2026 Jewellery & Watches Industry Analysis: why the winners make customers feel like creators

2026 Jewellery & Watches Industry Analysis shows a clear split between brands that treat the ring-buying journey as a task and those that make it feel like creation. The latter group is pulling away in organic search.

If you want the full market data behind this article, you can get the free 69-page report.

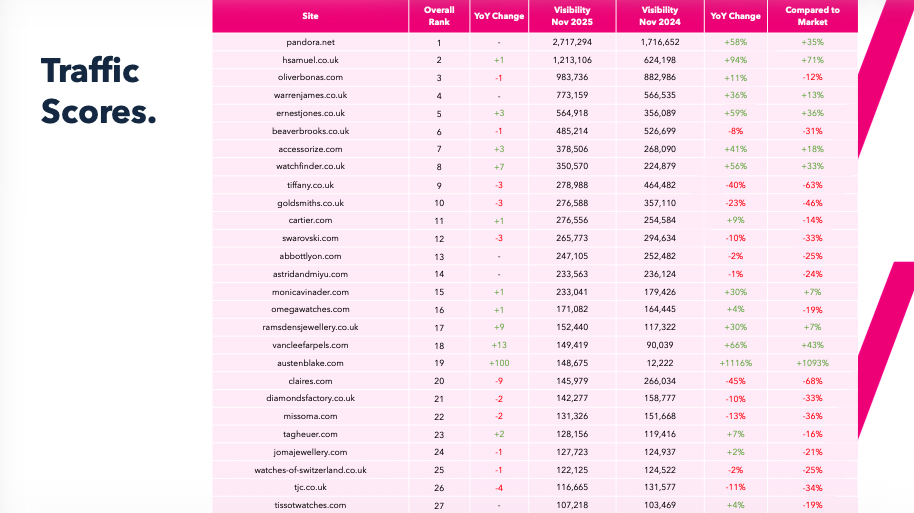

Which jewellery brands dominate organic visibility in 2026?

The table below shows the market’s current Top 10 for organic visibility (Traffic Score). YoY change highlights who’s compounding momentum.

| Rank | Brand | Traffic Score (Nov ’25) | Nov ’24 | YoY |

|---|---|---|---|---|

| 1 | Pandora (pandora.net) | 2,717,294 | 1,716,652 | +58% |

| 2 | H. Samuel (hsamuel.co.uk) | 1,213,106 | 624,198 | +94% |

| 3 | Oliver Bonas (oliverbonas.com) | 983,736 | 882,986 | +11% |

| 4 | Warren James (warrenjames.co.uk) | 773,159 | 566,535 | +36% |

| 5 | Ernest Jones (ernestjones.co.uk) | 564,918 | 356,089 | +59% |

| 6 | Beaverbrooks (beaverbrooks.co.uk) | 485,214 | 526,699 | −8% |

| 7 | Accessorize (accessorize.com) | 378,506 | 268,090 | +41% |

| 8 | Watchfinder (watchfinder.co.uk) | 350,570 | 224,879 | +56% |

| 9 | Tiffany & Co. (tiffany.co.uk) | 278,988 | 464,482 | −40% |

| 10 | Goldsmiths (goldsmiths.co.uk) | 276,588 | 357,110 | −23% |

What the numbers reveal

Leaders combine strong brand demand with navigable category ecosystems and product experiences that reduce cognitive load. H. Samuel’s near-doubling of visibility hints at site-wide alignment between navigation, content and product intent. By contrast, declines for Tiffany & Co. and Goldsmiths point to a mismatch between brand equity and generic capture in UK search. You can’t live on brand terms alone.

Wider market dynamics

The sector grew around a quarter year-on-year, so growth alone isn’t a differentiator; the question is where growth comes from. We’re seeing gains concentrate around brands that turn selection into participation (more on that below). That aligns with how search is evolving: more intent-rich, more task-based, and increasingly judged by whether a page helps someone decide. Brands that surface the right options, at the right time, with clarity, keep winning share even against higher-authority rivals.

Who are the biggest risers and fallers YoY?

