2025 Online Plants Industry Analysis: who’s growing, who’s slipping, and what it says about your customers

If you work in online plants, you know how hard it is occupy and cater for the entire buyer journey. A Saturday scroll sparks an idea to brighten a corner in your garden. Then the voice in your head starts interrogating the choice. Light, soil, eventual height, delivery, survival odds. This industry forces you to serve two buying minds at once — whim and considered. Our 2025 Online Plants Industry Analysis looks at how the sector’s strongest brands are engineering for both.

I’ll use fresh sector metrics from our 69-page report and wrap them in plain-English commentary you can act on.

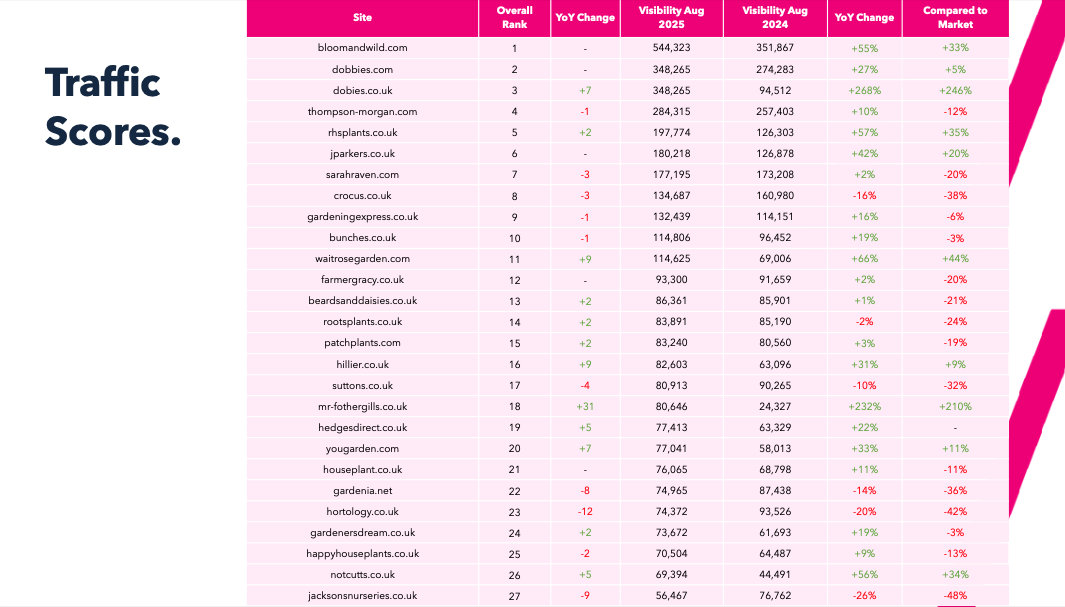

Which online plant brands are gaining the most organic ground?

Below is a cut of the Traffic Score YoY leaderboard — a directional way of seeing who’s winning organic demand and who’s leaking share. Values here show estimated organic visibility for August year-on-year and the percentage change.

| Rank | Brand | Visibility (Aug 2025) | Visibility (Aug 2024) | YoY change | vs Market |

