Every year, we release our Salience Index; this edition, the Footwear Market Performance Report, gave some interesting insights on shoe retailers vs. direct-to-consumer (D2C) name brands. Just six months ago, leading shoe retailers were facing significant challenges. Industry giants such as JD Sports, Footlocker, and Office were losing organic traffic to the growing dominance of D2C brands like Nike, Crocs, and New Balance.

This shift in consumer behaviour seemed unstoppable, fuelled by Google’s emphasis on experience, expertise, authority, and trust (EEAT), which gave D2C brands a clear advantage. After all, why buy from a middleman when you can go straight to the source?

However, the tide has since turned. Today, retailers are regaining ground, while D2C brands are seeing a decline in visibility.

Over the past six months, major D2C brands have seen drops in organic traffic, with:

- Nike: -5%

- New Balance: -6%

- Ugg: -2%

- Asics: -5%

In contrast, retailers have experienced significant traffic growth, with:

- JD Sports: +36%

- Shoe Zone: +39%

- Footlocker: +51%

Retailers now dominate the top positions in the industry, with JD Sports, Sports Direct, and Schuh ranking among the top five. Across the top 20 retailers, there’s an average year-over-year growth of 13%, outpacing the broader market’s 7% growth by 6%.

Meanwhile, D2C brands are only growing by 8%, with major players like Nike, Adidas, and New Balance seeing minimal growth of just 1% faster than hundreds of smaller brands. While not all D2C brands are facing struggles—Crocs and Under Armour, for instance, have seen a 30% increase in traffic, growing 23% faster than the industry—many are losing ground to retailers. What’s behind this shift?

