Tile Stores 2025: what the data tells us — and how shoppers are changing

If you sell tiles, you’re likely feeling a shift in the way consumers are searching and buying. This is your 2025 Tile Stores Industry Analysis. A single read that blends our Salience Index data with on‑site learnings from a standout performer, Porcelain Superstore. We’ll unpack the tile industry growth rate we’re seeing in search, which brands are pulling ahead, and where demand is drifting. If you want the raw data and every chart, you can get the free 69‑page report for deeper insight.

Is the tiles sector growing or shrinking?

Industry variance (YoY): +2%

This figure reflects the average change in organic visibility across the sector year on year. In other words, on balance, tile search traffic is slightly up versus last year.

What that reveals

A modest positive variance says two things at once. Demand is still there, but gains are lumpy. Some stores are accelerating while others are sliding. That pattern fits what we hear from in-house teams. Steady browsing, longer decisions, and more time spent comparing options on social and marketplaces before committing on-site. In short, growth is available, but it’s uneven and increasingly brand‑led.

Looking across our tiles market research, the winners pair consistent technical foundations with a buying journey designed for a tactile product. Samples, shipping clarity, and visual reassurance now sit alongside rankings as primary growth levers.

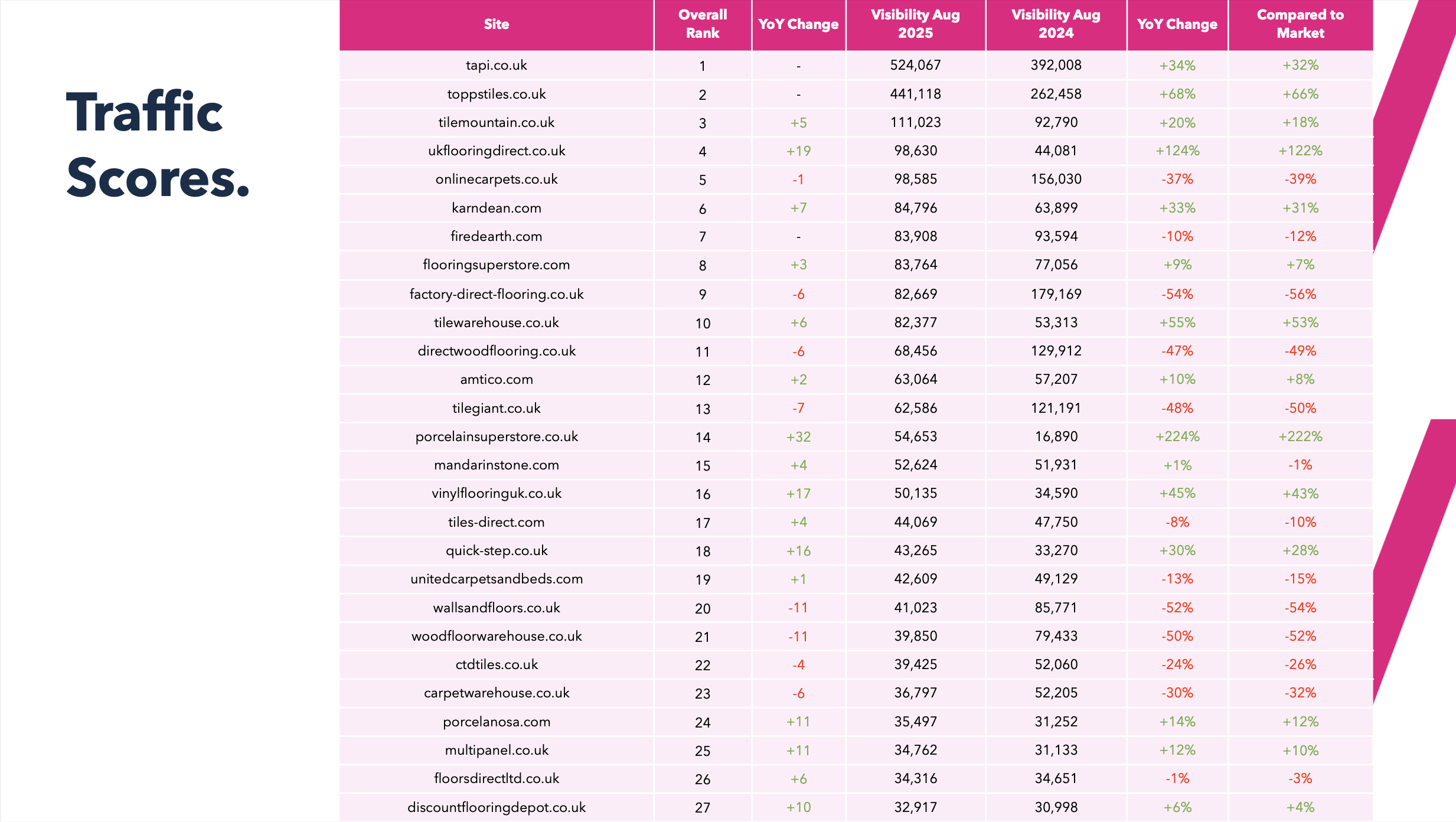

Which tile stores are the key players right now?

Below is a condensed look at visibility changes for well‑known brands. Where you see large swings, that’s search behaviour shifting between generic intent and brand‑driven discovery.

| Brand | Visibility (Aug ’25) | Visibility (Aug ’24) | YoY change | vs market |

|---|---|---|---|---|

| Porcelain Superstore (porcelainsuperstore.co.uk) | 54,653 | 16,890 | +224% | +222% |

| Mandarin Stone (mandarinstone.com) | 52,624 | 51,931 | +1% | −1% |

| Quick‑Step (quick-step.co.uk) | 43,265 | 33,270 | +30% | +28% |

| CTD Tiles (ctdtiles.co.uk) | 39,425 | 52,060 | −24% | −26% |

