Our 2025 confectionery industry report explores the performance of the top 100 online sweets and snacks brands. Analysing everything from traffic scores to page speed, brand reach to opportunity keywords, we pit the best of the best against each other and identify how they’ve changed since 2024.

The timing matters. With the HFSS ad ban set to land this October, limiting paid search and social for many snack brands, organic visibility is about to become far more important.

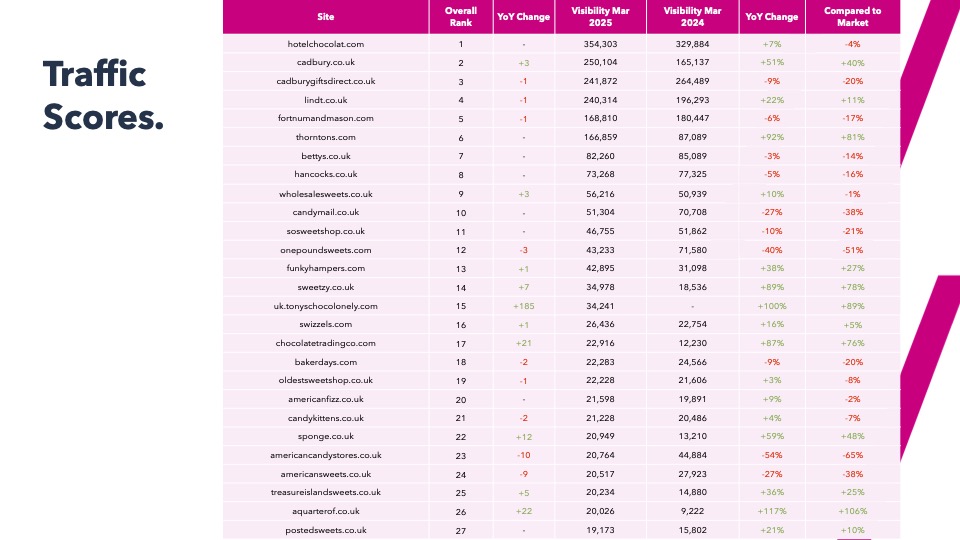

Fitting, then, that the confectionery market has seen an 11% increase in visibility this year. It’s clear more brands are investing in SEO to get ahead of the restrictions. But growth hasn’t been evenly spread. We’ve seen top-of-market brands lose some of their foothold, mid-market players take advantage, and several new names break into the top 100 for the first time.

We also cover domain authority, page speed averages, keyword competition and opportunities, and social scores. The aim? To give brands a clear view of who’s doing well and why, while highlighting areas for improvement.

We’ll run through some highlights below, but for the full breakdown, click here to download the 2025 Confectionery Market Report free of charge.

Want to know what the HFSS rules mean for your digital strategy? Read the full breakdown here