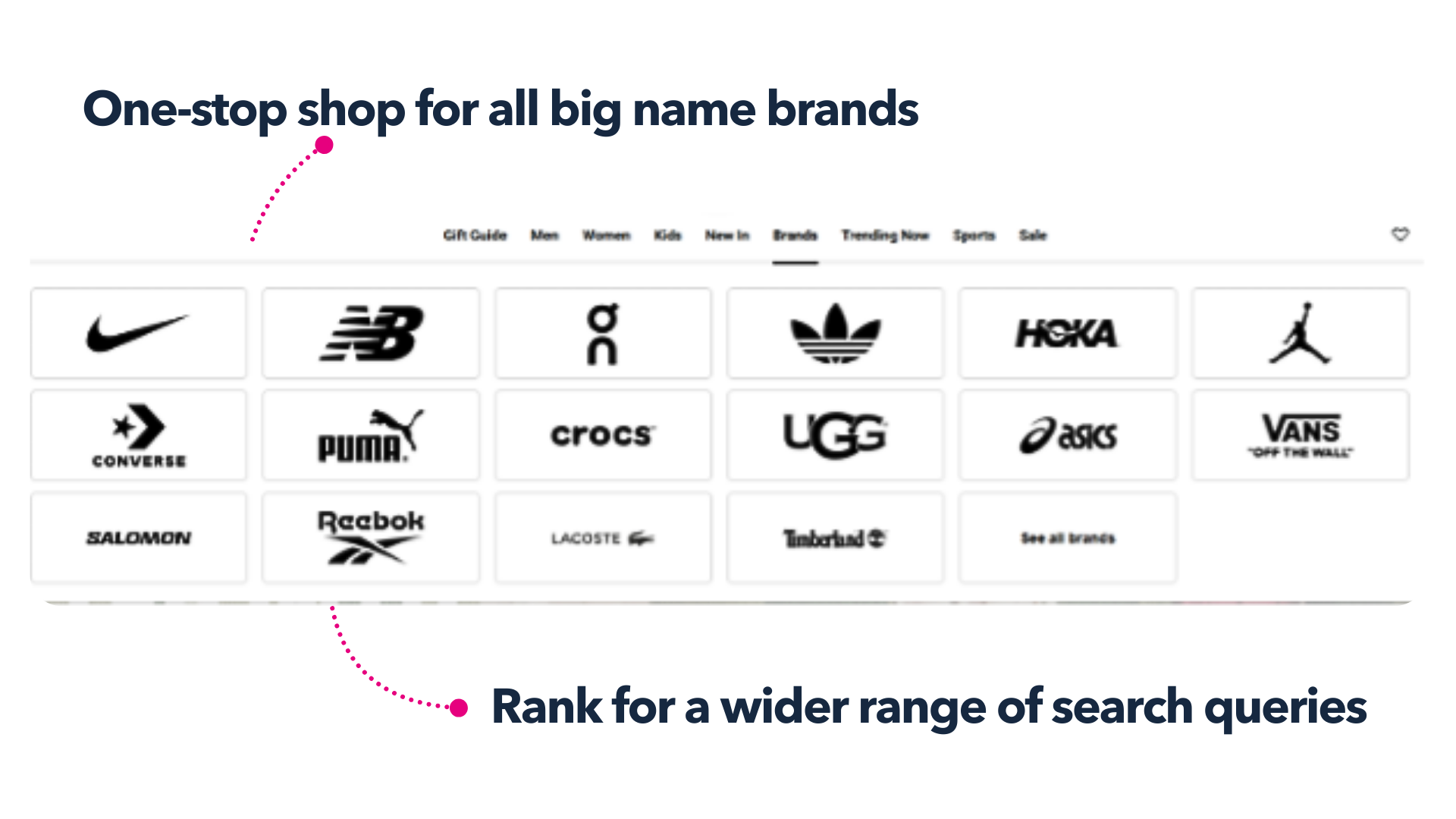

All The Shoes In One Place

Several factors likely contribute to this trend, but the biggest one is their broader product ranges to enable them to rank for a wider range of search queries. From being your one-stop shop to browse all the brands you know and love, like in Foot Locker’s mega navigation:

