What the 2026 Beauty Market Reveals About the Future of Organic Visibility

“Skincare” searches dropped 45% this year.

At the same time, “multichrome eyeliner” grew 2,243%.

These aren’t different markets. They’re the same shoppers, buying the same products, through the same search engine. But something fundamental shifted in how they search, and understanding that shift explains why some beauty retailers are surging while others are falling behind.

Social is now a search engine, and search is acting more like social. TikTok and Instagram aren’t just building awareness anymore. They’re teaching customers exactly what to want, and exactly what to call it, before those customers ever type a query into Google.

That dynamic is reshaping organic visibility across the £5B+ UK beauty retail market. And the data shows a clear divergence between brands that adapted and those still optimising for the old search landscape.

Why Generic Terms Are Dying

Start with the declines. Year-over-year, the category-level terms that once defined beauty search are in freefall:

- “Skincare”: −45%

- “Extension eyelashes”: −38%

- “Lip gloss”: −23%

- “Lipstick”: −18%

- “Eye cream”: −18%

- “Bronzer drops”: −49%

These aren’t niche terms. They’re the foundation of traditional beauty SEO, the queries that justified category pages, the targets for evergreen content, the anchor of keyword strategies.

So why are they collapsing?

Because social platforms trained shoppers to skip them entirely.

When someone watches a 45-second video of a creator applying mascara, they don’t learn that mascara exists. They already know that. What they learn is that this mascara is a “tubing mascara”, and that tubing mascaras don’t flake like traditional formulas.

Now they search “tubing mascara.”

Not “mascara.” Not “best mascara.” The specific sub-type they just learned about.

The phenomenon repeats across every product category. “Moisturiser” is generic; “non-comedogenic moisturiser” is specific (+32% YoY). “Primer” is generic; “gripping primer” is specific (+166% YoY). “Eyeliner” is generic; “multichrome eyeliner” is specific (+2,243% YoY).

Social creates the vocabulary. Search absorbs the demand. And the old category terms get left behind.