| Walls and Floors (wallsandfloors.co.uk) | 41,023 | 85,771 | −52% | −54% |

| Porcelanosa (porcelanosa.com) | 35,497 | 31,252 | +14% | +12% |

| Tileflair (tileflair.co.uk) | 21,911 | 14,664 | +49% | +47% |

| Tile.co.uk (tile.co.uk) | 21,899 | 26,473 | −17% | −19% |

| Al‑Murad (al-murad.co.uk) | 18,652 | 6,397 | +192% | +190% |

| Royalestones (royalestones.co.uk) | 19,319 | 12,737 | +52% | +50% |

| Floormart (floormart.co.uk) | 16,807 | 10,013 | +68% | +66% |

What these changes in organic visibility mean

First, the scale of Porcelain Superstore’s growth signals a demand shift from “big‑box solves everything” towards specialists who reduce friction after the click. When choice is overwhelming and tactile reassurance matters, shoppers reward sites that make sampling, colour matching and room visualisation effortless. That’s why a family‑run specialist can outpace names with deeper pockets.

Second, brand gravity matters. Porcelanosa posts steady gains thanks to strong brand salience. Meanwhile, broad catalogue players like Walls and Floors and CTD Tiles face pressure on generic rankings — the battleground where AI‑enhanced SERPs, marketplaces, and social discovery squeeze click‑through rates. Look to hit the middle of the funnel harder. Build pages and journeys that solve very specific buyer anxieties (size, slip resistance, grout pairing, underfloor heating) rather than only chasing head terms.

Tiles key players by brand reach: who’s top of mind?

When we blend branded search with owned social presence, we get a picture of mental availability — who buyers think of first.

| Rank | Brand | Monthly branded searches | Owned social score |

|---|---|---|---|

| 1 | Topps Tiles | 201,000 | 172 |

| 2 | Porcelanosa | 22,200 | 1,459 |

| 3 | Mandarin Stone | 22,200 | 204 |

| 4 | Fired Earth | 18,100 | 201 |

| 5 | Tile Giant | 40,500 | 73 |

| 6 | UK Flooring Direct | 27,100 | 93 |

| 7 | Tapi | 14,800 | 148 |

| 8 | Tile Mountain | 33,100 | 64 |

| 9 | Ca’ Pietra | 6,600 | 269 |

| 10 | CTD Tiles | 18,100 | 94 |

| 11 | Porcelain Superstore | 9,900 | 171 |

| 12 | Quick‑Step | 6,600 | 255 |

Keywords: What’s trending up — and what’s fading?

