As part of their annual Jewellery Industry report, Salience Search Marketing have analysed the jewellery industry to uncover how consumer behaviour and the online market has changed in a rapidly changing digital world

This is a developed sector with a number of established brands dominating top of market and only small fluctuations in performance across the last 12 months. Overall, the top 50 sites have seen a 6% increase in share of voice this year compared to last. If your brand isn’t growing by the same amount, it’s falling behind the curve.

The top of market:

While the top 5 brands are the same this year compared to last, there have been notable changes in share of voice.

The top 5 brands and how their share of voice has changed:

- hsamuel.co.uk (2% growth YOY)

- ernestjones.co.uk (20% growth YOY)

- beaverbrooks.co.uk (9% decline YOY)

- pandora.net (7% growth YOY)

- goldsmiths.co.uk (15% decline YOY)

Ernest Jones are the ones to watch here. A 20% increase in brand reach at the top of market is substantial. Keep an eye on how they are now targeting consumers through their website.

The opposite is true for Goldsmiths. Their share of voice has decreased by 15%. A review of their strategy is in need or they may end up overtaken by lesser digitally-established players. The likes of Watch Shop, Tiffany and Accessorize are on their heels.

The middle ground – stable but with opportunity for a brave brand strategy.

Looking across the next 20 brands, positions 6 to 26 in the Salience Visibility Leaderboard, brands are predominantly where they were last year. There have been some minor changes with the likes of Watch Shop overtaking Tiffany while Thomas Sabo have increased their position by one place.

Most interestingly, three brands buck the trend of stability. Jura Watches, Mappin & Webb, and Steven Stone have all seen significant growth when compared to the sector at large.

Visibility growth winners:

- jurawatches.co.uk (2% growth YOY)

- mappinandwebb.com (20% growth YOY)

- stevenstone.co.uk (9% decline YOY)

Having analysed their approach, Liam Porter, Content Strategist and Organic Growth Specialist has identified three tactics these brands are using to punch above their weight.

- Prominent placement of commercial pages

- Trust signals across high traffic pages

- A logical and clean site structure

This focus has enabled these brands to achieve substantial growth in a rather steady sector.

The placement of commercial pages:

