobile-first experiences are now table stakes.

Where to lean in. If you’re a challenger, build “answer pages” that out-explain the market (materials, fit, anti-glare use-cases) and pair them with shoppable modules. For incumbents, the job is defence: maintain snippet-worthy copy, keep FAQs fresh, and close gaps on Core Web Vitals.

Where are the quick wins? Opportunity keywords

These terms pair decent volume with low competitiveness — ideal for brands building authority, and a useful hedge for market leaders wanting to expand share with less risk.

| Keyword | UK monthly searches | Competitiveness |

|---|---|---|

| kids glasses | 2,000 | 4 |

| womens glasses | 1,900 | 7 |

| daily contact lenses | 2,400 | 9 |

| mens designer sunglasses | 3,300 | 7 |

| designer sunglasses | 8,400 | 15 |

| coloured contact lenses | 7,900 | 19 |

| colour blind glasses | 2,500 | 19 |

| mens glasses | 4,800 | 9 |

| designer glasses | 5,000 | 9 |

| womens sunglasses | 5,600 | 7 |

Why these matter. Many of these map to life-stage and identity (kids, women, men) or simple product attributes. They’re perfect for compact, intent-rich category pages backed by short explainers and comparison blocks.

Directional next steps. Brands may need to consider building faceted templates that surface these queries natively (e.g., size, face-shape, lens type), supporting each with plain-English copy and tight internal linking. If you’re a market leader, use these clusters to deepen coverage and keep competitors boxed out.

Who leads on brand awareness and social reach?

A blended view of brand searches plus owned social audience shows who’s in the public conversation — and who isn’t.

| Site | Monthly brand searches (UK) | Owned social score |

|---|---|---|

| ray-ban.com | 165,000 | 34,511 |

| oakley.com | 74,000 | 13,920 |

| specsavers.co.uk | 1,000,000 | 930 |

| sunglasshut.com | 90,500 | 5,297 |

| opticians.asda.com | 49,500 | 749 |

| visionexpress.com | 246,000 | 136 |

| glassesdirect.co.uk | 165,000 | 147 |

| visiondirect.co.uk | 49,500 | 329 |

| sungod.co | 18,100 | 475 |

| contactlenses.co.uk | 90,500 | 80 |

| jimmyfairly.com | 14,800 | 488 |

| oliverpeoples.com | 9,900 | 671 |

| mauijim.com | 5,400 | 1,216 |

| persol.com | 4,400 | 1,375 |

| izipizi.com | 8,100 | 745 |

What this tells us. Fashion-led global brands punch hardest on social — no surprise there — but several UK retailers show surprisingly strong brand search numbers without comparable owned reach. That gap is an opportunity: editorial, communities and Digital PR can turn one-off searchers into audiences you actually own.

How behaviour is shifting. Social discovery now pushes people into very specific searches (“the tortoiseshell frame with browline detail”), so you need content that connects the dots: short format video for inspiration, landing pages for explanation, and clear, structured PDPs for conversion.

Trust is a growth lever: who’s winning reviews?

Third-party review depth and recency are a signal to both shoppers and algorithms.

| Site | Reviews (count) | Average score |

|---|---|---|

| feelgoodcontacts.com | 344,045 | 4.6 |

| glassesdirect.co.uk | 262,848 | 4.5 |

| goggles4u.co.uk | 71,936 | 4.5 |

| specsavers.co.uk | 157,824 | 4.5 |

| selectspecs.com | 78,236 | 4.4 |

| visiondirect.co.uk | 108,056 | 4.5 |

| spex4less.com | 28,761 | 4.8 |

| lenstore.co.uk | 85,499 | 4.6 |

| shadestation.co.uk | 27,104 | 4.8 |

Why it matters. YMYL-adjacent categories like prescriptions are held to a high bar. Reviews reassure, reduce friction and nudge higher CTR when stars are pulled into SERPs.

What to do about it. Brands may need to consider integrating external review components into PLPs/PDPs, answering negative feedback quickly, and surfacing guarantees and returns alongside lens details. It’s the combination of proof and clarity that wins skeptical shoppers.