To translate “tiles market size” into something useful for digital, we look at search demand. Here are the products gaining or losing interest.

Emerging product searches

| Query | UK monthly searches | Interest trend |

|---|---|---|

| herringbone tiles | 6,600 | +15% |

| kitchen tiles and splashbacks | 4,400 | +8% |

| limestone floor tiles | 4,400 | +7% |

| tiles black | 3,600 | +17% |

| mosaic bathroom tiles | 2,900 | +35% |

| pink bathroom tiles | 2,900 | +13% |

| porcelain paving slabs | 2,900 | +6% |

| brick tiles for wall | 2,900 | +9% |

| LVT floor tiles | 2,400 | +23% |

| small bathroom tiles | 2,400 | +13% |

| stone effect tiles | 2,400 | +9% |

| beige bathroom tiles | 1,900 | +24% |

Receding product searches

| Query | UK monthly searches | Interest trend |

|---|---|---|

| bathroom tiles | 74,000 | −13% |

| floor tiles | 49,500 | −18% |

| kitchen tiles | 33,100 | −13% |

| vinyl floor tiles | 14,800 | −28% |

| outdoor tiles | 12,100 | −18% |

| bathroom wall tiles | 12,100 | −18% |

| mirror tiles | 8,100 | −29% |

| deck tiles | 6,600 | −36% |

The shift from broad to specific (and tangible)

Broad, catch‑all queries are slipping while specific looks and contexts (e.g., herringbone, mosaic bathroom, porcelain paving slabs) rise. That’s a classic maturing category signal. Shoppers have gone past “tiles near me” and into “help me picture this exact finish in my space.” Expect more intent to splinter by room size, finish and pattern.

This splintering rewards retailers who treat PLPs as buying guides, not just grids. That means filters that mirror how people decide (pattern, slip rating, shade variation), imagery that shows scale and grout contrast, and copy that speaks to use case, not just material. Younger buyers in particular expect short‑form video, UGC and “show me the look” inspiration to sit one click from the product.

Which keywords provide an opportunity?

High‑competition battlegrounds

| Keyword | UK monthly searches | Competitiveness |

|---|---|---|

| floor tiles | 28,000 | 21 |

| porcelain tiles | 11,000 | 24 |

| luxury vinyl tile | 2,200 | 22 |

| LVT tiles | 1,700 | 30 |

| ceramic tile | 700 | 24 |

| wall and floor tiles | 1,200 | 48 |

| porcelain patio tiles | 1,800 | 15 |

| stone floor tiles | 1,500 | 22 |

| natural stone tiles | 1,200 | 24 |

| luxury tile flooring | 100 | 37 |

Opportunity (low-competition) terms

| Keyword | UK monthly searches | Competitiveness |

|---|---|---|

| bathroom tiles | 45,000 | 6 |

| wall tiles | 9,900 | 8 |

| garden tiles | 4,000 | 4 |

| vinyl tiles | 4,800 | 11 |

| patio tiles | 3,400 | 4 |

| victorian tiles | 3,500 | 5 |

| porcelain paving slabs | 2,300 | 7 |

| stone tiles | 2,000 | 14 |

| cork floor tiles | 1,300 | 6 |

| cheap bathroom tiles | 1,000 | 6 |

Navigating 2025 SERPs without burning budget

Tile stores’ SEO in 2025 is less about piling into head terms and more about showing up where buyers make decisions. High‑competition keywords still matter for authority, but you’ll extract more revenue by owning specific, lower‑friction phrases that match how people buy. Treat these opportunities terms of the category “spines.” Build deep PLPs with rich filters, size/fit guidance, and dynamic content blocks for FAQs and aftercare.

Also, note how SERP real estate is changing. AI‑enhanced results and shopping modules are swallowing clicks on generic phrases. When you target lower‑competition terms with higher intent, you earn a larger slice of a smaller pie.

Speed, trust and reviews

Two hygiene points worth calling out: Page speed still matters. A one‑second delay in load time can reduce conversion by around 7%. On mobile, that’s fatal if your sample journey asks users to complete too many steps.