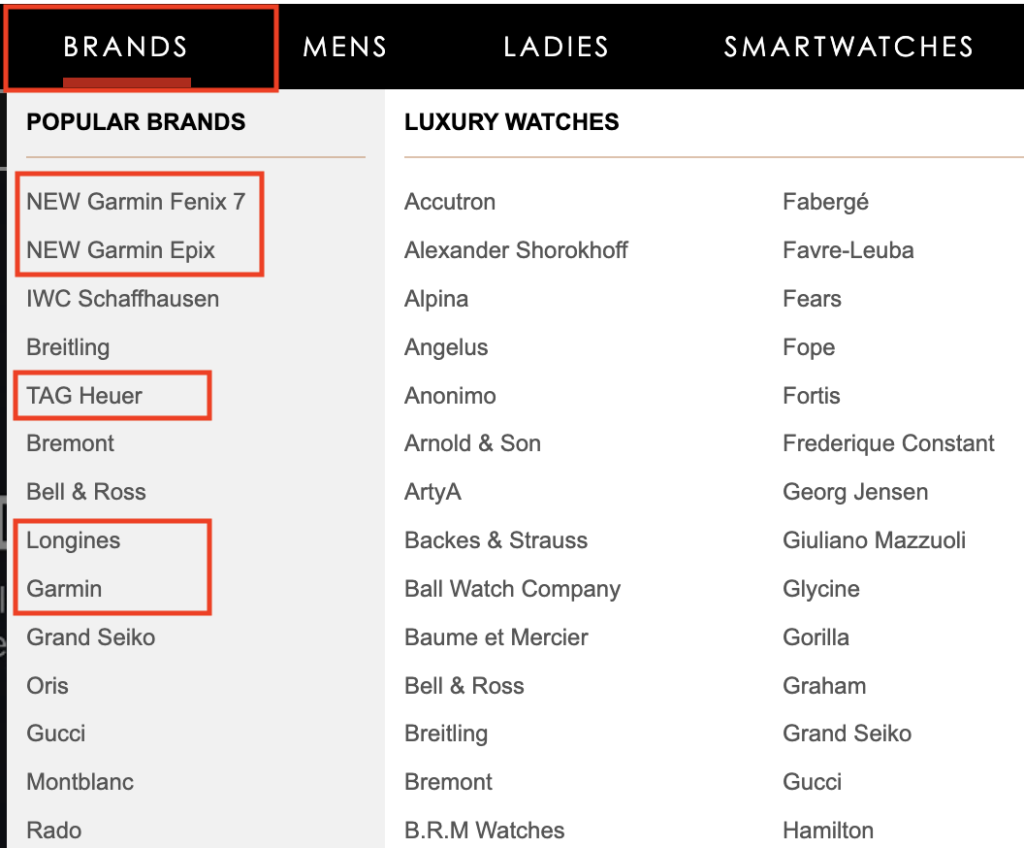

Both users and search engines need clear and logical pathways to commercial categories and subcategories. Jura Watches rank strongly on a range of watch brand terms. How they place these brands on their website is key to their success.

At top level, Jura Watches rank within the top 3 positions for branded terms such as Garmin Watches and Longines Watches. They’re never going to outrank the brand’s own website, so they are top of market for very lucrative terms.

- Garmin watches: Position 3 with 73,000 monthly searches

- Longines watches: Position 2 with 11,000 monthly searches

- G shock watches: Position 3 with 15,000 monthly searches

| Brand keyword | Rank | Monthly search volume |

| garmin watches | 3 | 73,000 |

| longines watches | 2 | 11,000 |

| g shock watches | 3 | 15,000 |

| seiko tuna | 1 | 1,300 |

| Squale | 2 | 1,100 |

To achieve this success, they have placed these opportunity brands with prominence in their meganav. Look at their website and you’ll notice how the Brands dropdown is the first in the meganav. The brands on which they see success are then placed within a Featured column at the start of the dropdown.

This signifies that these are the most important pages. They’re the first point of engagement which gives them prominence and results in improved rankings and visibility.

The key takeaway is to identify product sets where your brand is likely to convert well and place these categories with prominence in your meganav. You can double up by also linking through to the same pages from your homepage content. If you can blend both high conversion potential against search volume, you’ll maximise revenue in a structured and achievable manner.

To identify high volume terms, check out the Salience report which includes both high volume and opportunity keywords. To understand where conversion is most likely, use your existing data sets or compare your offerings to competitor pricing and product depth.

Trust signals across high traffic pages:

Proving how trustworthy your brand is has become incredibly important in recent years. It’s one of the most important soft-signal ranking factors and when done properly can have a holistic impact across your entire site.

In a world of increased consumer digital knowledge, providing users with confidence that their experience will be positive is of maximum value. From a user point of view, signals such as trust pilot reviews help increase how likely a user is to convert or continue their journey to purchase.

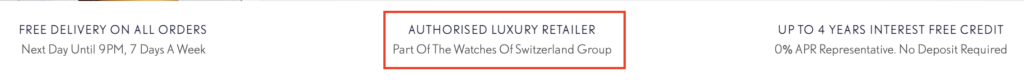

Mappin & Webb provide this type of signal across the breadth of their site.

For example, they use a USP bar on their homepage to identify that they are an “authorised luxury retailer” and part of “The Watches of Switzerland Group”.

They also use language and content within subheaders and paragraphs across key pages to promote their expertise. This includes the fact they are a “British treasure with over 240 years of tradition in the world of fine jewellery and watches”.