Below are notable movers. The figures reflect organic visibility change rather than paid activity.

| Direction | Brand | Rank (’25) | Traffic Score ’25 | ’24 | YoY |

|---|---|---|---|---|---|

| Riser | Austen & Blake (austenblake.com) | 19 | 148,675 | 12,222 | +1,116% |

| Riser | Mappin & Webb (mappinandwebb.com) | 43 | 63,714 | 30,983 | +106% |

| Riser | H. Samuel (hsamuel.co.uk) | 2 | 1,213,106 | 624,198 | +94% |

| Riser | Berry’s Jewellers (berrysjewellers.co.uk) | 28 | 105,091 | 55,848 | +88% |

| Riser | Van Cleef & Arpels (vancleefarpels.com) | 18 | 149,419 | 90,039 | +66% |

| Riser | Watchfinder (watchfinder.co.uk) | 8 | 350,570 | 224,879 | +56% |

| Faller | House of Watches (houseofwatches.co.uk) | 45 | 62,369 | 140,193 | −56% |

| Faller | Claire’s (claires.com) | 20 | 145,979 | 266,034 | −45% |

| Faller | Tiffany & Co. (tiffany.co.uk) | 9 | 278,988 | 464,482 | −40% |

| Faller | Watch.co.uk (watch.co.uk) | 42 | 64,223 | 75,797 | −15% |

Austen & Blake’s leap is the poster child for reframing. The physical products didn’t change; the perception did. Mappin & Webb’s resurgence suggests technical and content improvements that free up latent authority. On the decline side, House of Watches and Claire’s look like victims of weaker generic capture and possible indexation or content-quality gaps, issues that compound quickly when SERP layouts change.

Strategic reading

YoY jumps at this scale rarely come from single tactics. They come from removing psycho-logical (coined by Rory Sutherland) friction. Clearer pathways for different intents, transparent pricing, and confidence signals where doubt is highest. If your visibility slipped, start with search journeys, not keywords. What are people trying to accomplish, and where does your site help them.

How is search demand shifting (and what should you care about)?

Emerging product demand (12–24 months)

| Query | UK Monthly Searches | Interest Trend |

|---|---|---|

| belly ring | 3,600 | +112% |

| cluster ring | 2,900 | +123% |

| cushion-cut diamond ring | 880 | +179% |

| engagement rings for women | 14,800 | +60% |

| platinum diamond ring | 3,600 | +71% |

| lab-grown diamond engagement rings | 5,400 | +41% |

| womens charm bracelets | 2,400 | +114% |

What this signals

Demand is fragmenting toward style- and use-case language (“cluster”, “cushion-cut”, “engagement rings for women”) and material-led reassurance (“platinum”, “lab-grown”). This favours brands that build deep, interlinked guide hubs and category content that mirrors how people phrase uncertainty.

Actionable reading of behaviour

Younger shoppers lean into specifics earlier because they arrive pre-researched via short-form video and Reddit. That means more mid-funnel discovery pages and fewer generic catch-alls. It also means pages need to resolve micro-questions fast (care, sizing, ethical sourcing) without ejecting users into a blog cul-de-sac.

Which keywords are the real battlegrounds (and where’s the easier growth)?

High-competition “belt” terms (monitor & defend)

| Keyword | UK Volume | Competition |

|---|---|---|

| watches | 36,000 | 59 |

| moissanite | 17,000 | 27 |

| designer watches | 3,600 | 50 |

| diamonds | 10,000 | 21 |

| vintage watches | 2,300 | 41 |

“Opportunity” terms (lower competition, high value)

| Keyword | UK Volume | Competition |

|---|---|---|

| earrings | 22,000 | 5 |

| mens wedding rings | 11,000 | 5 |

| mens wedding bands | 7,400 | 4 |

| pocket watch | 8,400 | 11 |

| moissanite rings | 9,800 | 6 |

What the split tells us

Big-brand belts like “watches” and “diamonds” are noisy and expensive to defend. The smarter bet for challengers is to flood the zone on structurally-related, lower-competition queries where you can own the journey (guides → comparison → configurable product) and bank compounding wins.

Austen & Blake grew 1,116% by selling the same products differently

A mid-sized jeweller climbed from 12,222 estimated organic visits in November 2024 to over 148,000 in November 2025. Same diamonds as everyone else. Same gold. Same settings. What changed? The frame.

Rory Sutherland’s “psycho-logical value” lens explains it. When logical value (carat, clarity, price per gram) converges, advantage comes from how the purchase feels. Austen & Blake stopped asking shoppers to “browse the catalogue” and let them design.