Trust signals are now more part of the purchase path than ever before. External review profiles (like Trustpilot), visible guarantees (returns, warranties), and clear credentials reduce hesitation — especially for higher‑value orders or fragile goods. Tiles are heavy, breakable and high‑consideration. Shoppers worry about colours, delivery damage and returns.

Spotlight on Porcelain Superstore: why a specialist is bucking the trend

Spotlight

The data shows Porcelain Superstore moving decisively against the market. Its visibility more than doubled year on year. What’s driving that? From the outside‑in, three things stand out:

- Sample‑to‑purchase flow that feels built for humans. Clear CTAs, friction‑light sample ordering, and content that sets expectations on shade, finish and grout. That reduces the “will it really look like the photos?” fear.

- Category pages with real buyer logic. Rather than dumping every range into a single grid, the site helps you narrow quickly by look, size and pattern — especially helpful on trending intents like herringbone or mosaic bathroom.

- Brand cues without the hard sell. Social proof sits close to the decision, and imagery focuses on rooms and schemes over sterile close‑ups. The effect: confidence.

This is why “human‑first” experiences win. They recognise the tactile barrier and close it with samples, transparent delivery/returns, and copy that sounds like a sales associate who actually lays tiles.

Lessons you can apply

For tactile products, the job isn’t just ranking. It’s translating a feel through the screen. That means:

- Treating samples as a product in their own right — with fast fulfilment, tracked delivery and guidance on testing in different lights.

- Using micro‑copy to answer the real pre‑purchase questions (substrate suitability, cutting difficulty, slip ratings, cleaning).

- Making returns visible and fair. The less “what if” anxiety, the more likely browsers become buyers.

- If you want a deeper look at the methods behind growth like this, learn more about the service mentioned on our e‑commerce SEO page.

How search behaviour is evolving in 2025 for tile stores

You’ll likely have noticed the same thing we have across categories. Click‑through on broad terms is softening as SERP features expand and AI answers crowd above the fold. At the same time, product discovery bleeds into social and creator content. For tiles, where buyers need to picture the finish, that shift magnifies two behaviours:

- Pre‑search inspiration on social. People decide on looks (herringbone, checkerboard, micro‑cement, blush pink) before they even hit Google. Your job is to meet them with finished‑room imagery and helpful language when they do.

- Mid‑funnel research on site. Once on your domain, they want answers fast: slip ratings, rectified vs non‑rectified edges, grout contrast, sealing requirements, underfloor heating compatibility. The brands that front‑load this clarity keep users from bouncing back to influencer videos for reassurance.

This is why “human‑first” experiences win. They recognise the tactile barrier and close it with samples, transparent delivery/returns, and copy that sounds like a sales associate who actually lays tiles.

Practical takeaways from this tiles industry report

- Own PLPs for terms like garden tiles, Victorian tiles and porcelain paving slabs with content depth and UX that mirrors how people decide.

- Win the middle. Treat category pages as buying guides and make PDPs resolve objections fast. Reflect trending looks (see the emerging list) in navigation and content modules.

- Design for speed and trust. Faster loads, visible guarantees, embedded reviews — these remove purchase friction for big, fragile orders.

- Measure what matters. Visibility is the proxy for reach, but optimise for qualified clicks. Watch conversion and return rates.

Where next?

Want the full tables, rankings and context? Get the free 69‑page report for deeper insight.

Curious how these findings translate into real revenue? Head to our e‑commerce SEO hub to learn more about the service mentioned.

Interested in other case studies like the analysis around Porcelain Superstore — explore our client stories.

Brand vs performance, and why social still counts

You can be everywhere in the SERP and still lose the sale if you’re not the name people type. Topps Tiles remains the category’s brand awareness anchor, while Porcelanosa’s social footprint accelerates brand search.

Notice Porcelain Superstore sits just outside the top‑10 on this measure — yet it’s a visibility winner. That mix (growing performance plus rising branded demand) excites us about what they’ve got coming.

For most retailers, the directional play is quite clear. Build top-of-funnel awareness and reduce friction in the journey. That means category pages that answer style questions (“can I get this look in LVT?”), product pages that handle objections (slip ratings, design advice, cutting guidance), and content that shows the tile in context — real rooms, grout colours, etc..