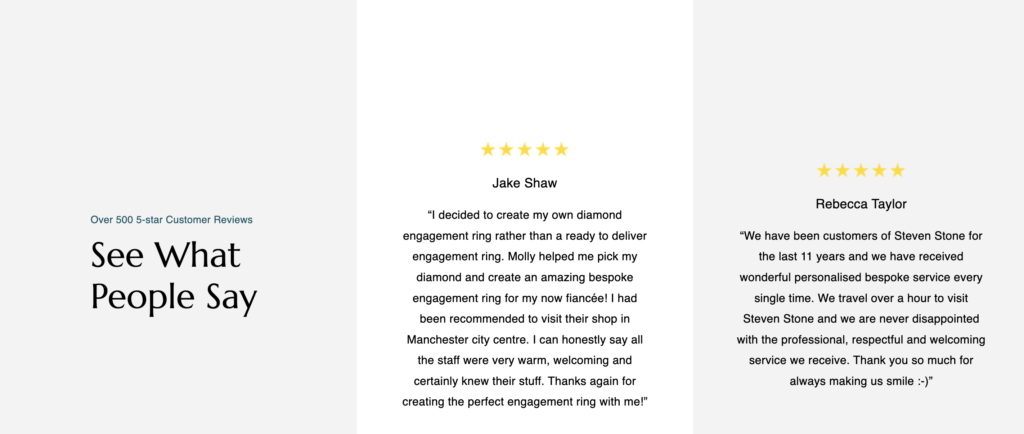

Steven Stone approach trust similarly, identifying their brand and expertise with clean cut-throughs on key pages.

They also use full-screen modules on their site to promote customer reviews. Check out their homepage and scroll down to their “See What People Say” content block. This indicates they have over 500 5-star customer reviews providing the most recent of these in large blocks – ideal for really making the most of their positive customer service.

The key takeaway here is to identify what trust signals your brand has and ensure that they are presented with prominence and clarity across the key pages of your site. From a search point-of-view, this will maximise engagement and showcase to the likes of Google that when a user enters your site, their intent has been satisfied and they are willing to engage.

Clean and logical category structure to promote content depth:

Long gone are the days where you can rank for a competitive term with a single category page and a number of products. As the digital world has expanded, so has the general size of a website.

Jura Watches have embraced this trend and have ensured that not only do they provide a category page for each brand, but provide clearly linked subcategories too. This helps users move down the funnel until they reach a page which includes only the products in which they are interested.

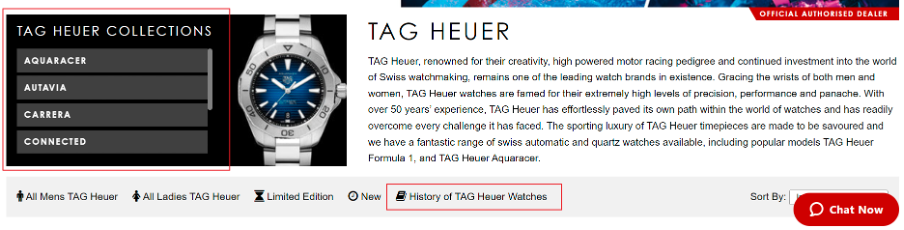

Take a look at their Tag Heuer category page.

They use a “Tag Heuer” collections module to provide users with quick access to more niche collections under the Tag umbrella and even link out to supplementary content to showcase their knowledge of the brand.

While clearly useful for users to funnel their intent, this approach is also perfect for search engines as it clearly identifies the depth in range and content about said products. At it’s most simple, this approach positions Jura Watches one of the most authoritative brands in the space on all Tag Heuer terms with great content depth, targeted intent, and a wide product range.

Summary

The jewellery industry has a number of well-established digital brands. At top level, it’s a stable industry where only few brands are disrupting the industry and punching above their weight. Those who are brave enough to put the time and effort into optimising their digital experience are likely to see huge gains. Especially when it seems a number of brands are resting on their laurels when it comes to digital. Look to emulate those whose share of voice has increased by more than 6% and you’ll likely see your brand start to outperform your direct competitors and those closer to top of market.