|---|---|---|---|---|---|

| 1 | bloomandwild.com | 544,323 | 351,867 | +55% | +33% |

| 2 | dobbies.com | 348,265 | 274,283 | +27% | +5% |

| 3 | dobies.co.uk | 348,265 | 94,512 | +268% | +246% |

| 4 | thompson-morgan.com | 284,315 | 257,403 | +10% | −12% |

| 5 | rhsplants.co.uk | 197,774 | 126,303 | +57% | +35% |

| 6 | jparkers.co.uk | 180,218 | 126,878 | +42% | +20% |

| 7 | sarahraven.com | 177,195 | 173,208 | +2% | −20% |

| 8 | crocus.co.uk | 134,687 | 160,980 | −16% | −38% |

| 9 | gardeningexpress.co.uk | 132,439 | 114,151 | +16% | −6% |

| 10 | bunches.co.uk | 114,806 | 96,452 | +19% | −3% |

| 11 | waitrosegarden.com | 114,625 | 69,006 | +66% | +44% |

| 12 | farmergracy.co.uk | 93,300 | 91,659 | +2% | −20% |

| 13 | beardsanddaisies.co.uk | 86,361 | 85,901 | +1% | −21% |

| 14 | rootsplants.co.uk | 83,891 | 85,190 | −2% | −24% |

| 15 | patchplants.com | 83,240 | 80,560 | +3% | −19% |

What the numbers say

The market grew +22% overall, which sets a high bar. Against that tide, RHS Plants is one of the standout gainers: +57% YoY, which is +35% ahead of the market. DOBIES also roars back with a triple-digit surge after a soft prior year, while Waitrose Garden accelerates sharply. On the flip side, legacy leaders like Crocus and Thompson & Morgan are either flat to modestly up, and underperform the market growth — a sign that their generic reach or brand-led demand isn’t keeping pace with sector momentum.

What this reveals about behaviour

A rising market with uneven gains hints at shifting discovery paths. People are still searching broadly (flowers, shrubs, houseplants), but are more often being captured by brands that guide decisions, not just list products. Behind the winners you’ll find faster paths from inspiration to selection, content that reduces anxiety (“will it live here?”), and clear fulfilment signals. Underperformers tend to look like catalogue sites — fine for planned buys, weaker for that Saturday scroll. Expect the next wave of growth to favour brands that compress research without rushing it: short, visual explainers, localised care cues, and softly-stated risk reduction (guarantees, survival support).

Why RHS Plants is outgrowing the market

In a sector where interest is seasonal and baskets mix impulse buys with long-term living decisions, that balance matters. RHS Plants has engineered a decision-first shopping experience that lets people start with the pretty picture and end with the right plant. It’s built for how people actually choose plants — quickly at times, painfully slowly at others. The growth backs it up: +57% YoY in a market rising +22%.

What they’re doing differently

- Visual entry points that pull you into inspiration without losing the thread.

- Filters and copy that map to how you actually decide (light, size at maturity, hardiness, pet-safe, delivery window).

- Calm page layouts and care content that shrink risk without turning the choice into homework.

This is the model to watch if you’re trying to serve both buying minds — whim and considered — without forcing a choice between them.

Want the full breakdown? Get the free 69-page report for the complete brand leaderboard, category splits and methodology. (Download it from the Online Plants landing page here.)

Which brands have the strongest digital brand reach?

Brand reach blends monthly branded search with owned social engagement to show who’s top-of-mind and has an addressable audience they don’t have to rent.

| Rank | Brand | Monthly brand searches | Owned social score |

|---|---|---|---|

| 1 | dobbies.com | 201,000 | 482 |

| 2 | bloomandwild.com | 165,000 | 876 |

| 3 | suttons.co.uk | 110,000 | 121 |

| 4 | thompson-morgan.com | 74,000 | 188 |

| 5 | sarahraven.com | 60,500 | 437 |

| 6 | patchplants.com | 27,100 | 707 |

| 7 | farmergracy.co.uk | 40,500 | 695 |

| 8 | crocus.co.uk | 40,500 | 177 |

| 9 | gardeningexpress.co.uk | 40,500 | 141 |

| 10 | squiresgardencentres.co.uk | 40,500 | 107 |

Reading the table

Three patterns jump out. First, Bloom & Wild remains a branded-search juggernaut and pairs it with the sector’s highest owned social score — a rare combo of recall and community. Second, DOBBIES leads on monthly brand demand but trails the social score of pure-play online specialists; brand equity is there, but conversation depth varies by channel. Third, Patch Plants over-indexes on owned social relative to brand search — consistent with an education-first strategy that earns engagement and then matures into demand.

The behaviour behind the numbers

Branded search growth is a proxy for trust: people who already chose you in their head. Social strength is a proxy for relationship: people who listen even when they’re not buying. In gardening — where care, longevity and ‘will it thrive?’ are lingering doubts — that relationship is often the clincher. Expect brands with communities (not just followers) to hold share during off-season dips because the dialogue continues when buying pauses.

Which domains are most trusted by shoppers right now?