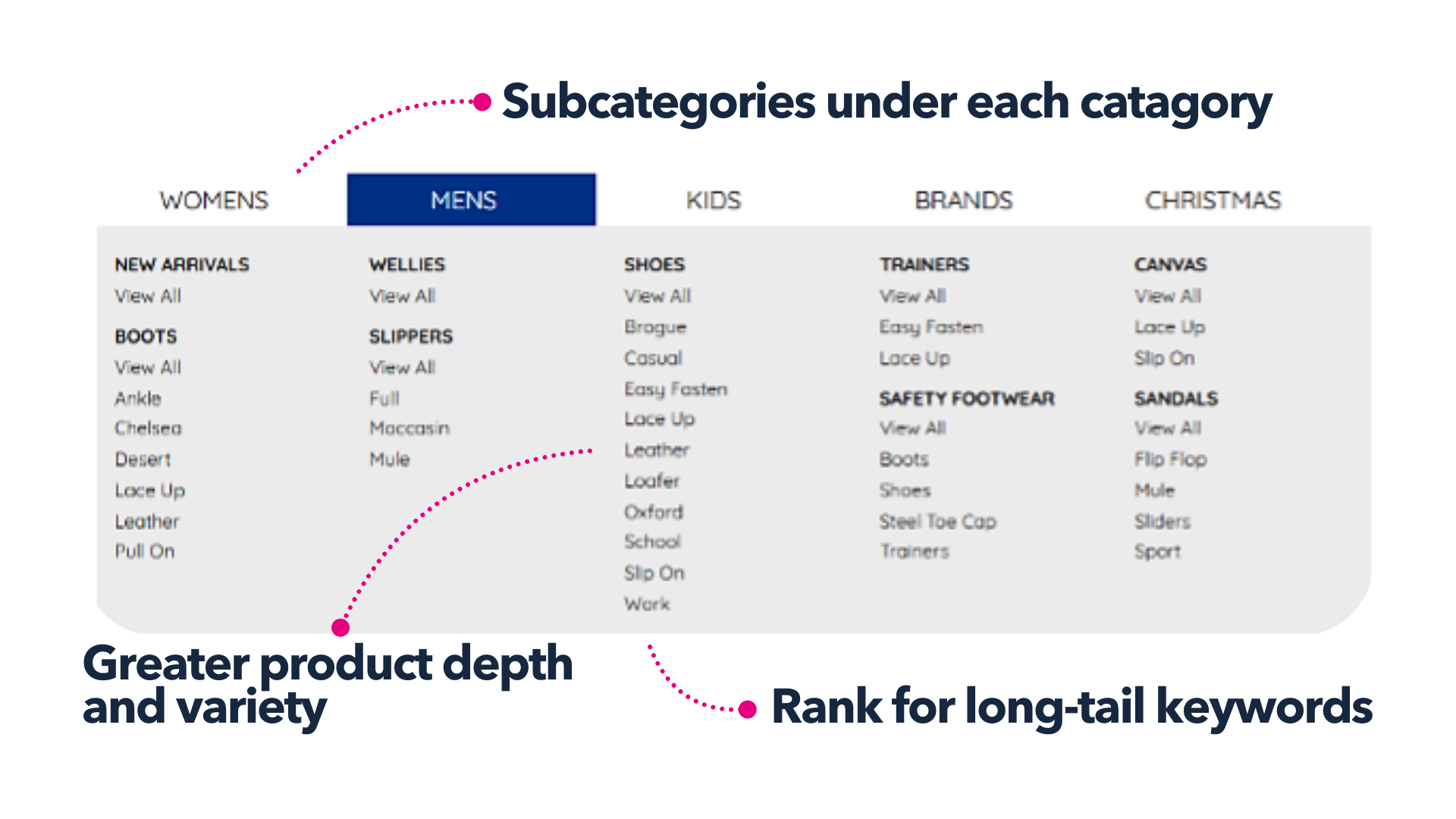

Or the prevalence of long-tail general keywords which expand their footprint outside of branded terms. We can see this in Shoe Zone’s mega navigation, where they take each category, such as boots, shoes, trainers, and more and create subcategories under them:

