We all have different tastes when it comes to fashion, but with footwear, most of us want the same three things: solid support, decent longevity, and a bit of style. While flair is subjective, the first two translate clearly to business, brands want to support their audience and stay in the game as long as possible.

That’s why we’ve walked through the catalogues, stats, and search performance of the biggest footwear players to see who’s still fresh, and who’s showing their creases.

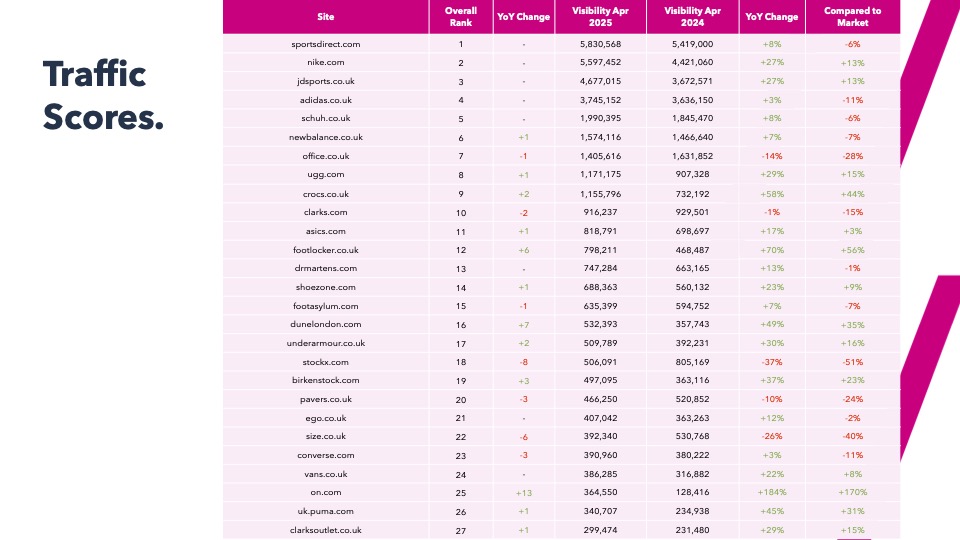

We’ve analysed the data behind search visibility, page performance, keyword gaps, and brand presence. The goal? To give you a clear view of who’s ahead, where the opportunities lie, and what’s working in 2025.

We’ve also taken a closer look at real-world brand moments, like the 2025 London Marathon, to see how footwear brands are performing off the shelf and in the spotlight. Some timed their campaigns to perfection. Others missed a massive opportunity. You can read our full spotlight analysis here.

If you’re curious about how your brand compares, download the full Footwear Market Report here. Or, if you’re after a quick preview, keep reading below.