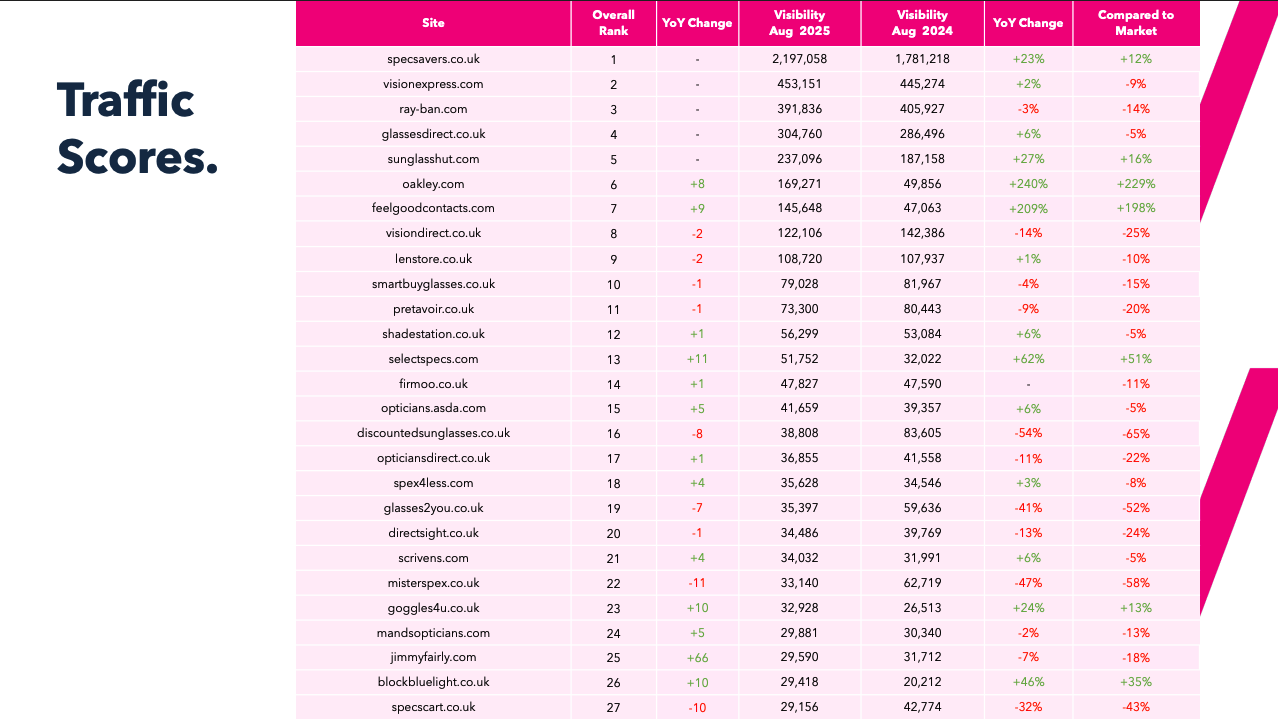

Who’s moving fastest on traffic visibility?

A snapshot of standout movers gives useful context for where the market is flowing.

| Site | Overall rank (Aug 2025) | Visibility (Aug 2025) | Visibility (Aug 2024) | YoY change | Vs market |

|---|---|---|---|---|---|

| quay.com | 63 | 8,104 | 1,499 | +441% | +430% |

| en.polaroideyewear.com | 66 | 7,233 | 3,501 | +107% | +96% |

| blickers.com | 68 | 7,191 | 2,940 | +145% | +134% |

| hawkersco.com | 65 | 7,331 | 4,348 | +69% | +58% |

| barnerbrand.com | 74 | 5,138 | 2,637 | +95% | +84% |

| lenssaver.co.uk | 71 | 6,006 | 13,587 | −56% | −67% |

| lulus.com | 69 | 6,250 | 12,650 | −51% | −62% |

| sunglassesforsport.com | 82 | 4,040 | 12,095 | −67% | −78% |

What could be driving this. Fashion-crossover brands benefit when social style waves hit search; specialist retailers can ride niche spikes. On the downside, thin category content, site-speed debt and unhelpful overlays are common patterns in the fallers.

How to respond. If you’re surging, double down on momentum with Digital PR to harden authority. If you’re sliding, triage tech debt (especially mobile speed), refresh category copy to match current intent, and rethink interstitials that block exploration.

Oakley — when sport collides with AI

Oakley’s AI glasses put a sports icon at the centre of a broader wearables conversation. Interest around “Oakley Meta glasses” and “Oakley AI glasses” shows what happens when performance hardware meets everyday utility. The brand’s best move so far has been to treat discovery queries as first-class citizens: a dedicated hub that explains features in plain language, structured headings that surface into snippets, and a concise FAQ covering device requirements, privacy cues and capture controls.

For you, the lesson is to think like a publisher when you ship innovation. Build a home for discovery that answers the “what is it / how does it work / will it fit my life?” sequence without fluff. Then use authentic athlete or user stories to translate features into outcomes a runner, cyclist or coach actually cares about. That’s how you convert hype into authority across both eyewear and wearables searches.

What this means for your 2025 plan

- Shift from broad to specific. Growth sits in intent-led, problem-solving clusters (blue-light, photochromic, sport). Design architecture and content around jobs-to-be-done, not just frame shapes.

- Marry visibility with salience. Several brands show strong generic rankings but softer brand recall. Use Digital PR, editorial and partnerships to turn searchers into an audience you can reach whenever you launch.

- Elevate trust on-site. Bake review components, guarantees and clear prescriptions guidance into PDPs and PLPs. That’s how you satisfy both users and modern ranking systems.

- Protect the hard terms. If you already lead on high-competition keywords, keep pages fast, structured and up-to-date. If you don’t, expand via opportunity keywords where the maths is kinder.

If you’d like to benchmark your site against the full field, you can get the free 69-page eyewear market report now — it has the complete tables, winners and losers.

If you’re weighing up next steps and want a practical plan for ecommerce growth, learn more about our eCommerce SEO service and how we build human-first search experiences that convert. Learn more about our eCommerce SEO service.

Curious how we execute for some of the UK’s biggest brands? Explore our client stories and tactics. See our work.