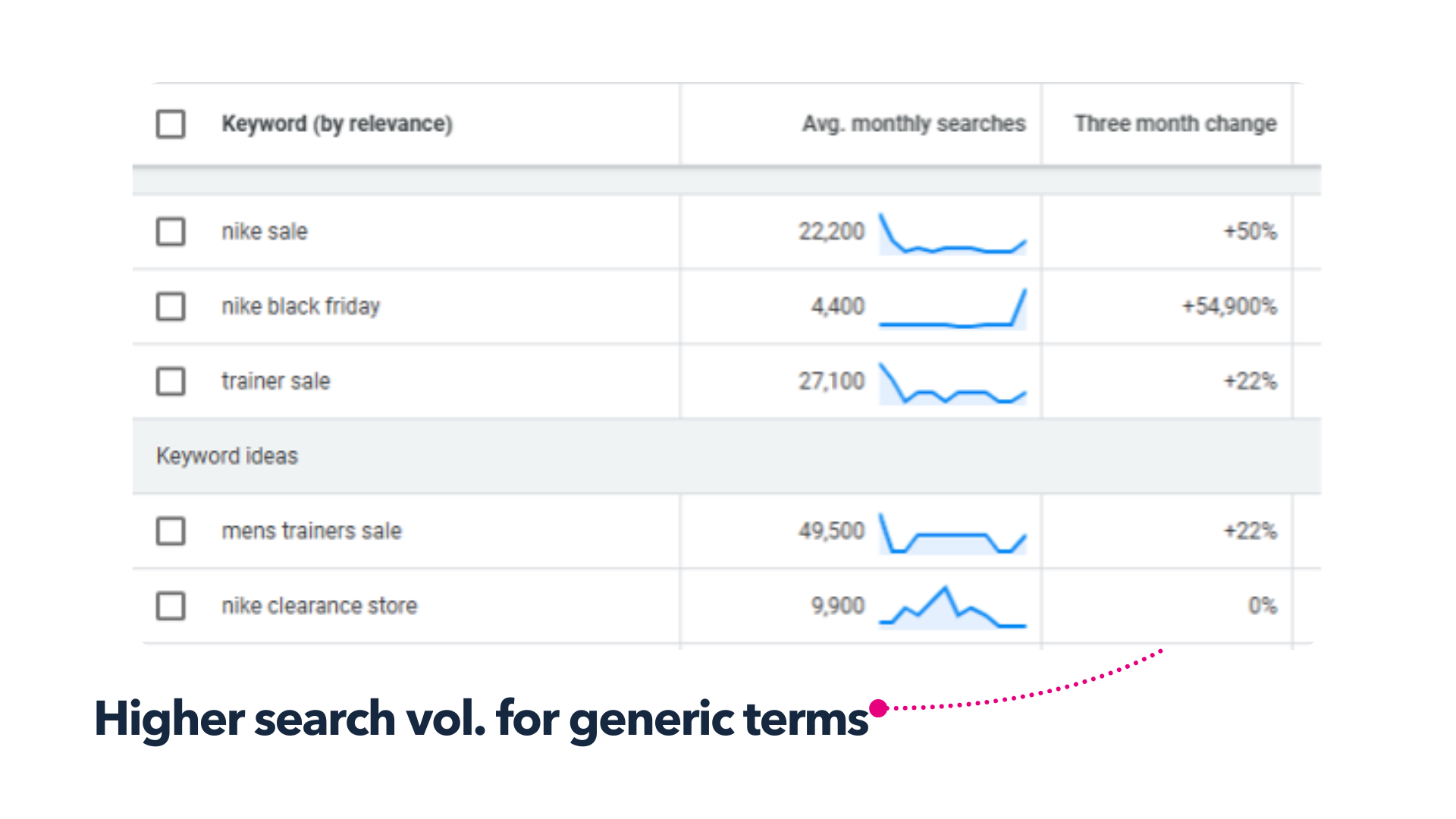

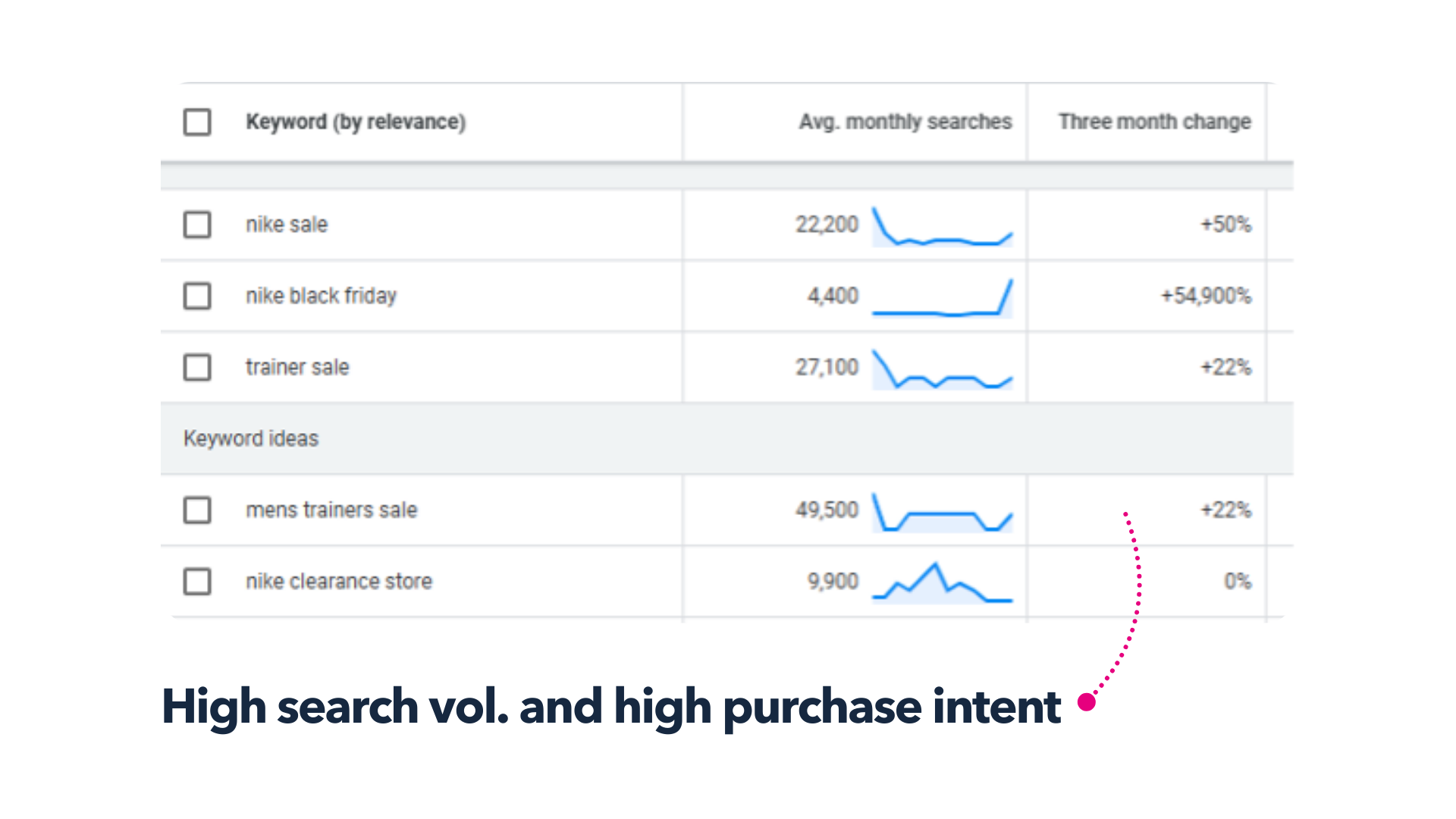

During high-traffic periods, generic search terms outperform brand-specific keywords, favouring sites with greater product depth and variety. Google Ad’s Keyword Planner can show you the peak and yearly trend data, with spikes in long-tail keywords compared to a steady neutral with branded terms:

By optimising your site for long-tail keywords as well, you’re increasing the keyword footprint of your categories, but the search volume of generics usually ends up in a higher total search volume.