Review profiles are a blunt but useful trust signal. Here are some of the most-reviewed sites and their average scores:

| Brand | Reviews (count) | Avg. score |

|---|---|---|

| gardenersdream.co.uk | 65,023 | 4.6 |

| longacres.co.uk | 30,188 | 4.5 |

| patchplants.com | 37,688 | 4.7 |

| yougarden.com | 15,233 | 4.8 |

| rootsplants.co.uk | 100,385 | 4.2 |

| crocus.co.uk | 28,203 | 4.5 |

| brooksidenursery.co.uk | 67,625 | 4.3 |

| plants4presents.co.uk | 13,032 | 4.7 |

| thompson-morgan.com | 17,771 | 4.8 |

| bloomandwild.com | 75,775 | 3.9 |

Why this matters

For considered purchases with survival risk, reviews compress uncertainty. High counts with strong scores indicate not just happy buyers but active feedback loops. Notice how Patch Plants and Plants4Presents achieve both volume and quality — typically a sign of post-purchase nurturing and clear service standards. Conversely, large order volumes with middling scores can mask frictions in delivery or care support that will show up in organic CTR and repeat behaviour.

What this says about search behaviour

People increasingly scan review snippets before clicking. In a zero-click world, star ratings in the SERP nudge the decision upstream. If your profile lacks recency, you’ll be filtered out. If your average is fine but comments flag plant health on arrival, you’ll see higher pogo-sticking and lower DTC conversion during peak heatwaves and cold snaps. Trust is seasonal too.

Which products and brands are trending up — and which are fading?

Search interest reflects what’s catching the eye in homes and gardens. Here’s a snapshot.

Emerging products (search growth)

- hibiscus flower (+137%)

- russian sage (+73%)

- hydrangea flower (+124%)

- campsis radicans / trumpet creeper (+144%)

- moonflower (+126%)

- creeping thyme (+56%)

- zanzibar gem plant / zuzu plant (+50%)

Receding products (search decline)

- blue passion flower (−86%)

- snapdragons (−44%)

- hanging basket (−31%) and artificial hanging baskets (−34%)

- houseplants / indoor houseplants (−18%)

- snake plant / sansevieria (−15%)

- heb(e)s (−37%)

Emerging brands (interest trend)

- One Click Plants (+77%)

- Evergreen Direct (+41%)

- Chiltern Seeds (+31%)

- Squires Garden Centres (+24%)

- Gardening Express (+22%)

Receding brands (interest trend)

- Dobbies (−16%)

- Sarah Raven (−14%)

- Patch Plants (−13%)

- Direct Plants (−28%)

- Claire Austin Hardy Plants (−56%)

How to interpret this

Plant fashion cycles are real. The shift away from generic “houseplants” terms mirrors a maturing audience — fewer first-time buyers, more people graduating to specifics and outdoor projects. Rising queries cluster around showy blooms and climbers, which fits a post-renovation mindset: improve the backdrop, then add drama. For brands, that means rich PLPs for seasonal stars, but also breadth for the curious buyer who’s moving beyond the Instagram staples.

What it signals about your UX

Discovery journeys are splitting: a) fast, visual skims for inspiration, b) deep dives into care and compatibility. Serve both. Short videos and decision cards soothe impulse worries (“is it pet-safe?”) while long-form care hubs keep the considered buyer engaged across months. The brands climbing fastest tend to support both modes without forcing a mode switch.

Speed still wins — but only if it protects the journey

Page speed is a known ranking and conversion factor. In practice, the trade-off in plants is tricky: heavy imagery sells the dream; heavy pages slow the site. The high performers minimise weight without losing the mood — compressed media, lightweight scripts, and thoughtful loading states that keep filters and images responsive during those quick-glance moments.

From a behavioural angle, speed earns the click back. A wobbly filter or a laggy size picker is enough to derail a fragile impulse. On mobile, every second you shave off reduces the chance that the buyer puts the phone down and the urge passes.

Want help translating these signals into a clean technical plan? Learn more about our eCommerce SEO service — from technical audits to content architecture designed for product discovery.