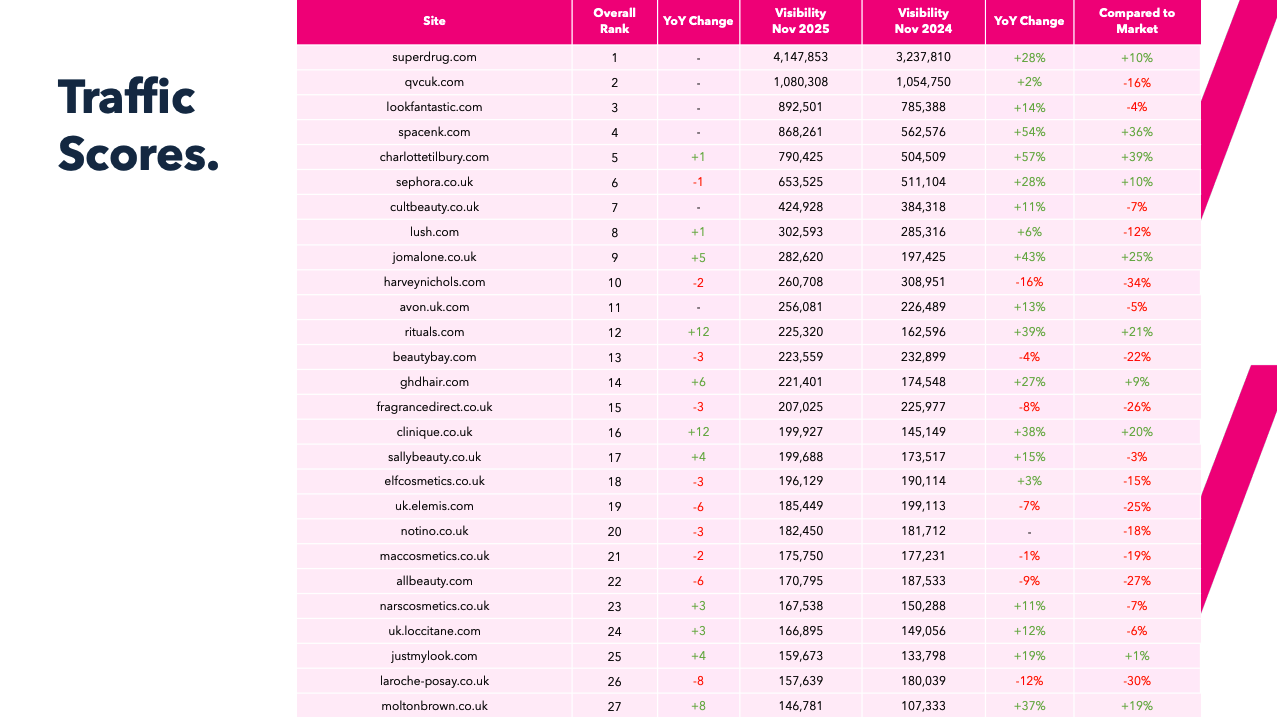

Winners and Losers: Who Captured the New Demand

The market baseline for organic visibility in UK beauty retail is +18% year-over-year. That’s the tide. The question is who’s rising faster—and who’s sinking despite it.

The gainers:

| Retailer | YoY Visibility | vs. Market |

|---|---|---|

| Charlotte Tilbury | +57% | +39 points |

| Space NK | +54% | +36 points |

| Jo Malone London | +43% | +25 points |

| Clinique | +38% | +20 points |

| Superdrug | +28% | +10 points |

| Sephora | +28% | +10 points |

The losers:

| Retailer | YoY Visibility | vs. Market |

|---|---|---|

| Harvey Nichols | −16% | −34 points |

| La Roche-Posay | −12% | −30 points |

| Paula’s Choice | declining | below market |

| P.Louise | declining | below market |

What separates the lists?

The gainers share a common trait: their on-site language matches social language. Product detail pages describe finishes, not just features. Collection pages exist for techniques and routines, not just product types. Schema data makes effects explicit.

When someone searches “glass skin routine” after watching it on Instagram, Space NK has a page that matches. When someone searches “tubing mascara,” Superdrug’s PDPs use that exact phrase. The vocabulary social platforms are minting lands on their sites, and Google indexes it.

The losers typically relied on broad category coverage. Their authority profiles are often excellent, strong link portfolios, clean technical foundations, but the content doesn’t echo the new demand signals. Social buzz dissipates before it crystallises into rankings.

Why Familiarity Matters More Than Ever

AI overviews and zero-click SERP features are compressing the click-out space on generic queries.

When Google’s AI summarises “best skincare routine” in the search results, fewer users click through to any site. The query still exists; the traffic doesn’t.

This makes branded search, people searching your name specifically, more valuable than ever. It’s demand that Google can’t intercept with a summary. It’s traffic that arrives because someone already decided they want you.

The leaders in UK beauty brand search:

| Brand | Monthly Searches (UK) |

|---|---|

| Superdrug | 1,500,000 |

| QVC | 823,000 |

| LOOKFANTASTIC | 550,000 |

| Charlotte Tilbury | 450,000 |

| Sephora | 368,000 |

Superdrug’s 1.5 million monthly brand searches act as a shock absorber. When AI overviews eat generic clicks, people still search “Superdrug skincare”, and that traffic isn’t going anywhere else.

But brand search volume doesn’t appear from nowhere. It’s the output of awareness efforts, physical presence, and increasingly, social visibility. The brands growing fastest in owned social audiences, Huda Beauty, Avon, M·A·C, are building the recognition that converts into branded queries.

This creates a flywheel. Social visibility builds brand recognition, brand recognition drives brand search, brand search delivers traffic that algorithms can’t redirect.