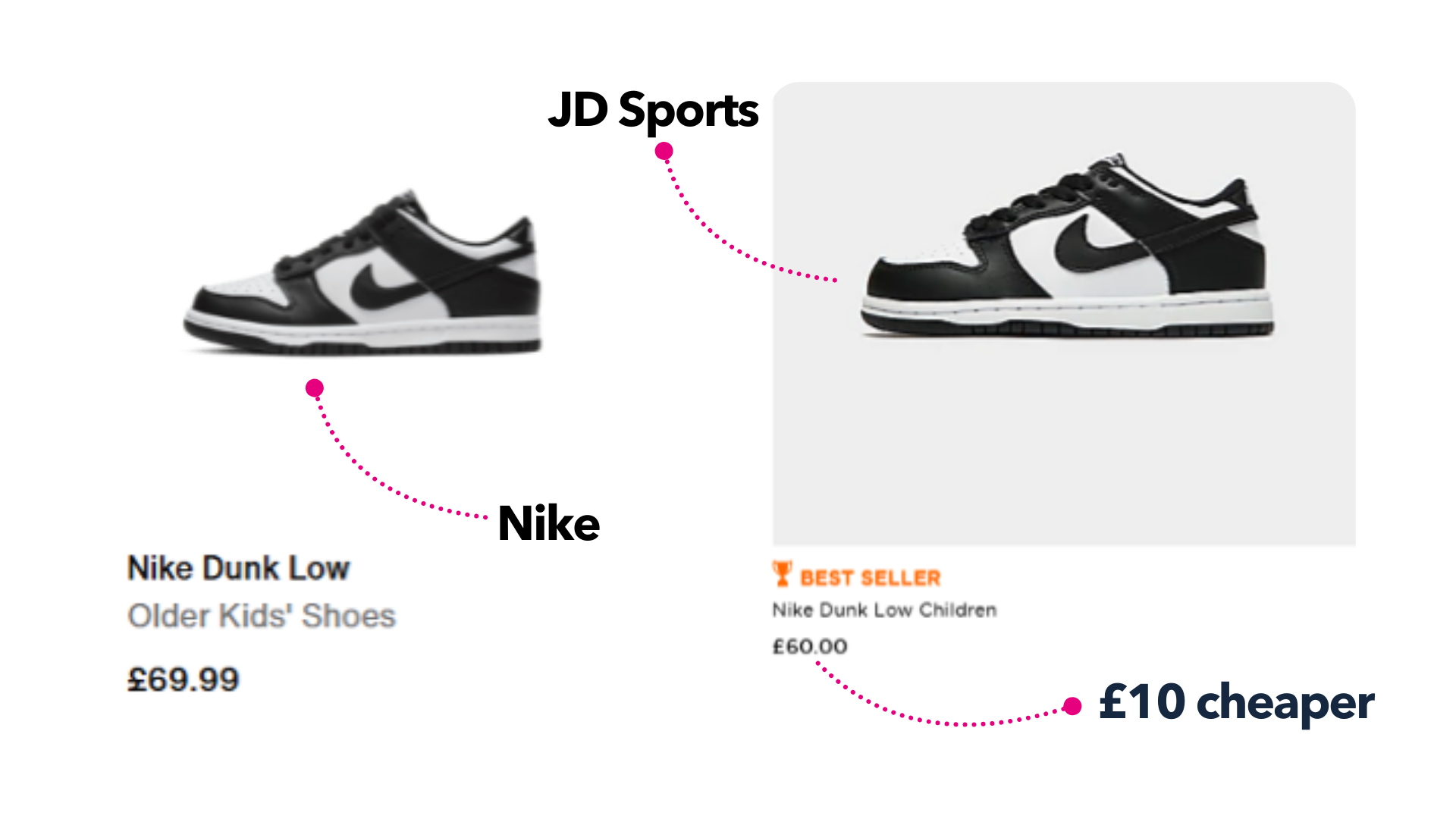

Named Brands At A Fraction Of The Price

Retailers also have the flexibility to stock all these shoe options at less than what the D2C brands would sell them for. For example, on the left is Nike and JD Sports, on the right, stock the same shoe at almost £10 cheaper:

Not only are you usually buying cheaper, but retailers offer larger discounts during key shopping periods such as Black Friday and Christmas. You can even see sales popping up throughout the year with retailers; name brands not so much.

Sale banners at Foot Locket and JD Sports:

With specific branded keywords like sale or clearance having high search volume and high purchase intent, retailers that listen to the audience and give them what they’re after will ultimately help them rank for these terms and perform better than D2C brands:

This phenomenon was evident last year when candymail.co.uk, a site with a vast selection of drinks and confectionery, dominated the search rankings despite offering no unique features.

Could it be those retailers with more extensive product inventories are winning the visibility race during peak shopping seasons? As the landscape continues to evolve, it’s clear that the competition between retailers and D2C brands is far from over. This makes it crucial for brands to stay agile and responsive to changing consumer behaviour.

That’s all, stay Human.

Want this kind of stuff in your inbox weekly? Subscribe to our newsletter here.

P.S. Here’s 4 things you’ll find interesting:

- Get a free audit of your current marketing strategy. >>Click here to get your free audit<<

- Look at our free 2024 Footwear Salience Index >>Click here to learn about your industry<<

- Make your content king. Hear our thoughts on the power of content marketing done right >>Click here to learn all things content marketing<<

- Read another footwear thought piece >>Why the Footwear Industry Needs a “Quiet Word” with its SEO Departments (ASAP)<<