What the +22% industry variance means for planning

A +22% average change in traffic scores points to broad opportunity, but also volatility. Gains are not evenly distributed. We’re seeing:

- Bigger winners among brands that “own” specific needs (pet-safe, shade-loving, beginner-proof) with clear, filterable pathways.

- Consolidation at the top as recognisable names pair brand cues with helpful, human copy that sounds like gardeners, not catalogues.

- Seasonal swings that are sharper than last year; spikes around heatwaves and Royal Horticultural Society moments amplify demand for hardy, drought-tolerant picks.

Strategic take

- If you’re already riding category growth, widen the bridge from inspiration to basket: more comparison blocks, honest survival framing, and delivery-to-planting timelines.

- If you’re flat in a rising market, diagnose where you’re losing the mixed-mind buyer. Thin PLPs, slow filters, or missing care cues are common culprits.

The ‘two minds’ of plant buying — and why design must honour both

You rarely get a clean funnel. People can fall in love with a fern at 10:02 and talk themselves out of it by 10:04. That’s normal. The sites that grow ahead of the market reduce friction for both states:

- Whim mind: quick inspiration, crisp photography, bold benefits, ‘will it fit and look good’. Here, speed and scannability rule.

- Considered mind: risk reduction, care guides, longevity, compatibility, and delivery windows. Here, credibility and clarity rule.

RHS Plants is the best example I’ve seen of a brand that has engineered for that pattern. They’ve built a decision-first shopping experience that lets people start with the pretty picture and end with the right plant. The growth backs it up — +57% YoY vs a market rising +22%. That’s +35% ahead of the market.

Curious how the best put this into practice? See why RHS Plants stands out in our plant-retail spotlight — lessons on speed, discoverability and decision support.

Where the next opportunities sit

Looking across the metrics and the lived reality of plant buying, a few directional plays emerge:

- Decision-first PLPs become table stakes. Lead with visual cards that carry “light ▸ soil ▸ size ▸ hardiness ▸ pet-safe ▸ delivery” at a glance. It’s what the scroller needs before they commit to a PDP. The winners already do this.

- Care confidence sells. Reviews that mention plant survival, clear guarantees, and practical care emails turn anxiety into advocacy. Expect higher review volume in spring/autumn and make reply-cadence part of the brand.

- Own a niche, then ladder up. Pet-safe, shade-loving, drought-tolerant — micro-categories are where new brand recall is won. Once you’re known for one, expand to the adjacent needs with internal linking that mimics how gardeners plan.

- Don’t ignore returning buyers. The sector is maturing; many buyers aren’t first-timers. They want specifics, cross-sell by habitat (soil pH, aspect) rather than generic add-ons.

- Content that respects time. Short, looping how-tos and seasonal checklists for impulse sessions; deeper planting guides and troubleshooting for the considered sessions. Both formats earn branded search later.

FAQs for stakeholders (and the board)

What is “market size” here?

We’re reporting on digital market size via aggregated organic visibility and branded search demand across leading domains. It’s a proxy for intent in the channel you can influence most cost-effectively.

Is this an “industry report” or a rankings list?

Both. The data gives you a benchmark across brand awareness, organic visibility, reviews and search trends. The analysis turns it into a narrative about why buyers behaved as they did — and what that implies for your roadmap.

What’s the “growth rate” to watch?

Two numbers: your YoY visibility vs the +22% industry change. If you’re not matching the baseline, you’re ceding share even if your traffic is up. If you’re beating it, decide whether it’s breadth (more generics) or depth (stronger brand searches) that’s driving the difference, then plan accordingly.

Pulling it together

The Online Plants market is growing, but it’s not lifting everyone equally. Brands that treat the journey as human — a spark of inspiration followed by a long, picky decision — are the ones compounding. RHS Plants shows what it looks like when a site meets both minds in one flow. Others are on the way, blending fast UX, decision-friendly content and social proof that actually addresses plant life, not just shipping speed.

If you want the full picture — every leaderboard, every brand, every trend — the 69-page PDF is where to go next. Download the free report to see the complete data and where your brand sits.

If you’re ready to turn this into a plan, our team builds technical and content foundations for retail sites that need to convert both impulse and considered buyers.